Global Tablet PC Market Research Report – Segmented By Operating System (Android, iOS and Windows), Screen Size (7 inch and 7 inch & above), Application (Education, Work, Entertainment and Others), Distribution Channel (Online and Offline) and Region (North America, Europe, APAC, Latin America, Middle East and Africa) – Industry Analysis (2024 to 2032)

Global Tablet PC Market Size (2024 to 2032)

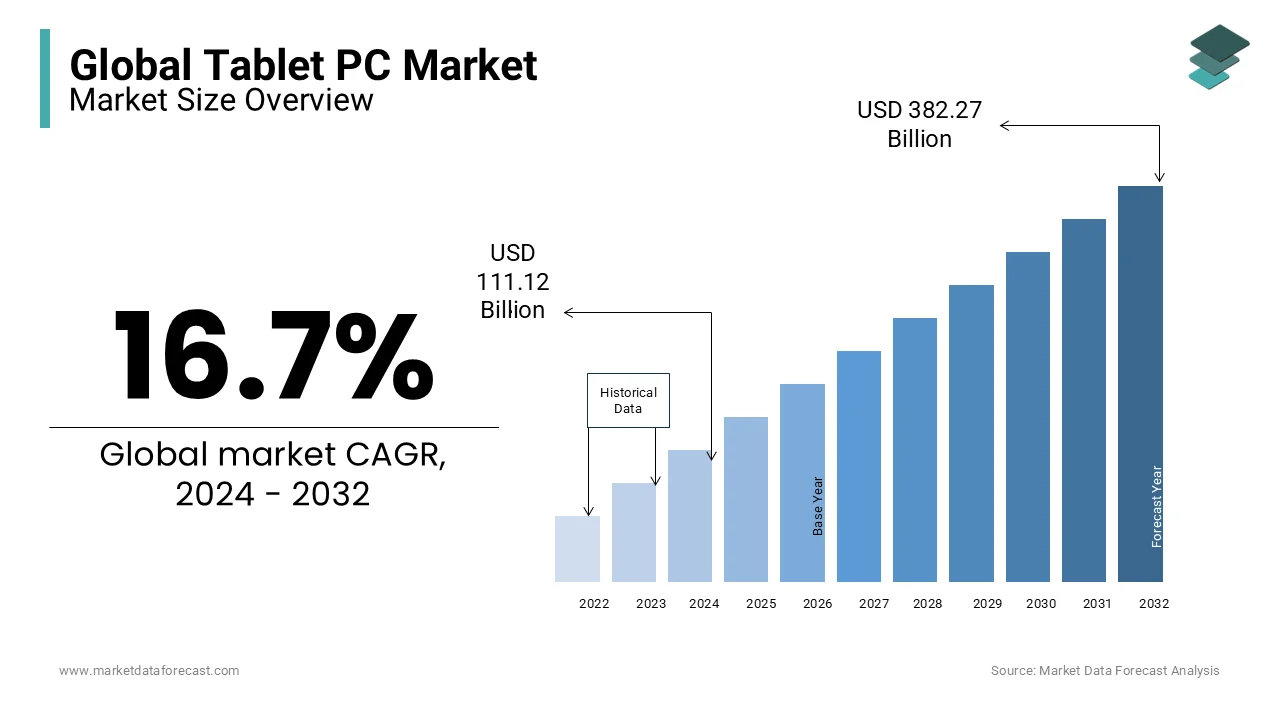

The global tablet PC market was worth USD 95.22 billion in 2023. It is expected to grow at a CAGR of 16.7% from 2024 to 2032 and be worth USD 382.27 billion by 2032 from USD 111.12 billion in 2024.

Current Scenario of the Global Tablet PC Market

A tablet PC comes with a touchscreen interface, which is larger than a smartphone and less than a computer or laptop. This is a wireless device that offers various applications where a person can do work appropriately on the go with the proper internet connection. A tablet PC can do a lot more like a computer, from watching movies to making presentations with the respective features available. Many top companies are playing a major role in launching highly innovative technological features in tablet PC, which are gaining huge traction from customers all across the world. According to the Census Bureau, 64% of the people owned a PC in 2021, only in the US, which is a positive sign that the market will grow during the forecast period. The demand for the use of tablets PC is still significant even in 2024, with the growing prominence for usage in schools, workplaces, and homes.

