Robo Advisory Market Size, Share, Trends & Growth Forecast Report by Type (Pure Robo Advisory & Hybrid Robo Advisory), Services Type (Wealth Management & Cash Management), End-User (Healthcare, Retail, Education, & Others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Robo Advisory Market Size

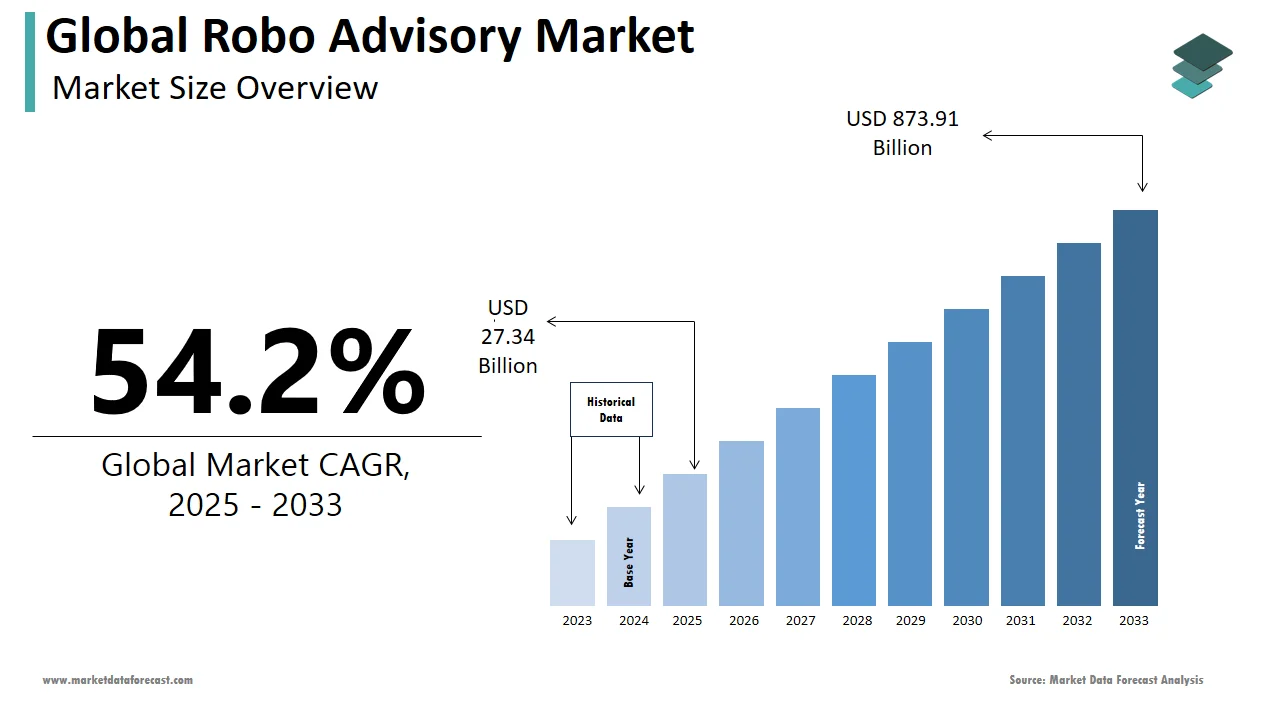

The global robo-advisory market was worth USD 17.73 billion in 2023. The global market is expected to grow at a CAGR of 54.2% from 2025 to 2033, and its size is anticipated to be USD 873.91 billion by 2033, up from USD 27.34 billion in 2025.

Robo-advisory is essentially an automated algorithm-based portfolio management service offered by wealth management companies. It dramatically reduces the administration costs of providing all financial advice through labor, helping wealth management companies to provide this service at minimal cost to their clients. Robo Advisory is an automated portfolio management software that enables clients to systematically adjust and customize online investments to achieve their long-term financial goals and short-term investment strategy.

The penetration of technology in the financial industry has been steadily growing over the last few decades, and similar growth has been noticed in the robo-advisory market worldwide. The adoption of this type of advisory service has risen exponentially in several countries in recent years.

- In a survey by WealthManagement.com, a large portion of participants, i.e., 91 percent, have intentions to adopt new technologies in 2024, with a main emphasis on solutions targeted at improving client retention and attraction, as observed by 36 percent of respondents. Trailing behind is cybersecurity, which secured the second spot with 32 percent of participants, an option launched in 2023.

For instance, the usage of robo-advisory is high in developed countries such as the United States, the United Kingdom and Australia when compared to developing and underdeveloped countries. These consultancy companies, like Betterment and Wealthfront, are popular in the U.S. and have been offering automated investment management solutions to individuals based on their preferences and risk profiles.

