Global Edible Mushroom Market Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Button, Shiitake & Oyster), Application (Fresh Mushrooms and Processed Mushrooms (Dried, Frozen, And Canned)), and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa), Industry Analysis (2025 to 2033)

Global Edible Mushroom Market Size

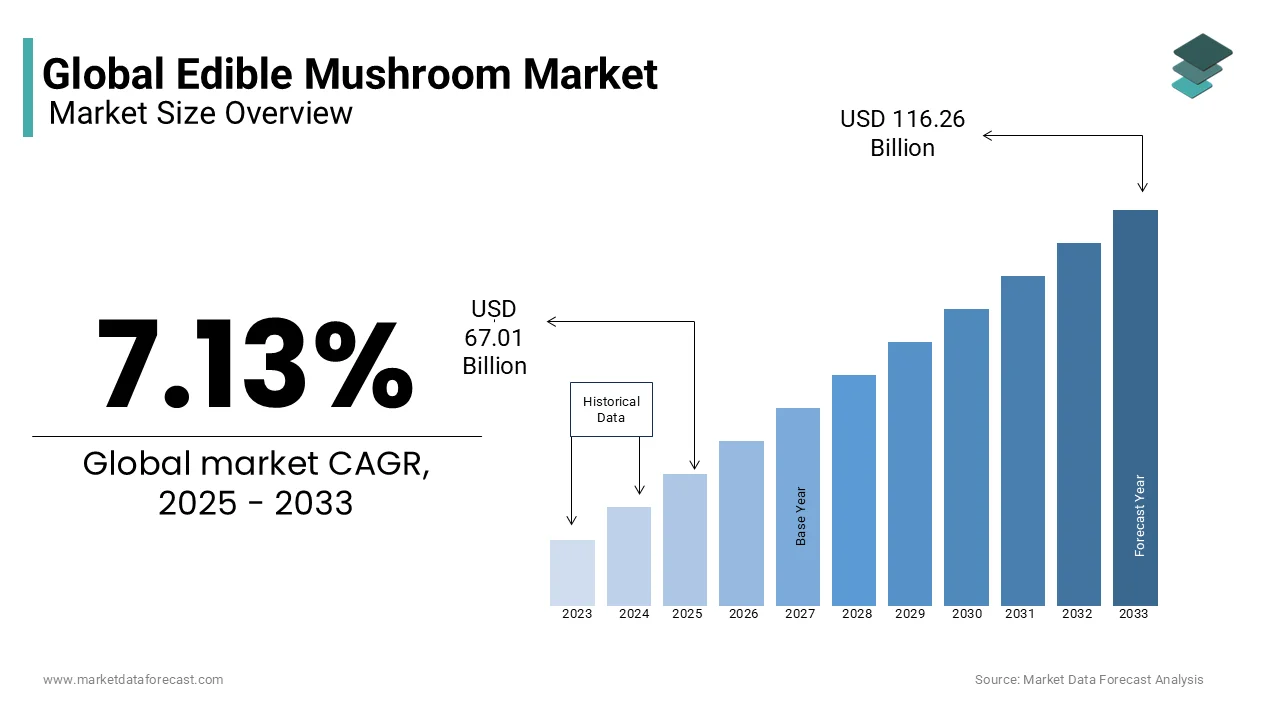

The global edible mushroom market size was valued at USD 62.55 billion in 2024. The global market size is expected to reach USD 116.26 billion by 2033 from USD 67.01 billion in 2025. The market's promising CAGR for the predicted period is 7.13%.

