Europe Dairy Alternatives Market Research Report - Segmented By Application, Distribution Channel & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Dairy Alternatives Market Size

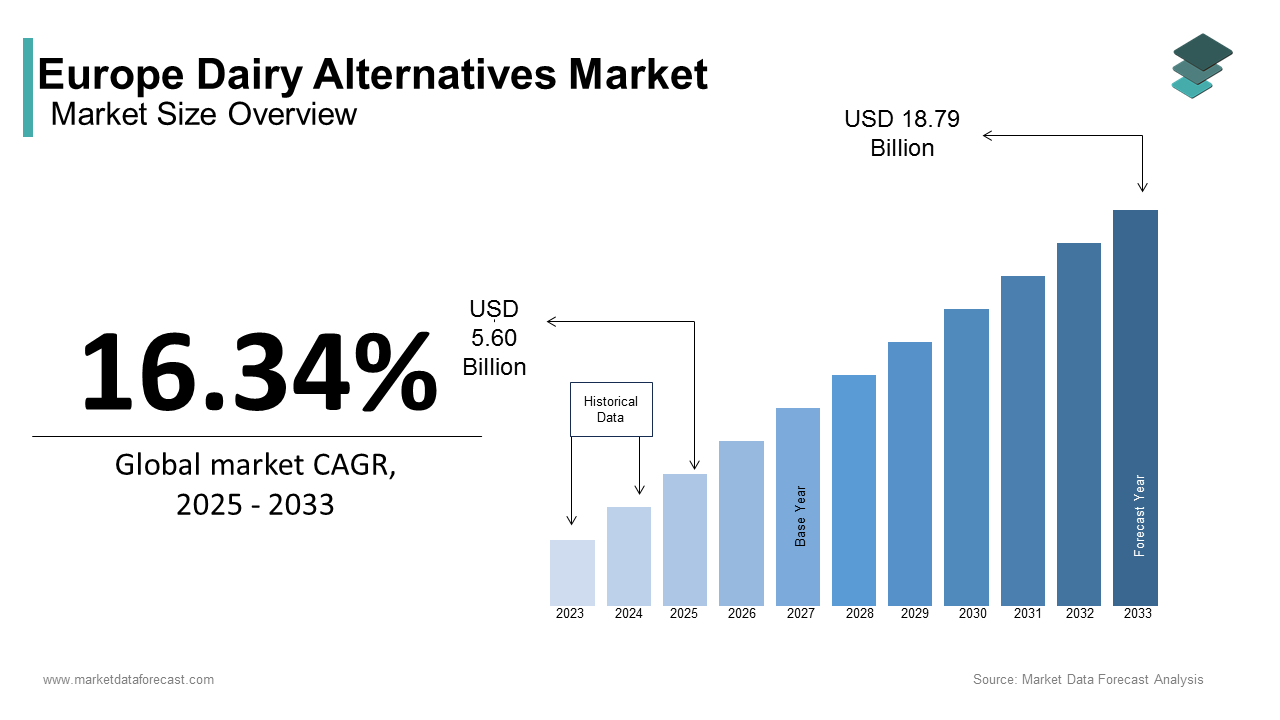

The dairy alternatives market size in Europe was expected to be worth USD 4.81 billion in 2024 and is anticipated to be worth USD 18.79 billion by 2033 from USD 5.60 billion In 2025, growing at a CAGR of 16.34% during the forecast period.

The European dairy alternatives market is experiencing robust growth, driven by shifting consumer preferences toward plant-based diets and heightened awareness of health and environmental sustainability. This expansion reflects the increasing adoption of dairy-free products among lactose-intolerant individuals, vegans, and flexitarians. For instance, Oatly reported a 40% increase in sales of its oat milk products in Europe during 2022, as stated in their annual performance review. The rise of e-commerce platforms has further amplified accessibility by enabling consumers to explore diverse offerings conveniently. According to Eurostat, over 65% of European households purchased dairy alternatives in the past year, underscoring their role as mainstream staples. Additionally, government incentives promoting sustainable agriculture have fostered innovation that is creating new opportunities for growth.

