Global Environmental Testing Market Size, Share, Trends & Growth Forecast Report – Segmented By Contaminant (Heavy Metal, Microbiological, Organic, Residue And Solids), Sample (Effluent, Water, Soil, Air), Technology (Rapid Method And Conventional Method) & By Region (North America, Europe, Asia-Pacific, Middle East & Africa, Latin America) - Industry Analysis From 2025 to 2033

Global Environmental Testing Market Size

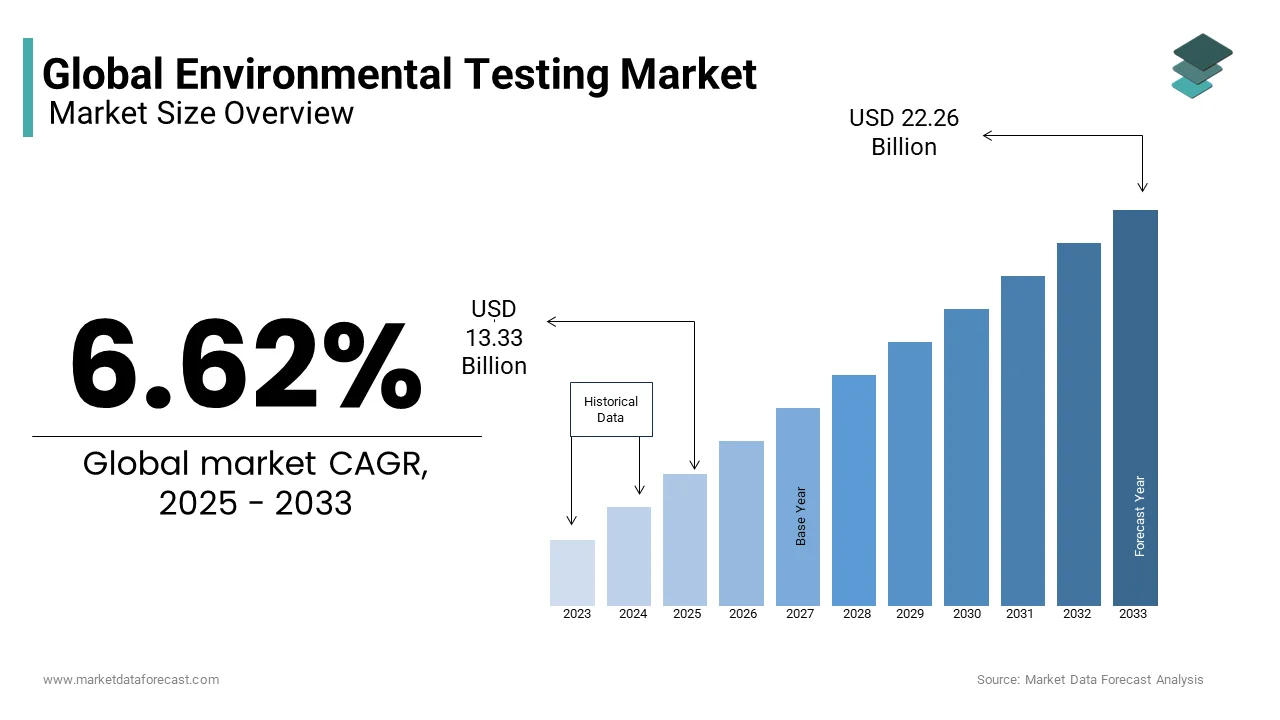

The global environmental testing market was valued at USD 12.50 billion in 2024 and is anticipated to reach USD 13.33 billion in 2025 from USD 22.26 billion by 2033, growing at a CAGR of 6.62% during the forecast period from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL ENVIRONMENTAL TESTING MARKET

Environmental testing values the surge in the number of contaminants in the environment and identifies their impact on the environment. Thanks to the increasing number of rules and regulations and the active participation of various governments and authorities for environmental protection. Since the release of large amounts of artificial and natural waste substances has a detrimental impact on the environment leading to global warming, environmental testing is essential for the valuation.

Maintaining the right quantities of all components in the environment is a must for a sustainable future. So, environmental testing contains testing of soil, air, water, sludge, petroleum, chemicals and others for their quality and effects on the environment and health. It is done mostly by Industries and manufacturing firms in order to understand the impact of waste or disposals generated from their plant.

MARKET DRIVERS

Growing industrial activities and environmental pollution in emerging countries, increased awareness of environmental degradation, and Deteriorating environment.

The rise in initiatives that cause sustainable development, favorable government policies, increasing instances of health issues caused by organic contamination are driving the growth of the market. However, the limited number of skilled professionals, the requirement of high capital investment, and lack of awareness are expected to restrict the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.62% |

|

Segments Covered |

By Sample, Contamination, Technology, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Eurofins Scientific SE, SGS S.A., Bureau Veritas S.A., Agilent Technologies Inc., Intertek Group PLC, ALS Limited, Romer Labs Diagnostic GmbH, AB Sciex LLC |

SEGMENTAL ANALYSIS

Global Environmental Testing Market By Sample

The wastewater/effluent testing, followed by soil testing, had the largest share in 2016 due to the generation of wastewater in industries.

