Global K-Beauty Products Market Size, Share, Trends & Growth Forecast Report – Segmented By Product Type (Sheet Masks, Cleansers, Moisturizers, Makeup and Others), End-User (Male and Female), Distribution Channel (Online Retail, Supermarket/Hypermarket and Specialty/Monobrand Stores) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis (2024 to 2029)

Global K-Beauty Products Market Size (2024 to 2029)

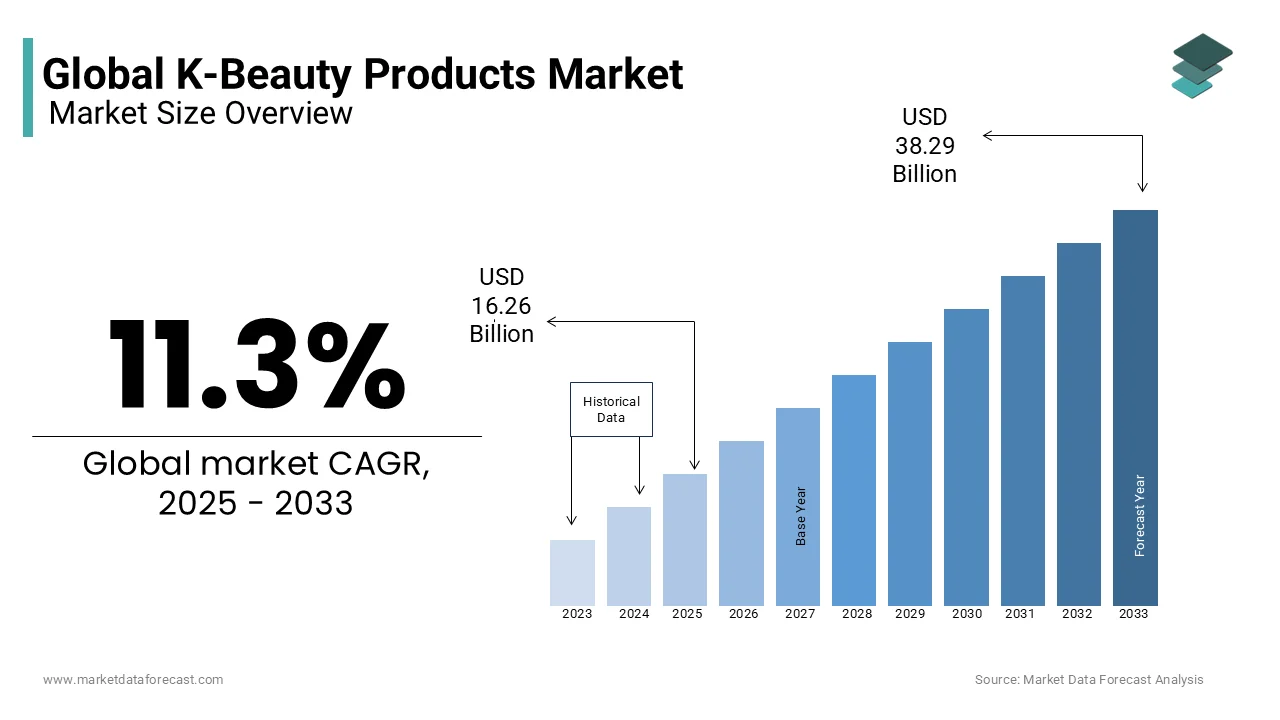

The global K-beauty products market size is expected to grow at a CAGR of 11.3% from 2024 to 2029 and be worth USD 24.96 billion by 2029 from USD 14.61 billion in 2024.

Current Scenario of the Global K-Beauty Products Market

K-beauty products have gained worldwide popularity through influencer marketing and celebrity endorsements. The multi-step skincare routine of Korean beauty has gained an immense vibe due to its incorporation of natural ingredients. K-beauty products had their mark for providing Glassy skin with commendable hydration to the skin. The unique formulations and use of natural and organic ingredients are increasing the demand for K-beauty products.

MARKET DRIVERS

The increased demand for natural and organic ingredients in the composition of skin care products is driving the global K-beauty products market growth.