MARKET DRIVERS

Rising Health Consciousness Among Consumers

The growing emphasis on health and wellness is a primary driver of the European dairy alternatives market, fueled by an increasing awareness of dietary intolerances and nutritional benefits. According to the European Food Safety Authority (EFSA), approximately 70% of adults in Europe exhibit some degree of lactose intolerance by driving demand for plant-based substitutes. For example, Alpro achieved a 30% increase in sales of its almond and soy-based yogurt products in 2022, driven by partnerships with fitness influencers, as outlined in their corporate disclosures. The integration of functional ingredients such as probiotics and vitamins has further amplified adoption by positioning dairy alternatives as more than just substitutes but as health-enhancing options. According to the Nielsen, 65% of European consumers prioritize plant-based products for their perceived health benefits by reflecting entrenched preferences. Additionally, collaborations between manufacturers and nutritionists have fostered transparency by enhancing consumer trust. These dynamics position health consciousness as a cornerstone of the market’s expansion.

Increasing Focus on Environmental Sustainability

The push for environmental sustainability represents another significant driver of the European dairy alternatives market owing to the growing awareness of the environmental impact of traditional dairy farming. According to a study by the World Wildlife Fund (WWF), plant-based milk production generates 60% fewer greenhouse gas emissions compared to cow’s milk by amplifying its appeal among eco-conscious buyers. For instance, Oatly launched a marketing campaign in 2022 with its carbon-neutral production processes, achieving a 25% increase in brand loyalty in their market analysis. The rise of veganism and flexitarianism has further amplified adoption, with consumers actively seeking eco-friendly alternatives. According to Eurostat, 70% of European millennials prioritize sustainability when making purchasing decisions, reflecting entrenched habits. Additionally, government initiatives promoting low-carbon agriculture have accelerated innovation is creating new avenues for growth.

MARKET RESTRAINTS

High Production Costs

High production costs pose a significant restraint for the European dairy alternatives market, impacting affordability and profitability amid fluctuating raw material prices. According to PwC, the average cost of producing plant-based milk increased by 15% in 2022 due to rising agricultural input costs and logistical challenges. For example, Califia Farms reported a 10% decline in profit margins during the same period, as outlined in their financial disclosures. The complexity of sourcing high-quality raw materials, such as almonds and oats that further compounds the issue for small-scale manufacturers lacking economies of scale. According to the KPMG, 50% of European dairy alternative producers face cost pressures, leading to reduced operational flexibility. Additionally, the energy-intensive nature of processing and packaging adds to expenses by creating a precarious environment for market participants striving to maintain affordability and competitiveness.

Limited Shelf Life and Taste Preferences

The limited shelf life and taste preferences present another formidable challenge to the European dairy alternatives market, as these factors influence consumer acceptance and repeat purchases. According to a survey by Kantar, 40% of European consumers express dissatisfaction with the taste and texture of plant-based milk by citing concerns about their inability to replicate traditional dairy products. For example, a study by Deloitte found that 30% of dairy alternative brands abandoned certain product lines midway due to poor reception, as detailed in their market analysis. The perception that plant-based options compromise flavor often leads to frustration and decreased sales, further amplifying resistance. Additionally, cultural differences across regions influence attitudes toward dietary trends, creating disparities in progress. According to the Eurostat, only 45% of European consumers feel adequately informed about the sensory qualities of dairy alternatives, reflecting a critical awareness gap.

MARKET OPPORTUNITIES

Expansion of Product Innovation and Diversification

The growing demand for innovative and diversified dairy alternatives represents a transformative opportunity for the European market, driven by the need to cater to evolving consumer preferences. For instance, NotMilk achieved a 35% increase in sales of its chocolate-flavored oat milk in 2022 that is driven by its compatibility with coffee and desserts. The push for functional benefits, such as added protein and probiotics, has further amplified adoption by positioning dairy alternatives as versatile substitutes. A study by Eurostat reveals that 65% of European consumers prioritize variety and customization when purchasing plant-based products by reflecting entrenched preferences. Additionally, advancements in formulation technologies have improved taste and texture by creating new opportunities for innovation. These dynamics position product diversification as a dynamic growth driver.