On the basis of contamination, the market has been segmented into

Global Environmental Testing Market By Contamination

Among the contamination segment, the organic contamination segment is projected to have a prominent share of the market during the forecast period due to the health concerns caused by organic contaminants.

Global Environmental Testing Market By Technology

The rapid technology segment has the largest share owing that the technology is quick, accurate, and user-friendly.

REGIONAL ANALYSIS

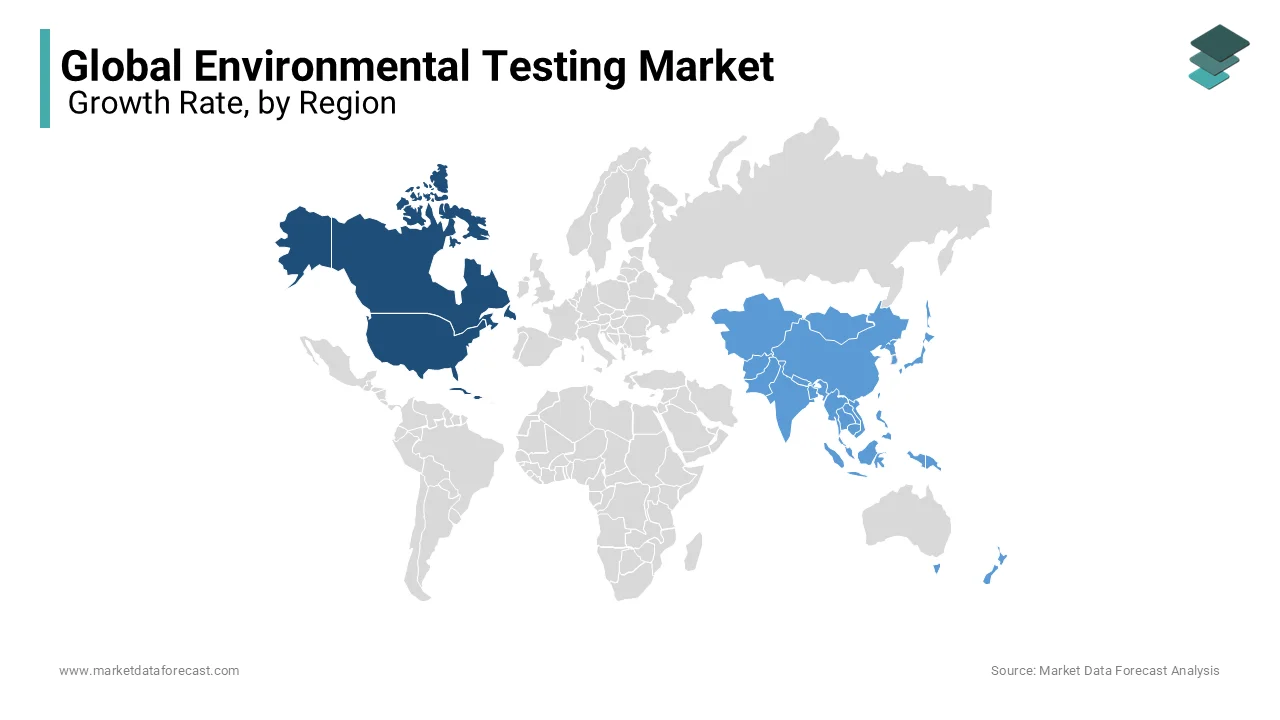

North America followed by Europe has the largest market during the forecast period due to the various governing organizations in the region have enforced various environment protection policies. Asia Pacific is expected to be the fastest-growing region during the forecast period owing to the increasing infrastructure construction, enormous growth potential in the region, various energy-related projects, and growing awareness about environmental issues in the region.

KEY MARKET PLAYERS

Key players in the environmental testing market include Eurofins Scientific SE, SGS S.A., Bureau Veritas S.A., Agilent Technologies Inc., Intertek Group PLC, ALS Limited, Romer Labs Diagnostic GmbH, AB Sciex LLC, R J Hill Laboratories Ltd., Suburban Testing Labs, and Asure Quality Limited.

MARKET SEGMENTATION

This research report on the global environmental testing market is segmented and sub-segmented based on sample, Contamination, Technology, and Region.

By Sample

- Effluent

- Water

- Soil

- Air

By Contamination

- Microbiological

- Organic

- Heavy metals

- Residues

- Solids

By Technology

- Conventional

- Rapid

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current market size of the global environmental testing market?

The current market size of the global environment testing market is USD 13.33 billion in 2025

What segments are added in the global environmental testing market?

Segments that are added to the global environmental testing market are contaminants, samples, technology

What market drivers are driving in the global environmental testing market?

Growing industrial activities and environmental pollution in emerging countries, increased awareness of environmental degradation, and Deteriorating environment.

Who are the market players that are dominating the global environmental market?

Key players in the environmental testing market include Eurofins Scientific SE, SGS S.A., Bureau Veritas S.A., Agilent Technologies Inc., Intertek Group PLC, ALS Limited, Romer Labs Diagnostic GmbH, AB Sciex LLC, R J Hill Laboratories Ltd., Suburban Testing Labs, and Asure Quality Limited.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com