Edible mushrooms are so, fleshy and fruity fungi and are generally grouped as vegetables. Edible Mushrooms are one of the most popular foods across the world because of the variety they offer. Edible Mushrooms are rich in many nutrients, mainly proteins. They are a vital ingredient in the dishes of many countries. Edible mushrooms are species of microfungi that have edible fleshy bodies and are grown for consumption. Edible mushrooms are strong in dietary value and are also eaten as a part of their health advantages. Mushrooms are a vitamin, selenium, and potassium-rich source. They assist in improving the metabolism of the body and reducing cholesterol as well. Mushrooms are also eaten for medicinal purposes as the risk of cardiovascular diseases is known to be reduced. Mushrooms are small in saturated fat and high in fiber content, which tends to increase their demand among customers who are health conscious. They have low levels of sodium and gluten that tend to add to their nutrition. Edible Mushrooms are soft, fleshy, and fruity fungi and are generally grouped as vegetables. Edible Mushrooms are one of the most popular foods across the world because of the variety they offer. Edible Mushrooms are rich in many nutrients, mainly proteins. They are a vital ingredient in the dishes of many countries.

The global edible mushroom market has experienced significant growth in the recent past. The demand for edible mushrooms is on the rise worldwide due to the growing awareness among consumers regarding the nutritional value and potential medicinal properties of edible mushrooms. Nowadays, people have been increasingly adopting plant-based protein sources due to changes in dietary preferences and a growing number of turning vegetarian. Mushrooms have gained popularity as one of the promising plant-based protein sources, and this awareness is growing rapidly among consumers and resulting in the increased demand for these products. In the coming future, the global market for edible mushrooms is anticipated to witness substantial growth due to the wide variety of mushroom species and products available in both fresh and processed forms. According to a study by the ICAR-Directorate of Mushroom Research, the production of mushrooms across the world has surged over five holds since 2000, and currently, it is recorded at 44 million tons in 2023, with the Asia Pacific region as the leading cultivator holding 95 percent share in production, followed by Europeans at 3 percent, and American continent at 1 percent.

MARKET DRIVERS

Growing Awareness of the Nutritional Profile of Edible Mushrooms

There is rising awareness of the nutritional value and health benefits of edible mushrooms, such as immune-boosting properties and cholesterol reduction, among consumers worldwide. As per a letter published in the American Journal of Preventative Medicine, there is a need for greater and stricter regulations regarding Amanita muscaria products because of a 114 percent rise in Google searches involving the products. Highly nutritious, Potassium, riboflavin, selenium, and Vitamin D are all abundant in them. They've been proven to be quite beneficial in terms of developing resistance, controlling weight, and reducing the risks of many chronic conditions. The most well-known edible mushroom varieties are shitake, button, oyster, paddy, smooth, and reishi. Used meat substitutes with the growing food-eating culture of veganism, edible mushrooms around the world are being tried and developed to serve as a meat protein substitute. The texture and the quality of the mushroom flesh help in the simulation of a vegan substitute for the meat version. The edible mushroom market has caught on to this early, and if they are able to harness this, then demand is expected to skyrocket. Short shelf life, like mushrooms, belongs to the fungi family, which thrives in specific conditions; they are susceptible to a change in their storage conditions. Once mushrooms are packaged in plastic packets, they tend to have a shelf life ranging between one to five days due to moisture.

Increasing Demand for Plant-based Protein Sources

According to the European Vegetable Protein Association, it is anticipated that the annual consumption of vegetable proteins is over 1.1 million tons in Europe. Edible mushrooms serve as a nutritious alternative to meat and have become an attractive option to consumers who are seeking plant-based protein options. The rising adoption of vegan and vegetarian diets is contributing to the growth rate of the global market. The global edible mushroom market is tapping into the growing culture of veganism as mushrooms are used to simulate the texture of meat. It is a great substitute for meat, and the industry can harness this to grow its sales volume. An increasing trend in the consumer’s attitude to switch to a healthier lifestyle can be another opportunity. Mushrooms, which are considered superfoods as they are very healthy, are a very attractive option for consumers looking for a healthy food option. Lack of proper equipment and cultivation houses, growing mushrooms is very meticulous as it requires the soil to be moist and at the right pH level, atmospheric humidity, etc. for it to grow and propagate. Also, the farming space and storage facility will be very capital-intensive. Quality of spawn also matters a lot as it decides the yield, if the quality of spawn is low then there are high chances that yield will be quite low and vice versa. A good quality yield should also be disease-free.

