Global Starter Fertilizers Market Analysis Size, Share, Trends & Growth Forecast Report, Segmented By Nutrient Component (Nitrogen, Phosphorous, Potassium And Micro Nutrients), Form (Dry And Liquid), Crop Type (Cereals, Fruits & Vegetables, Forage & Turf Grasses), Method Of Application (In-Furrow, Fertigation, Foliar And Other Methods) And By Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa), Industry Analysis From 2025 to 2033

Global Starter Fertilizers Market Size

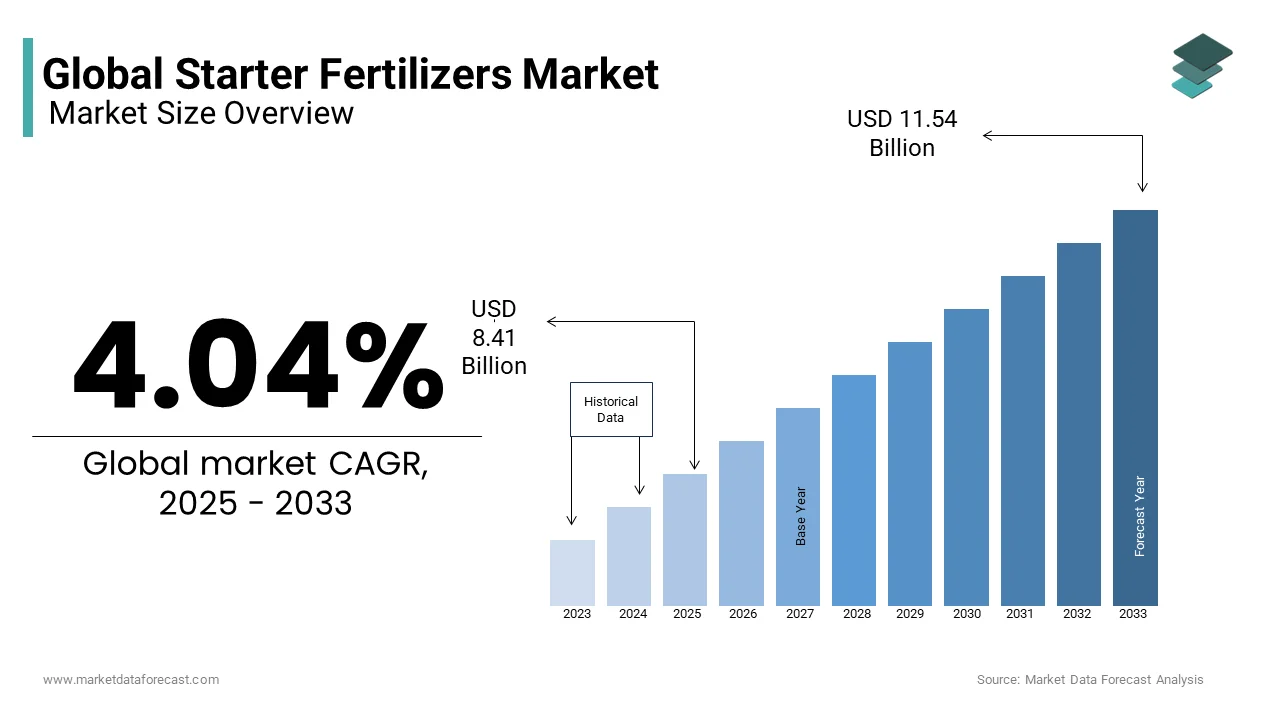

The global Starter fertilizers market was valued at USD 8.08 billion in 2024 and is anticipated to reach USD 8.41 billion in 2025 from USD 11.54 billion by 2033, growing at a CAGR of 4.04% during the forecast period from 2025 to 2033.

Nutrients are very important to be present in the soil for seeds to grow. At the time of planting, a small amount of fertilizer is placed near the seed to provide the necessary nutrients to the seed.

