Global Agricultural Micronutrients Market Size, Share, Trends, & Growth Forecast Report, Segmented By Type (Zinc, Boron, Copper, Manganese, Molybdenum, Iron, Cobalt and Others), Mode Of Application (Soil, Fertigation, Seed Treatment, Foliar and Others), Form (Chelated (EDTA, DTPA, EDDHA, IDHA, HBED) and Non-Chelated), Crop Type (Fruits And Vegetables, Cereals, Pulses And Oilseeds and Others) and Region(North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Agricultural Micronutrients Market Size

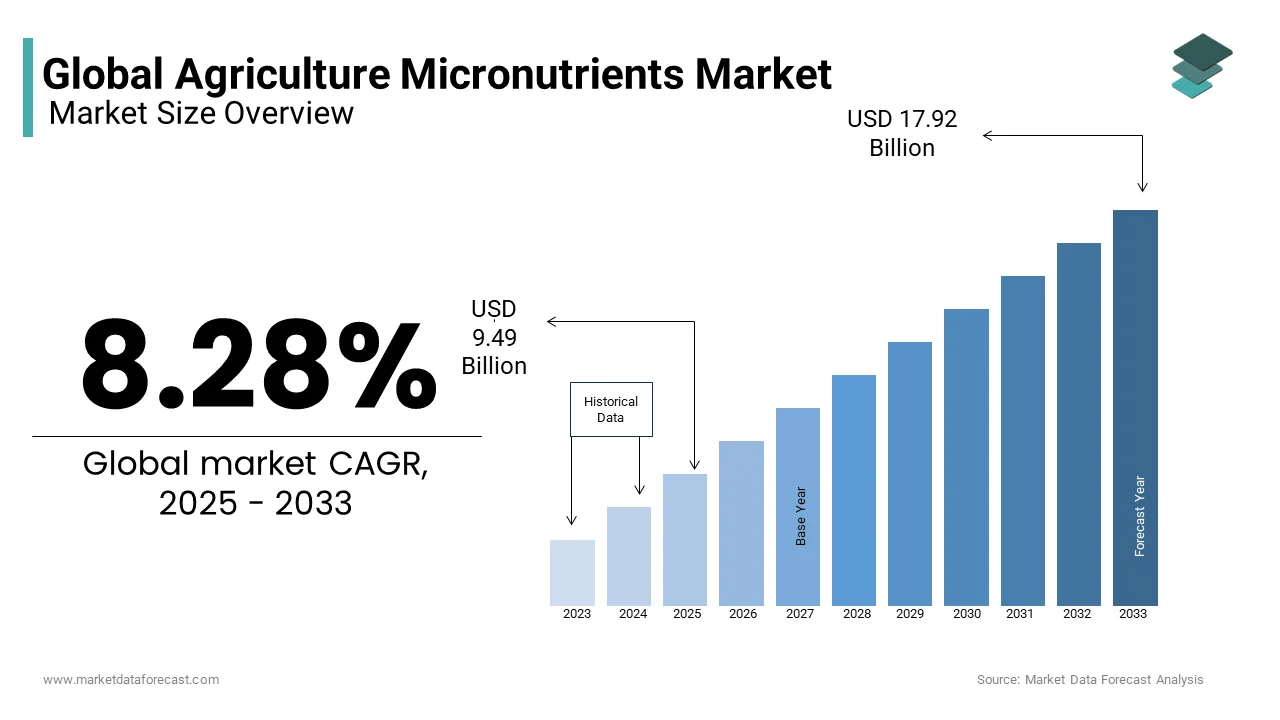

The global agricultural micronutrient market was valued at USD 8.76 billion in 2024 and is anticipated to reach USD 9.49 billion in 2025 from USD 17.92 billion by 2033, growing at a CAGR of 8.28 % during the forecast period from 2025 to 2033.

The market is growing rapidly due to rising soil deficiencies and increasing demand for high-quality yields. Micronutrients are supplements required by organisms throughout life in small amounts to coordinate a range of physiological functions. Micronutrients are essential for the growth of plants and play an important role in balanced crop protection. Deficiency of Micronutrients results in the withering of buds in crops, yellowing of leaves, health hazards, and eventually results in the decline of crop productivity.

Rising demand for food and increasing demand for standard quality and continuous yield because of a growing population depleting arab, le land are the major factors driving the market. Lack of awareness among farmers in developing regions, high cost, and lack of awareness about an appropriate quantity to be injected into the soil due to the lack of standardized levels established by regulatory agencies are the major restraints of the markets.