The massive fanbase of Korean celebrities and K-Pop idols accelerates the demand for K-beauty products and supports the market expansion. Korean brands give importance to the raw materials used in their composition as they prioritize safe, effective, and natural ingredients. To enhance product quality, attention is given to the sourcing process, extraction, and manufacturing procedures. These factors influence the consumers to choose K-beauty products, increasing the market growth. For Instance, COSRX, a popular K-beauty product, has been gaining traction in the recent period due to its unique composition consisting of snail mucin, propolis, and Cica, which earned recognition for hydrating and soothing properties. Sunscreens are a highly demanded product in the K-beauty industry due to their high effectiveness on skin with the required SPF value.

The visual appeal and interesting packaging designs attract people towards these products, a significant market strategy by the manufacturers. The market players are highly investing in R&D activities for significant innovations in the formulations by using safe, unique ingredients, attracting consumers seeking effective and gentle skincare solutions. The specific market strategies by the manufacturers induce gains in the consumer base, which is reflected in the global market growth. Some companies offer refillable skincare products that can be refilled at their stores after the bottle is completed. The increasing celebrity endorsements are boosting the adoption of K-beauty products, reflecting rising market revenue. The rising innovative product launches, collaborations and acquisitions by the market players to expand the K-beauty market is enhancing the market’s growth rate and are expected to further create market opportunities.

A wide range of advertising and campaigning through social media platforms is gaining an immense company consumer base. The manufacturers equally focus on manufacturing and promoting their products with high-range celebrities to attract consumers. The ease of availability to diverse products through e-commerce is expected to create lucrative opportunities for the market expansion of K-beauty products. The rising e-commerce and online retailing are boosting the K-beauty market growth opportunities.

MARKET RESTRAINTS

The major restraining factor for the expansion of K-beauty products is the high cost.

Some of the premium products with high effectiveness are expensive, which is difficult to afford for people in emerging countries, hampering the market growth. Product labels is another major factor hindering the global market growth. The clean label generally consists of a composition of ingredients in Korean, which cannot be readable by everyone. The ingredients need to be clarified to the consumers. The age grouping of cosmetics is showcasing a negative impact on the global K-beauty products market. The racial characteristics of people affect the ages of Koreans and Europeans differently. Some products specifically work for aging symptoms, which may impede the market value due to different age opinions. The stringent government regulations of the different countries for cosmetic products are challenging for K-beauty products as they seek to expand across the world. The diverse regulatory requirements, including ingredient safety and labeling standards, are creating difficulties in market expansion worldwide. The increasing veganism is expected to negatively impact the market growth as most K-beauty products include animal extractions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2029 |

|

CAGR |

11.3% |

|

Segments Covered |

Based on Product Type, Distribution Channel, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

ABLE C&C CO., Ltd., Adwin Korea Corp, Annie's Way International Co., Ltd., The Beauty Factory, Ltd., Bluehug, Inc., BNH Cosmetics, Ceragem Health and Beauty Co, Ltd., CK Beauty Enterprise Inc., LG Household & Health Care, and Amorepacific Corporation. |

SEGMENTAL ANALYSIS

Global K-beauty Products Market By Product Type

The masks segment dominated the market, with a 64% revenue share worldwide in 2023.

The sheet masks segment dominates skincare products as they are affordable and highly effective. Sheets are helpful in moisturizing, soothing, and brightening the skin by maintaining skin health. The fast-pacing effect and the ease of affordability allow the sheet masks to acquire market growth and are expected to maintain their domination in the forecast period. The moisturizers segment is gaining traction recently and is projected to grow significantly over the forecast period. These Korean moisturizers provide adequate hydration and soothing properties by repairing the skin barrier, raising the demand for moisturizers by propelling the K-beauty product's market value.

Global K-beauty Products Market By Distribution Channel

The supermarkets/hypermarkets segment held the largest share, 45%, in the K-beauty products market in 2023

The supermarkets act as a one-stop shop for all the necessities, which is convenient for busy people. Hypermarkets are more numerous as consumers can easily access the products as they directly buy the products of their choice. The retail stores focus on providing demonstration services regarding the brands consumers can select based on their choice.