Similarly, Nutmeg and Moneyfarm in the UK have been providing low-cost portfolio management services to tech-savvy investors. Market players operating in this market have been leveraging advanced algorithms and ML techniques to offer personalized investment recommendations for their customers. The market in the next few years is anticipated to be promising owing to the growing demand for convenient and cost-effective investment solutions.

MARKET DRIVERS

The rapid adoption of digital financial services and increasing demand for customized investment advice are propelling the growth of the robo-advisory market worldwide.

Automated consultancy is a practical option for an automated process without any manual commitment from financial advisers. Technological advancements have been aiding many industries around the world in transforming digitally. Various market forces are driving organizations to transform digitally, such as the emergence of new ecosystems accessible through digital channels, the reduction of barriers to digital entry, the reduction of ownership of assets and infrastructure, and decoupled value chains, among others. Financial advisory firms embrace technologies such as machine learning and artificial intelligence (AI) to develop financial algorithms that can learn and use knowledge to solve complex problems continually, which, in turn, helps companies gain an additional competitive advantage to serve their clients and improve the provision of advice.

- As per the survey results by Norton Rose Fulbright over financial services companies worldwide, 76 percent of participants are either presently utilizing AI/ML or considering its deployment. Most companies are either in the early phases of AI/ML advancement or looking at their limited application. Additionally, 94 percent of financial services companies expect greater use in the upcoming 3 years from 2024.

Recent advances in machine learning (ML), artificial intelligence (AI), and neural research promise to revolutionize business models in several industries where there has always been a strong demand for automation of complex processing, as activities by humans are prone to errors. Initially used in the financial sector, the need to manage wealth digitally has paved the way for growing demand for robot advisors, who use predefined algorithms to rank consumers for their ability to manage risk and, therefore, offer predefined and low-cost services. It has been observed that the arrival of robot advisers has reduced the cost of wealth management from 1.0% to 2.0% to 0.15% to 0.50% of total assets.

The absolute advantages of robot advisers to allow automatic management of people's wealth based on algorithms are further promoting the global robo adviser market growth.

- A study by ThoughtLab revealed that asset and wealth managers are employing ML, AI, robotic process automation (RPA), and business process management (BPM) under the cover of Intelligent automation (IA), which has emerged as a crucial strategy to keep current or create new revenue flows. Those companies that have opted for digital transformation are experiencing a rise in efficiency, i.e., 13.8 percent, assets under management at 8.1 percent, and revenue at 7.7 percent.

Several small investors can now use robot advisers to track the progress of their portfolios as they are available at low starting prices, offer attractive returns, and are transparent, surprisingly different, and innovative compared to plans offered by the banking sector. Analysts have observed that the current and future generations in various emerging economies are familiar with technology and prefer digital tools. In addition to this, financial advisory providers are also embracing new technologies as they can help them effectively serve a larger group of clients over time. The robotics advisory market is anticipated to experience a high growth rate due to increased accessibility and availability with a low price of financial assistance, and increased internet penetration associated with advanced technology. Increased competition with new entrants and diversified services are among the main factors that should increase the demand for Robo advisers at a high rate in the coming years.

MARKET RESTRAINTS

On the flip side, the shortage of direct contact or personalized support to clients, the escalation of risk profiles due to changing factors such as retirement and income, and the inability to adapt to changes in runtime scenarios are just a few factors that impede the Robo advisers market to reach its true potential.

MARKET OPPORTUNITIES

The robo advisory market is expected to flourish in the coming years due to the expanding role of automated consultants across several industries, including real estate, Finance, etc. Technological integration will completely reshape the market. These advisors present potential prospects for traditional investment managers to improve their service portfolio via the incorporation of technology. By integrating automated consultancy abilities into their current platforms, conventional companies can take advantage of analytics and automation to enhance operational productivity, lower costs, and deliver more customised advice to customers.

Additionally, technological incorporation allows traditional managers to broaden their market presence and penetrate new consumer segments, like tech-savvy investors and digitally native millennials. Incorporating this technology also enables companies to provide hybrid consultancy models that merge human advice with automated investment services, serving a wider spectrum of customer requirements and preferences.

- According to a financial expert’s article in Euractiv, as of now, in 2024, around 50 percent of millennials are inclined towards robo-advisor services, and the interest level is approximately double that of the preceding generation.

