Global Soybean Derivatives Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Soybean, Soy Meal(Soy Milk, Soy Protein Concentrate), And Soy Oil(Refined Oil, Lecithin, Others (Gums, Chemicals))), Application (Feed(Poultry Feed, Swine Feed, Ruminants, Aquafeed), Food(Protein, Fat, Fiber) And Other Industries), Lecithin Processing (Water, Acid, And Enzyme), And Region (North America, Europe, Asia Pacific, Latin America, And Middle East & Africa) - Industry Analysis (2025 To 2033)

Global Soybean Derivatives Market Size

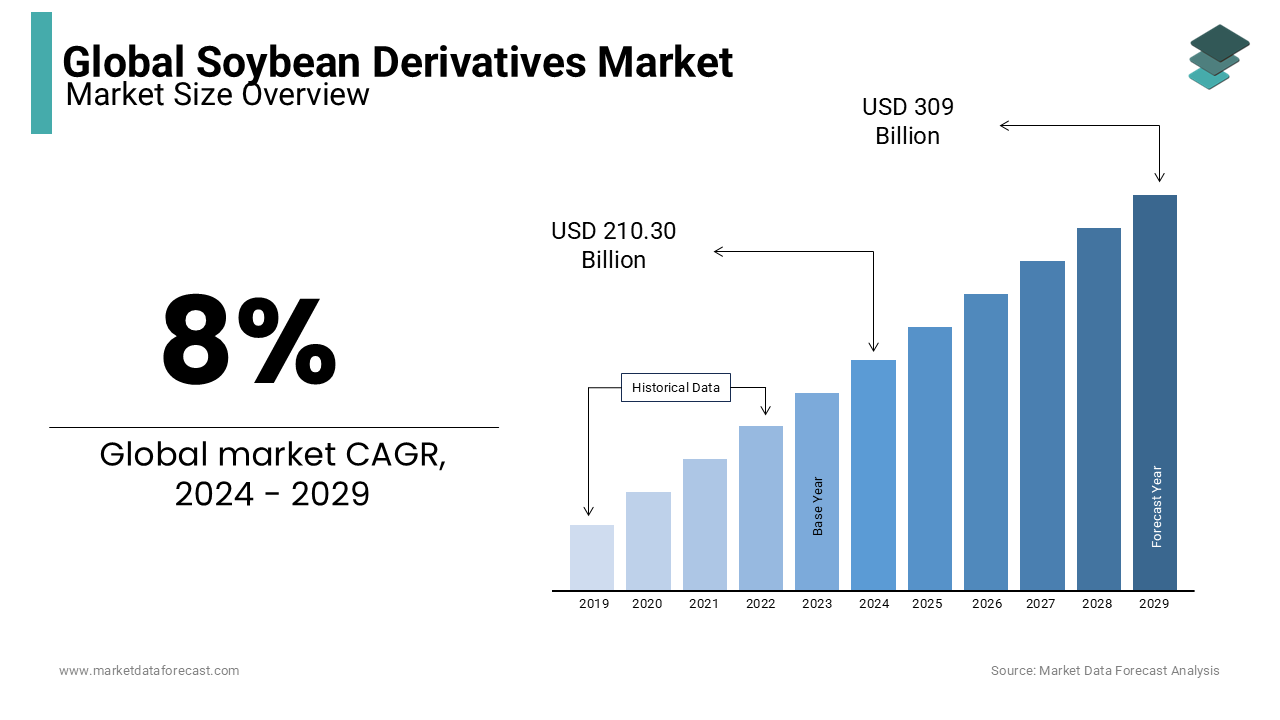

The global soybean derivatives market size was expected to be worth USD 210.30 Billion by 2024 and is anticipated to be worth USD 420.38 billion by 2033 from USD 227.12 billion In 2025, growing at a CAGR of 8% during the forecast period.Soy derivatives have recently been found in many different industries, such as animal feed and automotive, as a consumer still dominated by the food industry, seeking a variety of applications.

Soybeans, commonly known as glycine maxima, are legumes produced mainly in East Asia. Soybeans are widely grown as edible beans with many end-uses. In addition, fat-free (skim) soy flour is considered an inexpensive source of protein for animal feed and packaged foods. Soy contains significant amounts of phytic acid, minerals, and vitamins. Soybean vegetable oil is mainly used in food and industrial applications. Also, soy and its derivatives are used in the food and various industries, such as animal feed, automotive, and other industries. In the food industry, it is used in the production of mayonnaise, spreads, sauces, snacks, baked goods and bread. After extracting the oil from the beans, it produces residual fiber and then uses it for the production of feed for cattle, pigs, farms and cattle. Soy derivatives have become a relevant food product as public awareness of health problems has grown significantly in recent years.