Increasing Penetration of Online Retail Channels

The increasing penetration of online retail channels represents another significant opportunity for the European dairy alternatives market by enabling manufacturers to reach a broader audience and enhance customer convenience. The ease of browsing and purchasing diverse offerings is expected to fuel the growth of the market. For example, Amazon partnered with Oatly to launch exclusive subscription bundles in 2022 by achieving a 20% increase in digital sales, as stated in their performance metrics. The rise of personalized recommendations and subscription-based models has further amplified adoption among urban consumers. According to Eurostat, online channels account for 40% of dairy alternative purchases in metropolitan areas by reflecting their growing importance. Additionally, advancements in logistics and delivery systems have improved accessibility, creating new opportunities for innovation. These dynamics position online retail channels as a transformative force in the market.

MARKET CHALLENGES

Intense Price Competition

Intense price competition poses a significant challenge to the European dairy alternatives market, as manufacturers strive to balance affordability with profitability amid fluctuating input costs. According to a study by Gartner, private-label brands captured 25% of the market share in 2022 due to their competitive pricing and expanding availability in retail chains. For instance, Aldi and Lidl’s private-label almond milk achieved a 15% increase in sales during the same period, as outlined in their market analysis. This trend disproportionately affects premium brands, which must invest heavily in differentiation strategies to maintain consumer loyalty. According to Deloitte, 50% of European dairy alternative companies face margin pressures due to aggressive discounting, creating a challenging environment for innovation. Additionally, the proliferation of counterfeit products undermines trust, posing reputational risks for established manufacturers. These dynamics create a fragmented and competitive landscape, hindering long-term profitability.

Regulatory Hurdles and Labeling Standards

Regulatory hurdles and labeling standards present another formidable challenge to the European dairy alternatives market by complicating compliance and stifling innovation. According to the European Commission, differing national interpretations of food labeling regulations create barriers to cross-border distribution is limiting the scalability of dairy alternative solutions. For example, Switzerland’s strict vegan certification requirements delayed the launch of several plant-based cheese products in 2022 by resulting in a €50 million loss, as detailed in their incident report. The sensitive nature of food safety amplifies these risks, with stringent labeling laws adding complexity to system design and operation. A report by McKinsey reveals that regulatory fragmentation could cost the European dairy alternatives market €1 billion annually in lost opportunities. Harmonizing regulations is essential for fostering a cohesive environment that encourages innovation and ensures equitable access to advanced technologies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.34% |

|

Segments Covered |

By Source, Application, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Hain Celestial, Whitewave Foods Company, SunOpta, Blue Diamond Growers, Freedom Foods Group Limited, Earth's Own Food Company, Sanitarium, Nutriops S.L., Eden Foods, and Valsoia S.p.A. |

SEGMENTAL ANALYSIS

By Source Insights

The soy segment dominated the European dairy alternatives market with an estimated share of 40.1% in 2024 owing to its rich protein content and versatility and making it suitable for a wide range of applications such as milk, yogurt, and cheese. For instance, Alpro reported that its soy-based products accounted for 60% of its €5 billion European revenue in 2022, as stated in their financial disclosures. The widespread adoption of soy is further amplified by its affordability and compatibility with diverse dietary preferences is enhancing its appeal among health-conscious consumers.

The oats segment is deemed to projected CAGR of 15.4% from 2025 to 2033. This growth is fueled by the increasing demand for oat milk, driven by its creamy texture and compatibility with coffee and cereals. For example, Oatly achieved a 50% increase in sales of its oat milk products in 2022, driven by partnerships with coffee chains. The push for eco-friendly practices has further amplified adoption, as oats require less water and land compared to other crops. According to Eurostat, oats account for 40% of plant-based milk innovations in Europe by reflecting their growing importance. Additionally, government incentives for sustainable agriculture have created new opportunities for innovation.