MARKET CHALLENGES

Algorithmic accuracy is one of the key obstacles in front of the robo-advisory market. These consultants face various technical problems in achieving algorithmic accuracy. Companies struggle to gather quality data, which is the basis of automated financial planning and investment services. These advisors use algorithms that depend on superior-quality data to produce precise investment suggestions. Despite that, incorrect or incomplete information can result in dubious investment tips or advice and hinder their accuracy and market growth. Moreover, the complication of these algorithms is another issue derailing its growth trajectory. They need a deep understanding of statistical and mathematical concepts, rendering the design and implementation process further challenging. Flaws or mistakes in these difficult algorithms can lead to wrong investment suggestions, causing financial setbacks for investors.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

54.2% |

|

Segments Covered |

By Type, Service, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Betterment, FutureAdvisor, Personal Capital, Vanguard Personal Advisor, Wealthfront, WiseBanyan, SigFid Wealth Management, and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The pure robo advisory segment dominated the market in 2024, accounting for 57.4% of the global market share, and the domination of the segment is anticipated to continue throughout the forecast period. The growth of the pure robo-advisory segment is mainly attributed to cost-effectiveness, accessibility, and convenience. The user-friendly interfaces and algorithm-based investment strategies offered by pure robo advisors are boosting the expansion of the pure robo advisory segment in the global market. Pure robo advisory firms such as Betterment and Wealthfront are popular worldwide and have a substantial amount of user base.

The robo-hybrid advice segment is anticipated to account for a substantial share of the worldwide market during the forecast period, owing to the increasing integration of automated investment solutions with human advisory services by financial institutions.

By Service Insights

The wealth management segment held the largest share of the global robo advisory market in 2024 and the lead of the segment is estimated to continue during the forecast period. The democratization of investing and the shift towards passive investment strategies are of key factors propelling the growth of the wealth management segment.

- According to a 2024 survey by Capco, 91 percent of Singapore people under the age of 35 have increased their application of digital channels for wealth management objectives in the past 2 years. Followed by 75 percent of participants aged between 45 and 64. Moreover, 76 percent of those under 35 years old are comfortable with artificial intelligence (AI) directing their decisions for wealth management.

The cash management segment is predicted to grow at a healthy CAGR during the forecast period in the global market. Factors such as the rising complexity of cash management operations, the need for real-time liquidity visibility, and the adoption of cloud-based treasury solutions are propelling the growth of the cash management segment in the global market.