MARKET DRIVERS

The increasing trend towards lightweight devices that carry more features like laptops is a key driving factor for the tablet PC market to grow in recent years.

People are showing more interest in purchasing a device that allows them to do the same work as the computer, which is portable. User can do their daily work on a tablet PC even while traveling with internet connectivity. The expansion of high-speed internet connections across the world is also likely to fuel the growth rate of the tablet PC market. The world is evolving continuously, and digital transformation is taking place quickly around the world, with an increasing focus on launching high-speed internet connectivity. In today’s world, internet connectivity is available in every corner of the world, which is straightly leveraging scope for the adoption of more and more smart devices in the coming period. The growing number of IT sector is additionally adding fuel to the growth rate of the tablet PC market. Other than these, the growing prominence of video games in tablets is escalating the growth rate of the market. There is a wide range of video games present in today’s world, and kids, adults, and even elderly people are showing huge interest in these games, which is dominantly propelling the market’s growth rate. Some games encourage the development of problem-solving skills along with the chance to explore innovative skills, especially among kids, which are a major part of elevating the growth rate of the tablet PC market.

MARKET RESTRAINTS

Consumer desire for ‘phablets,' a hybrid gadget that combines a tablet and a phone, is predicted to stymie tablet adoption in the near future.

Hybrid PCs, which combine the elements of a notebook computer with a tablet, offer significantly more sophisticated features than tablets, such as a lighter design, an external keyboard, and improved battery efficiency. Up to a certain extent, rising demand for these devices is projected to limit market expansion. Furthermore, rising demand for smartphones, which have features similar to tablets such as larger screens, better operating systems, and less weight, is likely to limit global table market growth throughout the projection period.

In comparison to established suppliers, emerging players in the industry are focusing on drastically cutting the cost of tablet computers. Because device production costs are cheap, new entrants benefit from huge profit margins. As a result, the revenues of key participants in the worldwide tablet market are being eaten up by upstart suppliers. Furthermore, over the projected period, rising competition among major market participants and regular price drops are expected to stifle the worldwide tablet market's growth.

MARKET OPPORTUNITIES

Growing competition between the top companies to integrate special specifications in designing the world-class tablet PC is deemed to create potential growth opportunities for the market during the forecast period. Growing disposable income and rising prominence for high-quality gadgets, especially in developed and developing countries, are ascribed to leveraging the growth rate of the market. Apple iPad is gaining huge traction from customers all across the world. In developed countries like the US, Canada, and others, the demand for the Apple iPad is huge when compared with others. For instance, in 2023, the overall iPad shipment was 54.03 million.

According to the International Data Corporation, Samsung is the second biggest tablet salesholder. According to this survey report, Samsung sold nearly 6.7 million tablets during the first quarter of 2024. Of course, the sales slightly declined from the previous due to the economic crisis, but experts reveal that the demand for tablets remains significant and will grow over the years. Therefore, there is huge scope for the tablet PC market growth rate in the coming years without any doubt.

MARKET CHALLENGES

Most customers face serious challenges while using the tablet PC, such as storage issues. Many tablet PC comes with less storage capacity than laptops, and the user faces difficulty using them for work or any other computer, which is a great challenging factor for the market key players to develop a new product according to the customer’s choices at affordable prices. Disruption in the supply chain is greatly disturbing the manufacturing units due to the unavailability of the raw materials in proper time, which is negatively hindering the growth rate of the tablet PC market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

16.7% |

|

Segments Covered |

By Application, Type, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Samsung (South Korea), LG (South Korea), Asus (Taiwan), Lenovo (China), Huawei (China), Amazon (US), Microsoft (US), HP (US), Nokia (Finland), Toshiba (Japan), and Others. |