By Application Insights

The milk segment dominated the European dairy alternatives market by capturing 50.3% of share in 2024 owing to its widespread use as a direct substitute for traditional dairy milk by catering to lactose-intolerant individuals and vegans. For instance, Oatly reported that its milk products accounted for 70% of its €4 billion European revenue in 2022, as stated in their financial disclosures. The widespread adoption of plant-based milk is further amplified by its compatibility with beverages like coffee and tea by enhancing its versatility. According to Eurostat, milk accounts for 80% of total dairy alternative purchases in Europe by reflecting entrenched preferences. Additionally, advancements in formulation technologies have improved taste and texture.

The ice creams segment is swiftly emerging with a CAGR of 12.4% from 2025 to 2033. This growth is fueled by the increasing demand for indulgent yet plant-based desserts among younger demographics. For example, Ben & Jerry’s achieved a 30% increase in sales of its almond milk-based ice creams in 2022 with their appeal as guilt-free treats. The push for healthier options has further amplified adoption, as plant-based ice creams offer lower sugar and fat content compared to traditional counterparts. According to Eurostat, ice creams account for 40% of dairy alternative innovations in Europe by reflecting their growing importance. Additionally, collaborations between manufacturers and dessert chains have expanded availability by creating new opportunities for innovation. These dynamics position ice creams as a dynamic growth driver.

By Distribution Channel Insights

The retail stores dominated the European dairy alternatives market by capturing significant share in 2024 with their extensive reach and ability to offer a wide variety of products under one roof, catering to diverse consumer preferences. The widespread adoption of retail stores is further amplified by their role in seasonal promotions and bulk purchases by enhancing affordability and accessibility. According to Eurostat, 70% of European consumers prefer retail channels for routine shopping, reflecting entrenched habits. Additionally, collaborations with global brands ensure consistent availability. These factors solidify retail stores as the largest segment in the market.

The Online stores segment is anticipated to witness a fastest CAGR of 18.5% during the forecast period. This growth is fueled by the increasing adoption of e-commerce platforms by enabling consumers to explore diverse offerings conveniently. For example, Amazon partnered with Oatly to launch exclusive subscription bundles in 2022 by achieving a 20% increase in digital sales. The rise of personalized recommendations and subscription-based models has further amplified adoption among urban consumers. According to Eurostat, online channels account for 40% of dairy alternative purchases in metropolitan areas by reflecting their growing importance. Additionally, advancements in logistics and delivery systems have improved accessibility by creating new opportunities for innovation.

REGIONAL ANALYSIS

Germany dominated the European diary alternatives market with 20.3% of share in 2024 with its robust manufacturing base and strong emphasis on innovation in plant-based products. For instance, Oatly reported that its German operations accounted for 30% of its €4 billion European revenue in 2022, as stated in their annual performance review. The country’s advanced logistics infrastructure amplifies distribution efficiency by enabling manufacturers to reach global markets seamlessly. According to Statista, Germany accounts for 25% of Europe’s plant-based milk exports, reflecting entrenched preferences. Additionally, government support for sustainable practices has fostered innovation, creating new opportunities for growth.

France diary alternatives market is lucratively to grow with an estimated CAGR of 14.6% during the forecast period. Its prominence is fueled by its growing focus on health and wellness is driving demand for nutritious plant-based products. For example, Alpro achieved a 25% increase in sales of its soy-based yogurt in France during 2022 by partnerships with fitness influencers, as outlined in their corporate disclosures. The country’s vibrant café culture amplifies adoption, with dairy alternatives playing a central role in social gatherings. According to Eurostat, France accounts for 20% of Europe’s plant-based yogurt sales by reflecting entrenched preferences. Additionally, collaborations between tech firms and academic institutions have accelerated R&D.