REGIONAL ANALYSIS

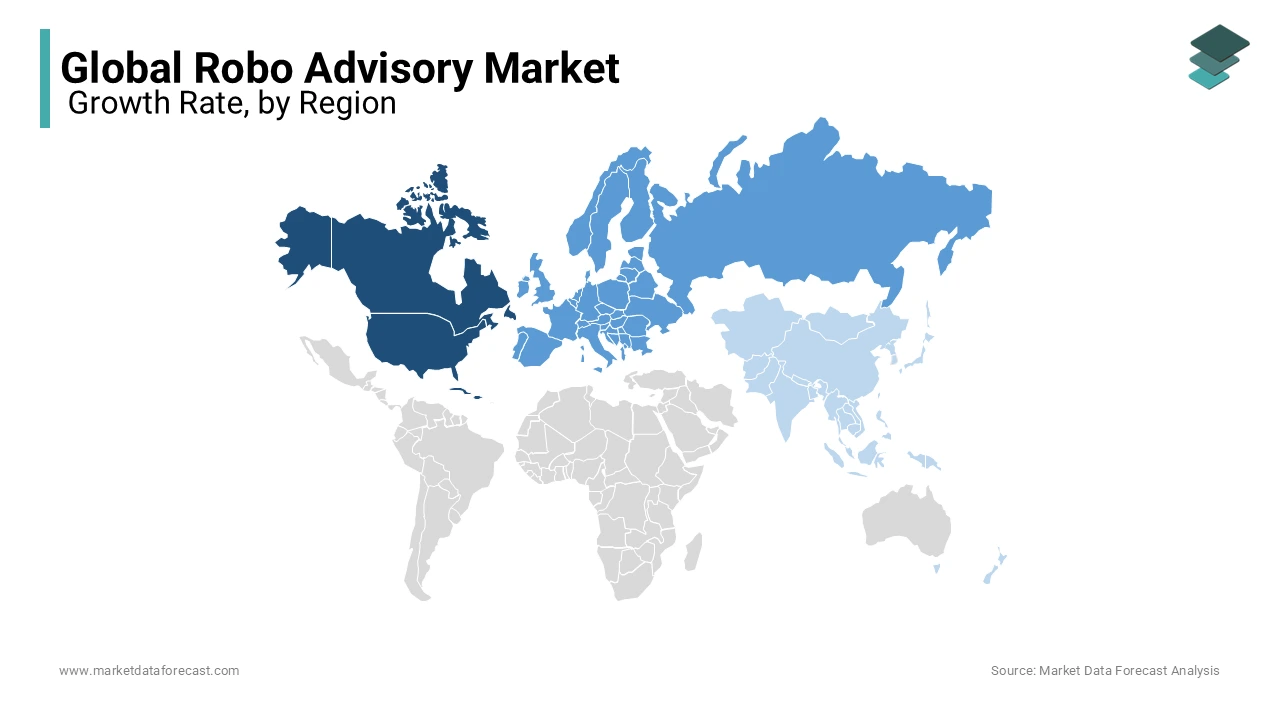

North America held the largest share of 40.7% of the global market in 2023, and the lead of the North American region in the global market is likely to continue throughout the forecast period. The dominance of the North American region is primarily attributed to the presence of a robust financial services sector across North America and high awareness and adoption of robo-advisory services among the North American population. Factors such as rapid adoption of digital investment solutions, the presence of established robo advisory platforms, favorable regulatory frameworks promoting fintech innovation, the presence of affluent population and growing emphasis on retirement planning across the North American region are further promoting the robo advisory market in this region. The U.S. holds the major share of the North American market, followed by Canada.

- According to a 2023 study by Altindex, people of the United States invested 70 thousand dollars on average through robo advisory in 2022, which is 5 times higher than Europeans and 9 times over the Chinese. In addition, the average assets under the management (AUM) per consumer in the American market is projected to cross the number of 116 thousand dollars by 2027

Europe is a notable regional segment in the worldwide market and is predicted to capture a substantial share of the worldwide market during the forecast period, owing to the increasing consumer awareness of robotic consulting solutions and services, as well as the need for consumers to manage their financial activities.

- As per eMarketer, in 2021, around 420000 adults in the United Kingdom utilised a robo-advisor to manage their investment, which climbed by 25.2 per cent from last year.

The rising demand for digital wealth management solutions, regulatory support for fintech innovation, and increasing preference for self-directed investing are contributing to the growth of the European market. For instance, regulatory initiatives such as the Markets in Financial Instruments Directive II (MiFID II) and the Sustainable Finance Disclosure Regulation (SFDR) of the European Union are driving transparency and sustainability in the European robo-advisory market. The rise of open banking and PSD2 regulations and the emergence of digital-first banks and investment firms targeting tech-savvy consumers are further propelling the robo-advisory market in Europe.

The Asia Pacific has experienced impressive growth in the robo advisory sector, both in volume and value, and is expected to experience the highest growth rate over the forecast period due to increasing adoption of automation by manufacturing industries and adoption of Robo industrial boards across the region. Countries like China, Japan, Thailand, and South Korea produce high-volume commercial and industrial flight boards. The adoption rate of flight advice in China and India is very high due to the massive deployment in the manufacturing sector. Factors such as growing wealth accumulation, increasing middle-class population seeking investment opportunities, rapid penetration of the internet and smartphones, the emergence of digital-native investment platforms, and government initiatives promoting financial inclusion and literacy are promoting the growth of the robo-advisory market in the Asia-Pacific region.

- As per Capco’s survey, several people in Singapore under the age of 35 in 2024 utilise robo advisory services, i.e. 40 per cent, against 16 per cent of participants aged between 45 and 64. Within this, not presently employing these services, a greater share of this younger population says they are ‘very likely’ to use it in the coming years (27 percent in contrast to 8 percent)

KEY MARKET PLAYERS

Companies playing a leading role in the global robo-advisory market include Betterment, FutureAdvisor, Personal Capital, Vanguard Personal Advisor, Wealthfront, WiseBanyan, and SigFid Wealth Management.

RECENT MARKET HAPPENINGS

- In August 2024, Scripbox commenced robo-advisory services via an app in India for direct mutual fund investors. The firm announced that it will cost 299 rupees per month.

- In July 2023, Revolut introduced Robo Advisor in the United States to streamline and maximise investment portfolios. This new characteristic robotizes the management of investment portfolios on behalf of clients to provide more effortless and affordable investing costs than conventional companies.

MARKET SEGMENTATION

This research report on the global robo advisory market has been segmented and sub-segmented based on type, service, end-user, and region.

By Type

- Pure Robo Advisory

- Robo Hybrid Advice

By Service

- Wealth Management

- Cash Management

By End-User

- Healthcare

- Retail

- Education

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which regions contribute the most to the global robo-advisory market share?

Major contributors to the global robo-advisory market share include North America, Europe, and Asia-Pacific, with increasing adoption in emerging markets.

What are the key factors driving the growth of the global robo-advisory market?

Growth in the robo-advisory market is driven by factors such as increased demand for low-cost investment solutions, advancements in artificial intelligence, and the rising popularity of automated financial advice.

How has the COVID-19 pandemic influenced the adoption of robo-advisory services?

The COVID-19 pandemic has accelerated the adoption of robo-advisory services as investors seek digital and remote-friendly investment solutions, contributing to the market's growth.

Who are the key players in the global robo advisory market?

Betterment, FutureAdvisor, Personal Capital, Vanguard Personal Advisor, Wealthfront, WiseBanyan and SigFid Wealth Management are some of the major companies in the global robo advisory market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com