MARKET DRIVERS

The global soy derivatives market is driven by the primary use of soy derivatives in the food and beverage industry due to increased protein consumption.

Soy derivatives are processed to make salad dressings, baked goods, sauces, bread, mayonnaise, and potato chips. The residual fibers obtained from the extraction of soybean oil are roasted and used to feed for farms, livestock, pigs and pets. As meat production increases and demand for animal protein products increases, the growth of the animal feed industry is expected to stimulate market demand during the forecast period. Soy derivatives are also used in the manufacture of paints, coatings, bioplastics, and biodiesel. Increased environmental awareness of greenhouse gas reductions has accelerated the growth of the naturally-derived product's market. This trend is supposed to stimulate market demand as raw material for biodiesel production during the outlook period. As the importance of recycling increases and the need to replace rare resources such as wood increases, the application of soy derivatives for the production of biocomposites increases.

Biocomposites are increasing applications in the construction, automotive, aerospace and packaging industries due to their biological properties. Competitive pricing and respect for the environment are assumed to have a positive impact on the global soy derivatives market in the near future as the application of biocomposites in the plastics industry to manufacture carpet backings and coatings increases. Due to their excellent insulation properties and low VOC emission levels, soy derivatives are increasingly used as insulation to save heating and cooling costs for businesses and homes. This trend is presumed to have a positive impact on the market during the projection period. Elastic soy derivatives are increasingly used to produce high-cost agricultural plastics because they exhibit properties such as good elasticity, good surface quality, and excellent corrosion resistance.

The increase in demand for bioplastics due to the tendency of chemical manufacturers to choose raw materials from nature is expected to have a positive impact on the market during the outlook period. Increased demand for other sugar derivatives, such as sucrose for biomass and bioplastics production, is likely to hamper the growth of the soy derivatives market in the next seven years. Low toxicity, high flash point and low VOC emissions are the main properties of soy derivatives and are anticipated to facilitate the manufacture of cleaning solvents. In the construction and automotive industry, the growing demand for increased carbon demand for green coatings is expected to accelerate the market for soy derivatives in the near future.

MARKET RESTRAINTS

Making sugar cane and wood pulp readily available in industrial applications for bioplastics and biogas production will limit market growth to some extent worldwide. Besides, some of the main challenges in this sector are the presence of numerous products in the market, such as tofu, textured vegetable protein (TVP) and seitan. Lecithin is the main reason that causes a soy allergy.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8% |

|

Segments Covered |

By Type, Application, Lecithin Processing, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Du Pont Nutrition and Health, Ruchi Soya Industries Limited, AG Processing Inc, CHS Inc, Noble Group Ltd, Wilmar International Limited, Cargill, Incorporated, Louis Dreyfus Commodities B.V., Archer Daniels Midland and Company, Bunge Ltd and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The Soy Oil segment is the largest in the soybean derivatives market. Soy oil, particularly refined oil, is widely used in food production, cooking, and as a key ingredient in processed food items. It is favored due to its neutral flavor, high smoke point, and nutritional benefits, including being rich in polyunsaturated fats. The demand for soy oil is driven by its applications in food industries, as well as its growing use in biodiesel production, contributing to its market dominance. Additionally, lecithin, a byproduct of soy oil, is widely utilized in food processing as an emulsifier, further boosting this segment.

The Soy Meal segment, particularly Soy Protein Concentrate and Soy Milk, is the fastest-growing in the soybean derivatives market. As consumers increasingly shift toward plant-based proteins and dairy alternatives, the demand for soy-based products like soy protein concentrate and soy milk has surged. These products are used in a variety of food applications, including meat alternatives, dairy-free beverages, and protein bars, making them key contributors to the growth of this segment. The rise in health-conscious consumption and plant-based diets is expected to continue driving rapid growth in the soy meal segment.

By Application Insights

The Feed segment is the largest in the soybean derivatives market. Soybean derivatives, especially soy meal and soy protein concentrate, are widely used in animal feed due to their high protein content, making them essential for poultry, swine, ruminants, and aquafeed. These derivatives are rich in essential amino acids, providing a cost-effective and nutritious option for livestock nutrition. The growing global demand for meat and animal products drives the strong demand for soy-based feed ingredients, solidifying the feed segment’s dominance in the market.