Starter fertilizers vary with different soils. A particular soil might be abundant in Nitrogen but have low phosphorus content. Starter fertilizers have to be selected based on the soil and seeds required. Starter fertilizers are mainly been used in fields with cool soil temperatures until soil conditions improve. Nutrients are not easily accessible for seeds when the soil temperature is cool. Using starter fertilizers reduces the environmental issues caused by the overuse of fertilizers. New technologies such as LEVEL, a fertilizer amendment that prevents nutrients present in the soil from becoming unavailable, are being introduced in the market.

The rapid increase in demand for efficient fertilizers and the adoption of new farming practices are some of the major factors that drive the growth of the market for Starter Fertilizers. To supply the global food requirements, an increase in the need for methods that increase the agricultural output led to an increase in demand for starter fertilizers. Ever-growing concerns for environmental degradation and a lack of adequate knowledge among farmers are some factors that restrict the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.04% |

|

Segments Covered |

By Nutrient Component, Form, Crop Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Stoller USA Inc., The Scotts Miracle-Gro Company, Conklin Company Partners Inc., Yara International ASA, CHS Inc., Agriu Inc., NC, Helena Chemical Company, Miller Seed Company, Nachurs Alpine Solution. |

SEGMENTAL ANALYSIS

By Nutrient Component Insights

Phosphorus held the largest market share in this segment. It is expected to hold the market share during the forecast period because of its major role in stimulating the growth of seedlings in the early stages. Nitrogen and phosphorus are second to phosphorus in the market share.

By Form Insights

Since both these forms are effective on the same level, they hold almost equal shares in the market.

By Crop Type Insights

Due to the high demand for cereals across the globe, cereals hold the largest share of the market. Also, Starter fertilizers are mainly suited for corn, which is included in cereals.

By Application Insights

The foliar method is projected to have the highest growth rate in this segment because it results in rapid nutrient intake.

REGIONAL ANALYSIS

Based on Region, the global starter fertilizer market is divided into North America, Asia-Pacific, Europe, Latin America, the Middle East, and Africa. North America led the Starter fertilizer market across the globe with its largest share in the market. This is due to the improved technologies in fertilizer application to enhance the production of cereals, food & vegetables. Asia-Pacific is the fastest-growing market in the Starter fertilizer market due to its huge customer base. Countries like India and China are adopting starter fertilizers at a rapid pace.

KEY MARKET PLAYERS

Stoller USA Inc., The Scotts Miracle-Gro Company, Conklin Company Partners Inc., Yara International ASA, CHSInc.c., Agrium Inc., Helena Chemical Company, Miller Seed Company, Nachurs Alpine Solution. Some of the market players dominate the global starter fertilizers market.

MARKET SEGMENTATION

This research report on the global starter fertilizer market is segmented and sub-segmented into the following categories.

By Nutrient Component

- Phosphorous

- Nitrogen

- Potassium

- Micronutrients

By Form

- Dry

- Liquid forms

By Crop Type

- Cereals

- Fruits & vegetables

- Forage & turf grasses

By Application

- In-furrow

- Fertigation

- Foliar

- other methods

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are starter fertilizers, and why are they important for crop production?

Starter fertilizers are small, concentrated doses of nutrients applied close to the seed at planting, helping young plants establish strong roots quickly, especially under cool or challenging soil conditions.

What factors are driving the growth of the global starter fertilizers market?

Growth is driven by the demand for higher agricultural productivity, increasing adoption of precision farming techniques, shrinking arable land per capita, and farmers seeking faster early-season crop establishment for better yields.

What are the most commonly used types of starter fertilizers?

The most popular types include nitrogen-phosphorus-potassium (NPK) blends, monoammonium phosphate (MAP), diammonium phosphate (DAP), and specialized micronutrient-enriched formulations tailored for key crops like corn, soybeans, and cereals.

What challenges are limiting the starter fertilizers market?

Challenges include the high cost of specialty fertilizers, risks of seedling damage if applied incorrectly, limited adoption among smallholder farmers, and increasing regulatory scrutiny around phosphorus runoff affecting water bodies.

What trends are shaping the future of the starter fertilizers industry?

Key trends include the rise of controlled-release formulations, bio-enhanced starters with beneficial microbes, greater use of liquid starter fertilizers in precision planting, and a strong push toward sustainable and environmentally friendly nutrient solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com