Global Refurbished Medical Devices Market Size, Share, Trends & Growth Forecast Report – Segmented By Product Type (Operating Room Devices & Surgical Devices, Patient Monitors, Defibrillators) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From 2025 to 2033

Global Refurbished Medical Devices Market Size

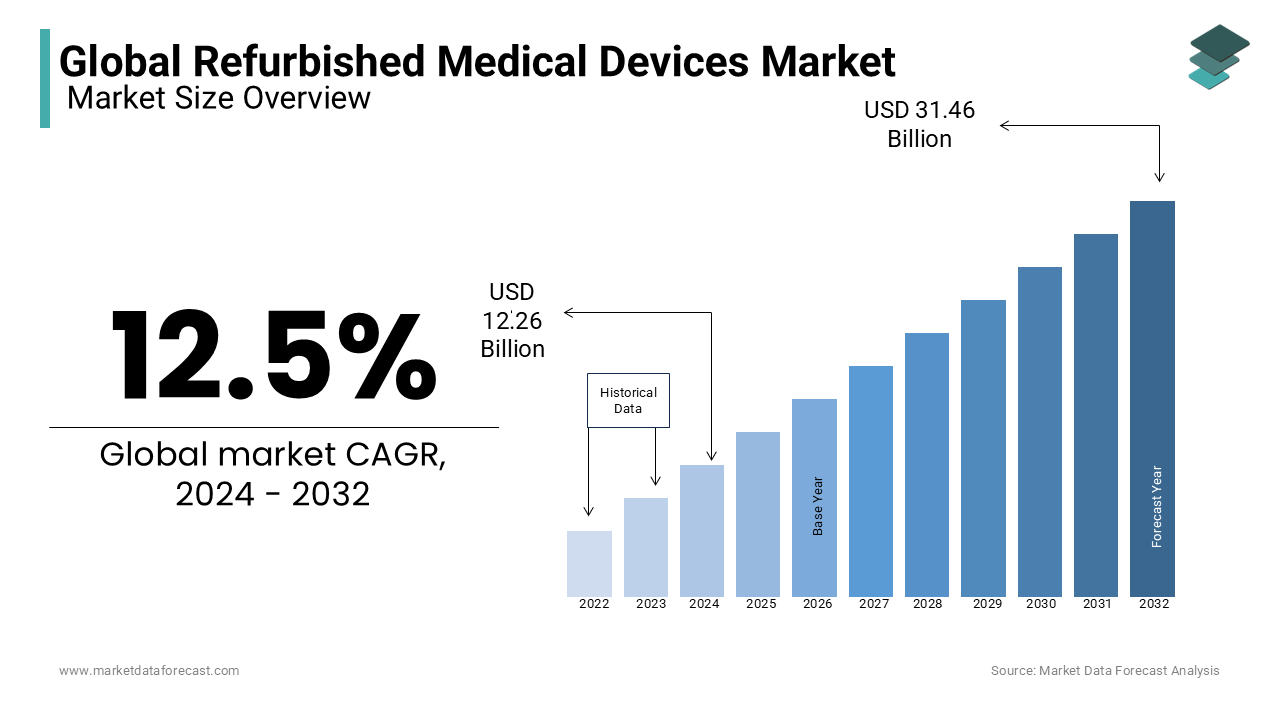

The global refurbished medical devices market size was valued at USD 12.26 billion in 2024. The refurbished medical devices market is predicted to be worth USD 35.38 billion by 2033 from USD 13.79 billion in 2024, growing at a CAGR of 12.5% from 2025 to 2033.