The Food segment is the fastest-growing in the soybean derivatives market, particularly in protein, fat, and fiber applications. With the rising demand for plant-based and vegan diets, soy-derived ingredients like soy protein, soy oil, and soy fiber are increasingly used in food products such as plant-based meat alternatives, dairy substitutes, and healthy snacks. As consumers focus on health, wellness, and sustainability, the demand for soy-based food products continues to grow rapidly, making it the fastest-expanding segment in the market.

By Lecithin Processing

The Water processing method is the largest segment in the soybean derivatives market, particularly for lecithin extraction. This method is commonly used due to its simplicity and cost-effectiveness. Water processing involves using water to separate lecithin from soybeans during the oil extraction process. It is a preferred choice in the food industry because it is a more natural approach, helping retain the quality and nutritional properties of lecithin. The demand for lecithin in food products like baked goods, chocolates, and dairy products drives the widespread use of the water method for lecithin extraction.

The Enzyme processing method is the fastest-growing in the soybean derivatives market. This technique uses enzymes to selectively break down components in soybeans to produce high-quality lecithin. Enzyme processing is gaining popularity due to its ability to produce more refined and pure lecithin with fewer chemicals and lower environmental impact. The growing consumer demand for clean-label, non-chemical processed food products and the increasing focus on sustainable and eco-friendly production methods are driving the rapid growth of enzyme processing in the soybean derivatives market

REGIONAL ANALYSIS

Asia Pacific is expected to be one of the largest markets during the forecast period. Due to the increase in domestic consumption, the positive prospects for the food and beverage sector in China and India are supposed to be a favorable factor for the soy derivatives market shortly. As a result, the regulatory propensity to promote growth in the bioplastics industry in the Asia Pacific region is foreseen to drive market demand in the near future. As the tariff rate is low, and the need for food increases, the increase in imports of soy derivatives in Europe is presumed to have a positive impact on the market during the forecast period. The implementation of the Soy 20/20 project in Canada has demonstrated partnerships between governments, academic institutions, and soybean manufacturers, which are anticipated to open up new market opportunities during the forecast period. In light of government support, the increasing availability of soybean crops in Brazil, along with the growth in biodiesel application, is expected to promote manufacturers to keep production units close. North America follows the same trend with high demand for soy derivatives. The Middle East is a significant contributor to soy derivatives. It shows tremendous growth opportunities in the near future. Furthermore, the leading conglomerates are in high demand to invest in the global soy derivatives market.

KEY PLAYERS IN THE GLOBAL SOYBEAN DERIVATIVES MARKET

Major key players in the global soybean derivatives market are Du Pont Nutrition and Health, Ruchi Soya Industries Limited, AG Processing Inc, CHS Inc, Noble Group Ltd, Wilmar International Limited, Cargill, Incorporated, Louis Dreyfus Commodities B.V., Archer Daniels Midland and Company, Bunge Ltd and Others.

RECENT HAPPENINGS IN THE MARKET

- The Thai government announced that it would finance $3.1 billion to increase production in the national bioplastics industry.

- In 2017 ADM expanded its existing GMO-free soybean processing capabilities in Germany to meet the growing demand for GMO-free and high-protein soybean meals across Europe.

- In March 2019, ADM Company and Cargill Inc. officially launched Grainbridge, LLC to complete the deal. The joint venture will produce digital tools to enable North American farmers to consolidate information on the economy of production and grain marketing activities for free on a single digital platform.

DETAILED SEGMENTATION OF THE GLOBAL SOYBEAN DERIVATIVES MARKET INCLUDED IN THIS REPORT

This research report on the global soybean derivatives market has been segmented and sub-segmented based on type, application, lecithin processing, and region.

By Type

- Soy Oil

- Refined Oil

- Lecithin

- Others (Gums, Chemicals)

- Soybean

- Soy Meal

- Soy Milk

- Soy Protein Concentrate

- Others

By Application

- Feed

- Poultry Feed

- Swine Feed

- Ruminants

- Aquafeed

- Food

- Protein

- Fat

- Fiber

- Other Industrial Applications

By Lecithin Processing

- Water

- Acid

- Enzyme

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What are the segments under which Soybean Derivatives Market divided?

Ingredients obtained from soybeans through crushing, drying, or other processing procedures are known as soybean derivatives. Soy oil, soy milk, soy meal, and other soybean derivatives are segmented in the global market. The market is divided into three categories: food and beverages, feed, and others.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]