Current Scenario of the Global Agricultural Micronutrients Market

Micronutrients are supplements required by organisms throughout life in small amounts to coordinate a range of physiological functions. Micronutrients are essential for the growth of plants and play an important role in balanced crop protection. A deficiency of micronutrients results in the withering of buds in crops, yellowing of leaves, and health hazards, eventually resulting in the decline of crop productivity. The global agricultural micronutrient market has accounted for notable growth in the past years and is anticipated to record significant growth during the forecast period. The market is growing rapidly due to rising soil deficiencies and increasing demand for high-quality yields. The micronutrients are the seven major elements that are essential for crop growth in low quantities, and these include boron, chlorine, copper, iron, manganese, molybdenum, and zinc. In most of the major crops, the micronutrients are supplied by fertilization, which includes zinc, manganese, boron, and iron. The micronutrient deficiency can be detected by visual symptoms on crops and by testing soils and plant tissues. The declining arable land, growing population, supportive government initiatives, and rising concerns regarding food security are significantly driving the market.

- For Instance, according to the Global Land Assessment for Degradation published by the United Nations Food and Agriculture Organization (FAO), around 2 billion hectares of land have been degraded worldwide since the 1950s.

MARKET DRIVERS

The increased awareness among people regarding crop productivity and the quality of crop production is escalating the demand for agricultural micronutrients, leading to market growth. The growing cases of micronutrient deficiencies in the plants, which can be visually noticed, and the rising awareness among the farmers regarding the necessity of micronutrients in crop yield and productivity are escalating the global market growth. The micronutrients such as Zinc, Iron, and manganese play a crucial role in enhancing nutrient uptake, crop productivity, and overall plant health, Growth is accelerating the adoption rate of micronutrients in agricultural practices and leading to market expansion. The increasing adoption of modern agricultural practices, which involves organic and natural methods owing to consumer demand, is prompting market players to focus on the introduction of various fertilizers with a combination of micronutrients, propelling the market growth. The decline in arable land across the world is enhancing the adoption of agricultural micronutrients, leading to substantial market growth.

The rising investments in research and development activities by the market players in expanding the benefits produced by the micronutrients and the growing innovations in the development of biodegradable chelates are estimated to provide market growth opportunities in the coming years. The biodegradable chelates will ensure environmentally friendly practices by limiting aquatic pollution, and this propels the market with growth opportunities during the forecast period. The escalation in the government support initiatives to enhance agricultural practices by adopting proper methods that increase crop yield and quality fuels the global market expansion. The growing population and the increasing demand for food are enhancing the adoption of innovative agricultural practices, which positively influences market growth.

- According to data provided by the World Bank, the global population is projected to reach 9.7 billion by 2050, which is an increase of 35%. This states the requirement of an increase in agricultural production of at least 50%.

MARKET RESTRAINTS

Lack of awareness among farmers in developing regions, high cost, and lack of awareness about an appropriate quantity to be injected into the soil due to the lack of standardized levels established by regulatory agencies are the major restraints of the markets. The high costs associated with the fertilizers in combination with the essential micronutrients are a major factor limiting the adoption among farmers, leading to restricted market growth. The rising concerns regarding the bioaccumulation of biodegradable chelates, as their persistence in aquatic systems can lead to bioaccumulation in plants and organisms, which inhibits the bioavailability of essential micronutrients in agricultural soils. This acts as a significant challenge for global market expansion. Various challenging factors, such as environmental impact from the production and extraction, contribute to pollution, the need for awareness among the farmers of developing nations, and the excessive use of micronutrients may lead to plant toxicity. All these factors are estimated to hamper the market growth opportunities. The stringent regulations regarding product approvals and the product safety and efficacy of the plant will act as a significant challenging factor for market growth due to its complexity. The shortage of skilled professionals for testing and the limited government schemes to support the micronutrient issues the market growth opportunities.

- For Instance, around 700 of the 1454 testing facilities in India provide micronutrient deficiency detection services, where around 140 million farmers lack access to laboratories and services in the country.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.28% |

|

Segments Covered |

By Type, Mode of Application, Form, Crop Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE, Mosaic, Cheminova, Agrium Inc., Aries Agro Ltd., Coromandel International Ltd., Yara International, Valagro, Gujarat State Fertilizers & Chemicals, Tradecorp International, AkzoNobel. |

SEGMENTAL ANALYSIS

By Type Insights

The zinc segment held the most significant share in the global agricultural micronutrients market and is anticipated to record prominent growth during the forecast period. The increasing rate of zinc deficiencies in the soil is the major factor contributing to the segment revenue growth. The selection of the micronutrients depends extensively dependsype and soil. As the micronutrients are already present in the soil, the requirement for micronutrients is low compared to traditional fertilizers. The enhanced government initiatives for increasing the zinc concentrate in the soil for qualitative and quantitative crops will augment the segment expansion.