Other factors such as continuous innovation in mushroom cultivation techniques to improve yield, quality, and efficiency, the versatile use of mushrooms in various food products, including soups, sauces, and snacks, and the growing consumption of mushrooms in restaurants, cafes, and catering services are promoting the growth of the edible mushroom market.

MARKET RESTRAINTS

Factors such as limited shelf life and perishability of fresh mushrooms, seasonal variations in mushroom production, and challenges in transportation and logistics are primarily hampering the growth of the edible mushroom market. Difficult and expensive to transport, as edible mushrooms have a short shelf life, it is difficult to transport them around the world. The logistics involved increasing the final cost to the consumer, which makes this a niche segment. A great example of this would be the shitake mushrooms, they are native to Japan, when they are transported from Japan to another country their cost increases, which is restraining the growth of the edible mushroom market.

MARKET OPPORTUNITIES

Mushrooms are gaining popularity and are consumed as a meat substitute in developed countries. These are a rich source of minerals and vitamins, for example, vitamins B12, B6, B5, B2, B1, zinc, and selenium. Moreover, the consumption of plant-based foods and proteins has rapidly increased, and so is the consumption of edible mushrooms. So, the market players are actively engaged in developing innovative products. For instance, Mash Food, an Israeli food technology startup, is integrating fungi into meat at a ratio of 50:50, which conserves and improves the texture and flavors of meat that flesh-eaters crave while simultaneously lowering its environmental impact. Besides this, these mushrooms are quickly getting popular across the United States. As per the country's product label, it is called Amanita Muscaria. Currently, they are unregulated; however, it is expected that in the future, more regulations relating to edible mushrooms are going to be introduced. Hence, it presents potential opportunities for the edible mushroom market.

MARKET CHALLENGES

Lack of knowledge and the incidences of food poisoning are some of the critical challenges for the expansion of the edible mushroom market. Several farmers do not have the understanding and the technical knowledge regarding mushroom farming, which impedes their capability to adopt effective cultivation practices. According to research, in 2024, around 45 percent of small-scale cultivators were unaware of advanced mushroom farming approaches, restricting the developmental potential of this industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.13% |

|

Segments Covered |

By Type, Distribution Channel, Application, And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Costa Group, Okechamp S.A, Monterey Mushrooms Inc, Monaghan Mushrooms, Drinkwater's Mushroom Ltd, The Mushroom Company, Shanghai Finc Bio-Tech Inc, CMP Mushrooms Green yard NV (Lutèce), Bonduelle SA, Intended Audience. |

SEGMENTAL ANALYSIS

By Type Insights

The shiitake segment held 46.88% of the global market share in 2023 and emerged as the dominating segment. The growth of the button segment is majorly attributed to the growing usage of button mushrooms in salads, soups, and others. The low cost of cultivation and high nutritional value of button mushrooms are further propelling the expansion of the button segment in the global market. As per a study by ICAR, mainly six mushrooms command the global market and production, namely Shiitake mushroom with 26 percent, oyster mushroom at 21 percent, black ear mushroom at 21 percent, button at 11 percent, Flammulina at 7 percent, paddy straw mushroom at1 percent, and other types account for 13 percent. Other segments, such as oyster and button, accounted for a substantial share of the worldwide market in 2023 and are anticipated to register steady growth during the forecast period. The demand for button mushrooms is growing significantly. The consumption of button mushrooms is high in countries such as the United States, China, and India.

By Distribution Channel Insights

The fresh mushrooms segment captured 41.7% of the global market share in 2023 and was the most dominant segment in the global edible mushroom market. This domination is attributed to their easy availability and growing acceptance from consumers. The rise of vegetarian and vegan diets is also boosting the consumption of fresh mushrooms and contributing to the segmental expansion. For instance, the global consumption of fresh mushrooms surpassed 10 million metric tons in 2021.

By Application Insights

The store-based segment held the largest share of the global market in 2023, and its domination is anticipated to continue throughout the forecast period. The store-based distribution channel has been offering consumers convenient access to fresh produce and a wide variety of mushroom species. The widespread presence of supermarkets, grocery stores, and specialty food outlets and the ability that stores offer for consumers to inspect and select mushrooms based on quality, freshness, and variety is further boosting the growth of the store-based segment.