Online retailers have gained a consumer base in recent years and are expected to grow significantly over the forecast period. The e-commerce sector is leading in a surge due to the high level of product promotion and accessibility to various ranges, offers, and discounts issued by retailers, driving the market growth.

Global K-Beauty Products Market By End-User

The women segment dominated in 2023 with a share of 67% of K-beauty products market revenue. Women are the significant people concerned regarding the skincare routine compared to men. Women working and active in social and economic status are keen to show immense interest in skincare products to maintain healthy and glassy skin. The rising disposable incomes of women are influencing them to invest in trendy and luxury products for better, youthful skin.

The men's segment is expected to grow significantly in the forecast period. Many men use serums, SPF, and moisturizers to maintain healthy skin. The K-beauty industry is introducing innovative and unique formulations for men's healthy skin, propelling the market growth.

REGIONAL ANALYSIS

Asia Pacific dominated the global K-beauty products market in 2023 with a significant growth rate due to higher adoption of healthy skincare products for maintaining a youthful appearance. The expanding K-beauty market in emerging countries such as India, China, and others bolsters the market growth. Personal care is growing worldwide as the COVID-19 pandemic made time for people to increase their self-care routines. The increasing product launches, collaborations, and acquisitions further expand the market growth.

North America is expected to have significant growth in the forecast period. Induced urbanization makes people in developed countries like the U.S. and Canada more concerned about skincare. Popular K-beauty brands are expanding their market in central countries like the US, Japan, and China. The presence of branches of the leading organizations in these countries propels market expansion. The availability of a diverse range of products in offline retail stores is driving the market growth of the K-beauty industry. The introduction of various K-beauty products in the European region according to skin type and concerns is increasing the K-beauty market size. The increased celebrity endorsements and the high-level promotions of the products are increasing the adoption of these products.

KEY MARKET PLAYERS

Some of the notable companies operating in the global K-beauty products market analyzed in this report include ABLE C&C CO., Ltd., Adwin Korea Corp, Annie's Way International Co., Ltd., The Beauty Factory, Ltd., Bluehug, Inc., BNH Cosmetics, Ceragem Health and Beauty Co, Ltd., CK Beauty Enterprise Inc., LG Household & Health Care and Amorepacific Corporation.

RECENT HAPPENINGS IN K-BEAUTY PRODUCTS MARKET

- In 2023, Amorepacific, the parent company of Laneige and Sulwhasoo, launched their new R&D center in San Fransico to focus on developing new skincare technologies and ingredients suitable for the US market.

- In November 2022, L'Oreal announced the launch of C-beauty, K-beauty, and J-beauty products in collaboration with Shihyo, a Korean brand. This brand range includes herbal ingredients with fermented rice and other innovative Asian techniques.

- In 2022, Selena Gomez partnered with the K-beauty brand Glow Recipe to promote self-care and wellness. She promoted Watermelon Glow Niacinamide Dew Drops, a lightweight serum for hydration and brightening the skin, which received an immense response from consumers after this celebrity endorsement.

DETAILED SEGMENTATION OF THE GLOBAL K-BEAUTY PRODUCTS MARKET INCLUDED IN THIS REPORT

This research report on the global K-beauty products market has been segmented and sub-segmented into the following categories.

By Product Type

- Masks

- Cleansers

- Moisturizers

- Makeup

- Others

By Distribution Channel

- Online Retailers

- Supermarkets\Hypermarkets

- Specialty\Monobrand Stores

- Others

By End-User

- Men

- Women

By Region

- North America

- the United States

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- Spain

- United Kingdom

- Italy

- France

- Switzerland

- The rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Southeast Asia

- The rest of Asia-Pacific

- Latin America

- Brazil

- Argentina

- Chile

- Rest of Latin America

- The Middle East and Africa

Frequently Asked Questions

How big is the K-Beauty products market?

The K-beauty products market has experienced significant growth and transformation over the years, driven by changing consumer preferences and globalization.

What are the key factors driving the growth of the K-beauty products market?

The growing consumer awareness of Korean skincare and beauty products, innovative product formulations, and effective marketing strategies majorly propel the growth of the K-beauty products market.

What regions are experiencing the highest growth in the K-beauty products market?

While K-beauty has a global presence, regions like Asia, North America, and Europe have shown significant growth in recent years.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1800

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]