The iron segment is expected to have substantial growth during the forecast period. Iron is an essential micronutrient that is highly essential for plant development and growth, contributing to segment expansion. The chelated iron is widely used as a soil additive that treats iron deficiencies in plants, especially pulses, cereals and oilseeds. ,

By Crop Type Insights

Cereals are the fastest-growing segment around the world, owing to continuous technological advancements and the growing demand for cereals. The escalating demand for food grains worldwide, owing to the g, growing population and increasing production of staple crops as they act as the primary food source, propels the s, segment expansion. The increased demand for cereals across various regions, as they provide extensive health benefits, will proliferate the segment revenue in the coming years.

The fruits and vegetables segment is estimated to have prominent growth during the forecast period. The rising health issues among people are increasing the adoption of highly nutritious food, which positively influences the segment growth. Fruits and vegetables are indispensable parts of the human diet, which enhances their demand and leads to segment revenue expansion.

By Mode of Application Insights

The foliar segment dominated the global agricultural micronutrient market with a notable share and is estimated to maintain the domination during the forecast period. The foliar application helps in the rapid delivery of essential micronutrients, and this helps in enhancing nutrient uptake, which accelerates crop health and yield. This is a significant factor contributing to the segment growth rate. The foliar application also provides various benefits, such as prevention and correction of nutrient deficiencies and enhancement of photosynthesis, which improves the overall plant health and augments segment growth.

By Form Insights

The chelated micronutrients segment accounted for the largest share of the global market and is anticipated to record the highest CAGR during the forecast period. The chelation enhances the stability and availability of the micronutrients, which helps for the crops' nutrient deficiencies, which propels the segment revenue. The wide adoption of chelates in modern farming methods, owing to their limited application and environmentally friendly characteristics, is escalating the segment revenue growth.

The non-chelated segment is estimated to account for considerable growth during the forecast period. The availability of non-chelated products at lower prices over the chelated micronutrients is augmenting the segment's growth opportunities.