REGIONAL ANALYSIS

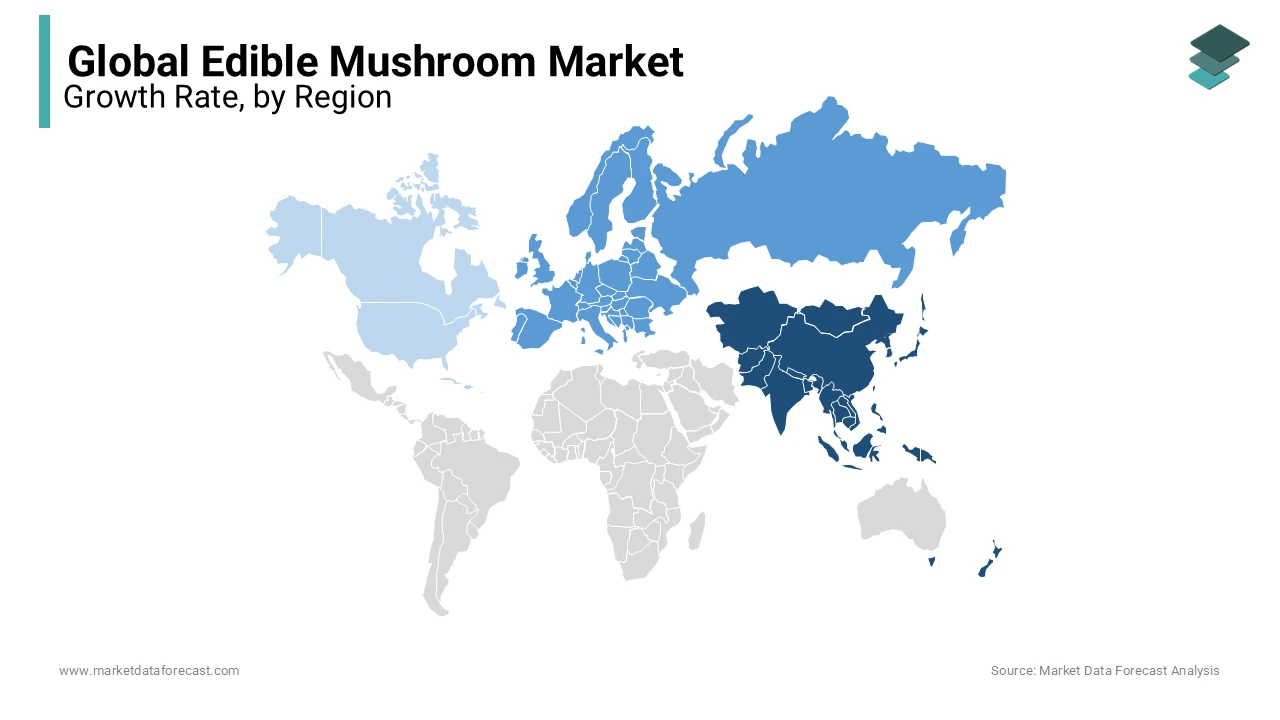

The Asia-Pacific region is expected to register the highest CAGR of 8.86% during the forecast period due to the increasing popularity of mushroom-based functional foods, government initiatives to promote mushroom farming and the rise of e-commerce platforms for mushroom sales. As per the study by ICAR, in terms of production by country, at the start of 2024, the leading nations based on fresh mushroom cultivation are China with 93 percent of overall global production, Japan with 0.01 percent, and Poland with o.o1 percent. India is in sixth position with about 0.24 million tons of output in 2023. However, its domestic data reveal that it has touched 0.31 million tons. Notably, the CAGR of China and India, 9.23 percent and 8.58 percent, respectively, in cultivating fresh mushrooms, is comparable to the trends from the last 20 years. Regardless of the significant strides in China, depicting fostering the development of the Indian mushroom industry alongside global leaders.