Refurbished medical devices are restored devices built to meet safety and performance requirements comparable to their condition at the initial, which does not change the intended use of the original device. Good refurbishment involves a set of standard operating procedures which ensure the safety and effectiveness of the devices. The global refurbished medical devices market has had moderate growth in the past years and is anticipated to have significant growth in the coming years. This is due to the rising costs of medical devices, which are majorly restricted access to various expensive devices by low and middle-income organizations, allowing them to adopt refurbished devices in budget-friendly contributing to market revenue. The growing number of healthcare service providers worldwide and cost containment pressure on healthcare organizations drive market growth. According to data published by the American Hospital Association, in 2022, there are about 6093 hospitals in the U.S, and it also stated that about 2960 nongovernment not-for-profit community hospitals, 1,228 investor-owned (for-profit) community hospitals, 951 state and local government community hospitals and 635 federal government hospitals and 112 non-federal psychiatric hospitals. The rise in several healthcare organizations is expected to increase the demand for refurbished medical devices.

MARKET DRIVERS

The growing incidence of cancer and cardiovascular diseases is one of the major factors promoting the global refurbished medical device market growth.

According to the statistics published by the American Cancer Society, an estimated 1.9 million new cancer cases are expected to come to the United States in 2022. In addition, the patient count suffering from cardiovascular diseases is growing significantly worldwide, and WHO says that CVDs constitute a significant cause of death worldwide. Due to a large patient population suffering from chronic diseases such as cancer and cardiovascular diseases worldwide and the growing demand for low-cost medical devices due to budget constraints in developing countries, the global refurbished equipment market is expected to grow significantly. Companies such as GE Healthcare, Siemens, and Philips, for instance, have begun focusing on the refurbishment of large scanning machines like angiography, radiology-based equipment, magnetic imaging resonance, X-ray systems, and other molecular imaging instruments and are now selling them at a 30% discount over new systems.

The growing number of private hospitals purchasing refurbished instruments due to budget constraints and unfavorable reimbursement scenarios for various medical services is further propelling the refurbished medical device market worldwide. Growing initiatives by leading medical device manufacturers to build refurbished facilities in developed and developing countries are anticipated to fuel the global refurbished medical devices market. When opposed to new medical equipment, refurbished medical equipment costs 30% to 50% less. Furthermore, e-commerce sites are expected to simplify selling and buying refurbished medical devices. In addition, growing privatization in the healthcare industry, rising demand for low-cost medical devices owing to economic constraints, and increasing acceptance of refurbished medical devices in numerous nations are other key factors fuelling the growth of the refurbished medical equipment market during the forecast period.

In both developed and emerging markets, mobile and shared imaging service providers' trend is expected to expand. Budget limitations, technological obsolescence, a lower-than-average number of procedures, and patient convenience drive hospitals and diagnostic imaging centers to use mobile and collaborative imaging services. Moreover, to attract patients and provide healthcare accessibility, many hospitals and healthcare providers offer home-based imaging facilities for ultrasound and X-ray procedures. The cost of capital equipment is a significant concern for these service providers. OEMs and third-party refurbishes will utilize these opportunities to reach this growing market and sell their refurbished imaging equipment reasonably. Hospital budget cuts, a vast inventory of used or old medical instruments, a growing preference for eco-friendly goods, a rising number of diagnostic centers and hospitals, and opportunities in emerging markets contribute to the growth of the global refurbished medical devices market.

MARKET RESTRAINTS

Restricted import and use of refurbished medical devices in some countries, a lack of standardization of policies for the use and selling of refurbished medical devices, an influx of low-cost latest medical devices, and a negative perception of refurbished medical device quality are all expected to limit the market growth. In addition, the lack of standardization and synchronization of policies associated with using and selling refurbished medical devices is the critical challenge players face in the global refurbished medical devices market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Siemens Healthcare Systems, First Source Inc., DMS Topline, Radio Oncology Systems Inc., Johnson & Johnson, GE Healthcare, DRE Inc., Block Imaging International Inc., Integrity Medical Systems Inc., Everx Pvt Ltd., Philips Healthcare, Agito Medical A/S and Soma Technology. |