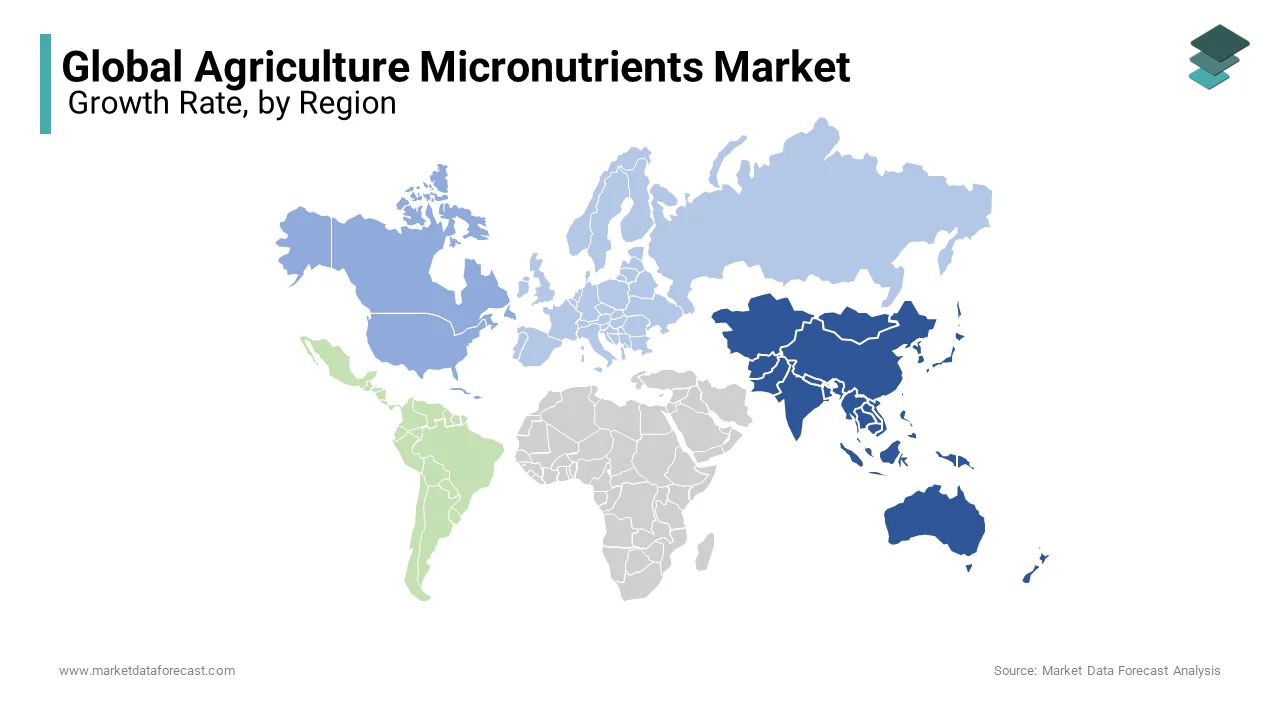

REGIONAL ANALYSIS

Asia-Pacific is the largest market globally and continues to dominate the world throughout the forecast period, owing to the high demand for food, increasing investment in the agricultural sector, and management of crop production costs. The growing population and the increasing demand for high-quality food products with organic farming practices are enhancing the regional market growth rate. The rising adoption of modern farming techniques, growing agricultural practices across the region, and the presence of vast arable land for agriculture are propelling the regional agricultural micronutrient market expansion. The increasing nutrient deficiencies in the soil across the regional countries are fueling the market growth. The presence of government support initiatives, along with the significant contribution of the major market players in the region, augments the regional market growth opportunities.

- For instance, according to the FAO, China’s agricultural industry is estimated to produce about one-fourth of global grain production, which feeds one-fifth of the global population.

The North American region is projected to hold notable growth during the forecast period owing to rising agricultural practices across the region. The presence of advanced and well-established infrastructure in the region, and growing awareness among the people regarding the necessity of agricultural micronutrients esare calatingg, a re escalating he regional market growth opportunities. The presence of favorable regulations in the region and the significant feed manufacturers is proliferating the regional market share growth.

- According to the Food and Agriculture Organization (FAO), China, India, Japan, the United States, Germany, Turkey, and Mexico are the top agricultural-producing countries worldwide.

The European region is expected to have considerable growth during the forecast period. The rising technological advancements and growing vegan population in the region are enhancing the demand for crop production, and the escalating government support schemes, along with rising testing facilities for micronutrient deficiency, are a few factors contributing to the regional market expansion.

- For instance, the European Soil Data Centre (ESDAC) has surveyed top soils in Europe to determine the micronutrient content.

KEY MARKET PLAYERS

BASF SE, Mosaic, Cheminova, Agrium Inc., Aries Agro Ltd., Coromandel International Ltd., Yara International, Valagro, Gujarat State Fertilizers & Chemicals, Tradecorp International, and AkzoNobel are playing a dominant role in the global agriculture micronutrients market.

RECENT HAPPENINGS IN THE MARKET

- In February 2023, Andersons Inc. announced the introduction of MicroMark DG, a new brand of granular micronutrients that uses dispersion granule technology. MicroMark DG Blitz is a calcium, boron, manganese, and zinc blend, and another one is the MicroMark DG Humic, a calcium, sulfur, manganese, zinc, and humic acid blend.

- In February 2022, The Mosaic Company announced the acquisition of Plant Response, an industry consolidator of leading biological-based solutions. The acquisition changed the company to Mosaic Biosciences, where the company intends to support the crops and their natural biology.

- In May 2022, Coromandel International announced the introduction of five new products under its portfolio. These products will support its crop protection range.

MARKET SEGMENTATION

This market research report on the global agriculture micronutrients market is segmented and sub-segmented into the following categories.

By Type

- Zinc

- Boron

- Copper

- Manganese

- Molybdenum

- Iron

- Cobalt

- Others

Mode of Application

- Fertigation

- Seed treatment

- Foliar

- Others

Based on Form

- Chelated

- Ethylenediaminetetraacetic Acid (EDTA)

- Diethylene Triamine Pentaacetic Acid (DTPA)

- Ethylenediamine Di-2-Hydroxyphenyl Acetate (EDDHA)

- D, L-Aspartic Acid N-(1,2-Dicarboxyethyl)

- Tetrasodium Salt (IDHA),

- Hydroxybenzyl Ethylenediamine Diacetic Acid (HBED)

- Non-Chelated

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

what is the size of agricultural micronutrients market?

The global size of the agricultural micronutrients market was worth USD 9.49 billion in 2025

what is the growth of agricultural micronutrients market?

The agriculture micronutrients market is expected to reach USD 17.92 Billion by 2028 with a CAGR of 8.28 % between 2025 to 2033.

what are the market key players involved in agricultural micronutrients market?

Some of the key players operating in the global market are BASF SE, Mosaic, and Cheminova, Agrium Inc., Aries Agro Ltd., Coromandel International Ltd., Yara International, Valagro, Gujarat State Fertilizers & Chemicals, Tradecorp International, AkzoNobel, are playing a dominated role in the global agriculture micronutrients market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com