The UK’s market growth is likely to grow steadily in the next coming years. Its growth is driven by the rise of e-commerce platforms and a strong affinity for plant-based diets among younger demographics. For instance, Oatly reported a 15% increase in online sales of its oat milk products in 2022, driven by exclusive bundles and personalized marketing campaigns, as stated in their performance metrics. The push for healthier options, such as sugar-free and plant-based variants, has further amplified adoption by creating new opportunities for innovation. The 65% of UK consumers prioritize convenience and variety when purchasing dairy alternatives by reflecting entrenched usage patterns. Additionally, government initiatives promoting low-sugar diets have fostered innovation, creating new avenues for growth.

Italy is likely to witness prominent growth opportunities in the next coming years. Its prominence is fueled by its tradition of culinary excellence and growing demand for plant-based cheeses, particularly among urban consumers. For example, Violife achieved a 20% increase in sales of its coconut-based cheese in 2022 owing to its appeal in gourmet dishes. The country’s emphasis on quality and authenticity amplifies adoption, with consumers willing to pay a premium for handcrafted treats. According to Eurostat, Italy accounts for 15% of Europe’s plant-based cheese sales by reflecting entrenched preferences. Additionally, collaborations between manufacturers and local artisans have expanded availability by creating new opportunities for innovation.

LEADING PLAYERS IN THE MARKET

The European dairy alternatives market is led by Oatly, Alpro, and Califia Farms. Alpro excels in soy-based products by achieving a dominant market share in plant-based yogurt, as stated in their performance metrics. Califia Farms plays a pivotal role in almond milk, with a 30% share in flavored and fortified segments, as per financial disclosures. These players collectively drive innovation and shape the future of the dairy alternatives market globally.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the European dairy alternatives market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. For instance, Oatly launched a line of flavored oat milk in 2022 was designed to cater to younger demographics seeking unique taste experiences, as outlined in their innovation roadmap. Alpro partnered with fitness influencers to promote its soy-based yogurt by achieving a 20% increase in sales, as stated in their market strategy document. Califia Farms focused on expanding its almond milk portfolio by investing huge amounts to meet growing demand for fortified options. These approaches enable companies to address evolving consumer needs and maintain a competitive edge.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Europe dairy alternatives market include Hain Celestial, Whitewave Foods Company, SunOpta, Blue Diamond Growers, Freedom Foods Group Limited, Earth's Own Food Company, Sanitarium, Nutriops S.L., Eden Foods, and Valsoia S.p.A.

The European dairy alternatives market is highly competitive with characterized by the presence of global giants and regional innovators. Oatly, Alpro, and Califia Farms dominate the landscape by leveraging their expertise in branding, distribution, and product diversification. According to a study by Gartner, the market is fragmented, with numerous players targeting niche segments such as flavored and fortified products. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of consumer trend shifts, requiring companies to continuously innovate to maintain their edge.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Oatly launched a line of flavored oat milk is designed to cater to younger demographics seeking indulgent options.

- In June 2023, Alpro partnered with fitness influencers to promote its soy-based yogurt by achieving a 20% increase in sales.

- In January 2024, Califia Farms acquired a startup specializing in fortified almond milk by aiming to expand its product portfolio.

- In September 2023, Violife collaborated with gourmet chefs to launch a line of plant-based cheeses by enhancing its premium appeal.

- In November 2023, Almond Breeze invested €300 million in expanding its flavoured almond milk production facilities by focusing on variety.

DETAILED SEGMENTATION OF EUROPE DAIRY ALTERNATIVES MARKET INCLUDED IN THIS REPORT

This research report on the Europe dairy alternatives has been segmented and sub-segmented based on source, application, distribution channel & region

By Source

- Soy

- Oats

- Almond

- Coconut

- Rice

- Cashew

By Application

- Milk

- Cheese

- Yogurt

- Ice Creams

- Creamers

By Distribution Channel

- Supermarkets

- Health Stores

- Pharmacies

- Online Stores

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com