SEGMENTAL ANALYSIS

By Product Type Insights

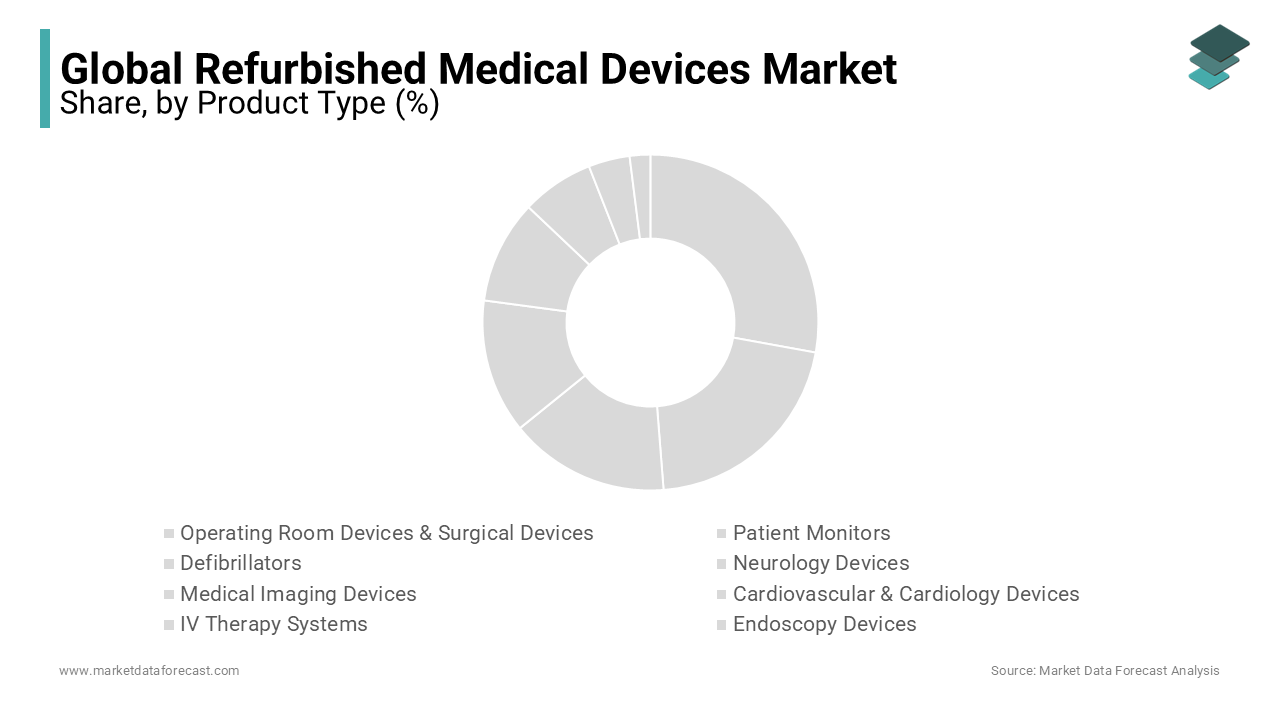

The patient monitors segment dominated the global refurbished medical devices market revenue due to its broad adoption among hospitals and home healthcare. The patient monitors measure the patient's vitals and display the data supporting the patient's treatment. The patient monitors, measures, records, and displays patient parameters like heart rate and rhythm, SPO2, blood pressure, temperature, respiratory rate, blood pressure, blood oxygen saturation rate, and others, which keep track of patient health by providing high-quality health care. Patient monitors are highly required as they are crucial in monitoring the patient's health condition, accelerating their adoption across healthcare organizations. The growing technological advancements in the healthcare industry are enhancing the launch of advanced and technological patient monitor devices, promoting market growth opportunities.

The medical imaging devices segment is estimated to grow prominently in the coming years as medical imaging devices like MRI, CT, ultrasound, and others are in high use due to rising trauma cases. The growing technologies in imaging devices are helping doctors diagnose and monitor diseases and damaged conditions in the body. The increasing cost of imaging devices is inducing medical organizations to adopt refurbished devices due to cost-effectiveness, which is majorly driving the segment growth and enhancing the market revenue.