Europe emerged as the top-performing regional segment for edible mushrooms globally in 2023 and is anticipated to showcase a prominent CAGR during the forecast period. The growing production activities of fiber-rich food commodities from the countries of the European region have an impact on the high volume of production of edible mushrooms. Due to a changing pattern of food consumption, the European edible mushroom market is projected to showcase promising growth during the forecast period. The growing popularity of vegetarian and vegan diets and the presence of established mushroom cultivation regions in Europe are majorly fuelling the growth rate of the European market. Poland, the Netherlands and France are the major manufacturers of mushrooms in Europe.

North America accounted for a substantial share of the global market in 2023 and is expected to grow at a healthy CAGR during the forecast period. The growth of North American is majorly attributed to the growing awareness among consumers of the nutritional benefits of mushrooms and the expansion of mushroom cultivation facilities. The U.S captured 70.8% of the North American market share in 2023.

KEY MARKET PARTICIPANTS

Companies that play a key role in the global edible mushroom market include Costa Group, Okechamp S.A, Monterey Mushrooms Inc., Monaghan Mushrooms, Drinkwater's Mushroom Ltd, The Mushroom Company, Shanghai Finc Bio-Tech Inc., CMP Mushrooms Green yard NV (Lutèce), Bonduelle SA and Intended Audience. The major manufacturers of mushrooms have been investing in research to develop hybrid mushrooms with even more fiber and less fat content. Apart from that, a lot of companies are experimenting with the conditions to figure out the ideal conditions to produce the mushrooms. These advancements are expected to push the market forward by a substantial amount.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, a panel of researchers from the ICAR-Central Plantation Crops Research Institute (CPCRI), together with the Department of Botany at the University of Calicut, discovered a novel record of edible Coprinopsis cinerea which is a type of mushroom naturally produced on areca nut husk. This finding is grounded on multi-gene-based molecular and morphological research by a team. Coprinopsis is classified as a group of mushrooms mainly known for their environmental role in decaying organic matter. Moreover, the study is also currently going on to find their abilities, like anti-inflammatory and immunomodulation effects, and as a provider of bioactive elements for pharmaceutical applications.

- In January 2024, Infinite Roots, a Hamburg-based company, announced that it had secured funding of 58 million dollars to expand its platform for mycelium fermentation, receiving capital from a prominent European retailer and the holding company of Haribo.

MARKET SEGMENTATION

This research report on the edible mushroom market has been segmented and sub-segmented based on type, distribution channel, application, and region.

By Type

- Button

- Shiitake

- Oyster

By Application

- Fresh Mushrooms

- Processed Mushrooms

- Dried

- Frozen

- Canned

By Distribution Channel

- Store Based

- Supermarkets/Hypermarkets

- Specialty Retailer

- Convenience Stores

- Non-Store Based (E-Commerce)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1.What are the nutritional benefits of consuming edible mushrooms?

Edible mushrooms are low in calories and fat but rich in essential nutrients, including protein, fiber, vitamins, and minerals. They are an excellent source of B vitamins, such as riboflavin (B2), niacin (B3), and pantothenic acid (B5), as well as minerals like selenium, potassium, and copper. Mushrooms are also known for their antioxidant properties, which help protect cells from damage caused by free radicals and support overall health and well-being.

2.What are the main uses of edible mushrooms in culinary applications?

Soups and stews: Mushrooms add depth of flavor and umami richness to soups, stews, and broth-based dishes, enhancing the overall taste and complexity of the dish.

Stir-fries and sautés: Mushrooms can be quickly cooked in a hot skillet or wok with other vegetables, proteins, and sauces, creating flavorful and nutritious stir-fry dishes.

3.What factors are driving the growth of the edible mushroom market?

Increasing consumer awareness of the health benefits and nutritional value of mushrooms, leading to higher demand for fresh and processed mushroom products.Growing interest in vegetarian and plant-based diets, with mushrooms serving as a versatile and flavorful meat substitute in a variety of recipes.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com