Other segments, such as cardiology devices, Intensive care systems, surgical devices, and others, are expected to have moderate growth rates during the forecast period due to rising healthcare expenditures and rising medical device costs, which are allowing organizations to seek refurbished devices.

REGIONAL ANALYSIS

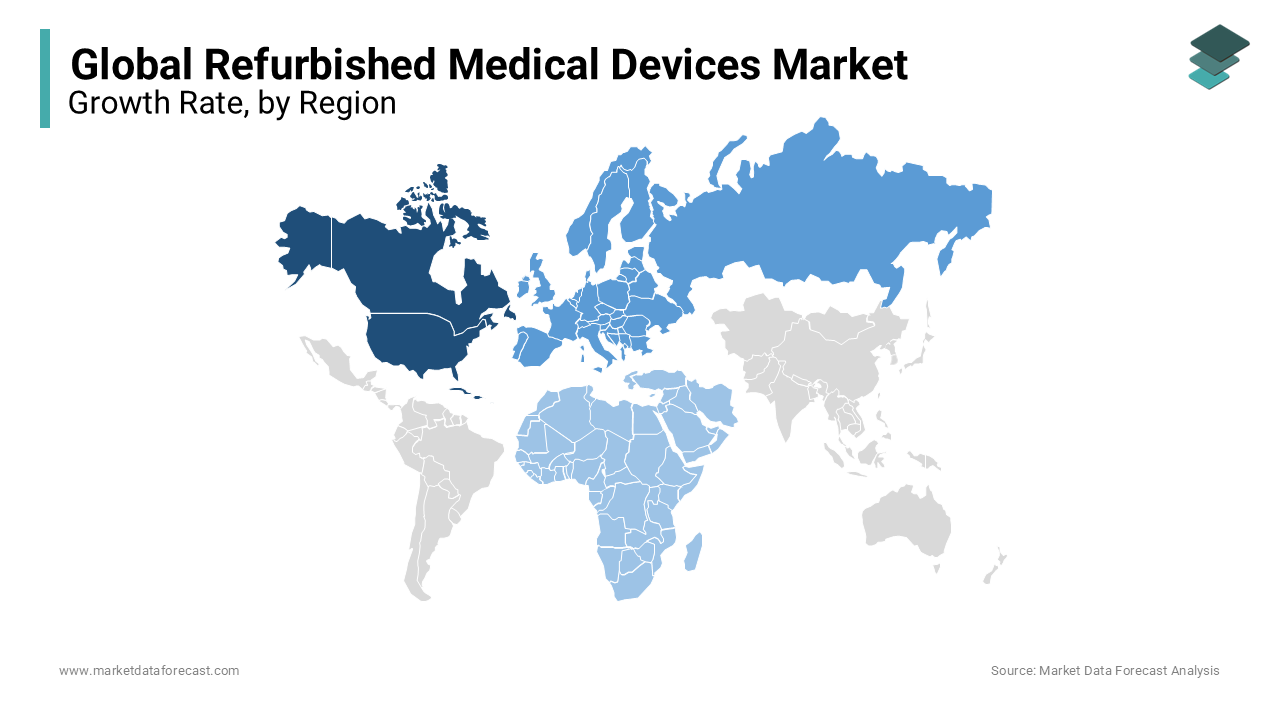

North America led the market in 2024 and is anticipated to hold a significant proportion of the worldwide market during the forecast period. The increasing trend of medical tourism and the growing privatization of the healthcare sector in this region primarily drives the dominance of North American. Due to its advanced healthcare infrastructure and government support, North America dominates the global refurbished medical equipment market. In addition, many private healthcare facilities, such as private hospitals, clinics, and diagnostic centers, an aging population, and a high incidence/prevalence of various diseases contribute to the region's market growth. The U.S. market had a significant share of the North American region in 2023 and is estimated to continue dominating the regional market during the forecast period, followed by Canada.

Europe is another lucrative region worldwide and is expected to register a promising growth rate during the forecast period. In 2015, 75.5% of the global demand for refurbished medical devices was for diagnostic imaging equipment. Countries such as the UK, Germany, and France have accounted for most of the European market share in 2024.

Asia-Pacific is predicted to show a high CAGR during the forecast period due to the ever-increasing provision from the government and effective reimbursement policies in this region. In addition, due to an increased prevalence of chronic and infectious diseases, increased population income and affordability increased knowledge of healthcare and public healthcare spending, and increased private investment in the healthcare sector, Asia-Pacific is the fastest-growing region in the worldwide market refurbished medical equipment.

Latin America is anticipated to hold a considerable share of the worldwide market during the forecast period.

The market in MEA is estimated to grow steadily in the coming years.

KEY MARKET PLAYERS

Companies leading the global refurbished medical devices market profiled in this report are Siemens Healthcare Systems, First Source Inc., DMS Topline, Radio Oncology Systems Inc., Johnson & Johnson, GE Healthcare, DRE Inc., Block Imaging International Inc., Integrity Medical Systems Inc., Everx Pvt Ltd., Philips Healthcare, Agito Medical A/S and Soma Technology.

RECENT HAPPENINGS IN THIS MARKET

- In June 2023, Global MedTech Solutions partnered with a leading pharmaceutical company to develop refurbished infusion pumps integrated with innovative monitoring systems. The intelligent pumps can automatically adjust medication dosage based on real-time patient data, improving treatment accuracy and patient safety.

- In March 2023, Apex Medical Equipment introduced a line of refurbished surgical robots with state-of-the-art artificial intelligence algorithms. These advanced robots offer precise and minimally invasive surgical procedures, reducing recovery times and improving patient outcomes.

- In January 2023, MediTech Solutions launched its revolutionary refurbished MRI machines with enhanced imaging capabilities and advanced diagnostic features. The new technology promises higher accuracy and faster scan times, revolutionizing the field of medical imaging.

- In January 2023, GE HealthCare acquired IMACTIS, a pioneer in the quickly expanding field of Computed Tomography (CT) interventional guidance across a variety of care areas.

- In April 2022, Blue Star's wholly-owned subsidiary, Blue Star Engineering & Electronics, inaugurated a medical diagnostic equipment refurbishment facility in India.

MARKET SEGMENTATION

This research report on the global refurbished medical devices market has been segmented and sub-segmented based on product type and region.

By Product Type

- Operating Room Devices & Surgical Devices

- Patient Monitors

- Defibrillators

- Neurology Devices

- Medical Imaging Devices

- Cardiovascular & Cardiology Devices

- IV Therapy Systems

- Endoscopy Devices

- Intensive Care Systems

- Neonatal Intensive-Care Devices

- Other Medical Devices

By Region

- North America

- Latin America

- Europe

- Asia-Pacific

- Middle East & Africa

Frequently Asked Questions

What was the size of the refurbished medical devices market worldwide in 2024?

The global refurbished medical devices market size was valued at USD 12.26 billion in 2024.

Which segment by product type led the market in 2024?

Based on the product type, the patient monitoring devices segment had the major share of the refurbished medical devices market in 2024.

Which region is growing the fastest in the global refurbished medical devices market?

Geographically, the Asia-Pacific region accounted for the largest share of the market in 2024.

What are some of the notable players in the refurbished medical devices market?

Siemens Healthcare Systems, First Source Inc., DMS Topline, Radio Oncology Systems Inc., Johnson & Johnson, GE Healthcare, DRE Inc., Block Imaging International Inc., Integrity Medical Systems Inc., Everx Pvt Ltd., Philips Healthcare, Agito Medical A/S, and Soma Technology are a few of the notable players in the refurbished medical devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com