SEGMENTAL ANALYSIS

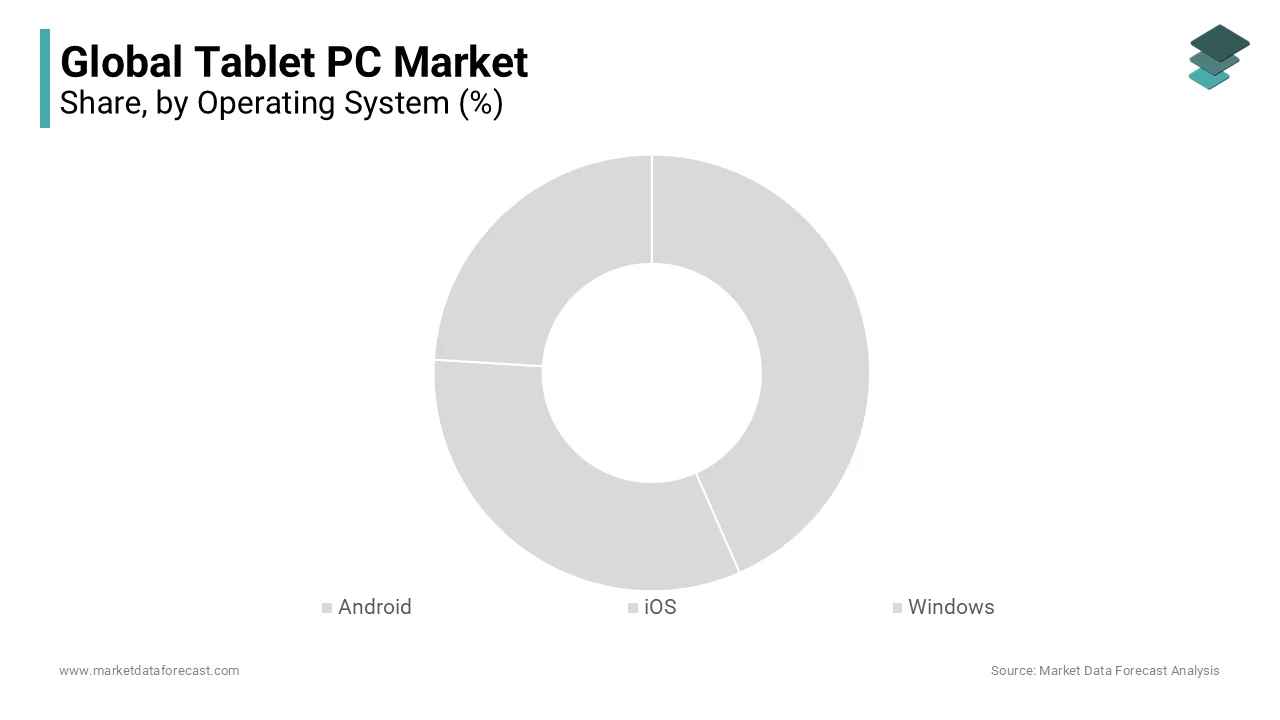

Global Tablet PC Market Analysis By Operating System

IOS, installed exclusively on Apple iPads, dominates the segment and accounts for 37% of the market share. iPads are the most popular tablets in the world and are highly preferred by graphic designers because of selected professional applications that only run on iOS platforms, hence aiding the market growth of iOS-supported tablets.

The Android platform is the fastest-growing segment and is the only alternate platform challenging iOS. Android operating systems are available in several brands; hence, Android tablets are the most mass-produced across the world. The primary factors driving the growth of the Android tablets are relatively cheaper prices, easy availability, and high compatibility across various devices. Therefore, Android tablets are expected to outsell iOS tablets over the forecast period.

Global Tablet PC Market Analysis By Screen Size

The 7-inch segment is leading with the largest share of the tablet PC market. Consumers’ preferences for specially designed tablet PCs with advanced features are substantially prompting the growth rate of the 7-inch tablet PC market. The user’s priority for the smaller and lightweight tablets is making the manufacturer's design, especially using lightweight raw materials, which is showing huge growth opportunities for the tablet PC market. 7-inch tablets are lightweight and designed with specific features to attract varied customers that are likely to fuel the growth rate of the market during the forecast period. The launch of hybrid tablets that can be used as laptops is likely to enhance the new opportunities for the 7-inch and above tablet PC market.

Global Tablet PC Market Analysis By Application

The entertainment segment is predicted to hold the highest share of the worldwide market compared to other uses. Tablets have a bigger screen than a smartphone and are easier to carry than a laptop, hence, its users receive the best of both worlds in a single device to enjoy OTT content. Educational tablets have been the fastest-growing segment post-pandemic, owing to the advent of online classes and a surge in tech platforms. Graphic designers use tablets the most for professional work and are pivotal in the growth of the tablet PC market during the study period.

Global Tablet PC Market Analysis By Distribution Channel

The online segment is gaining huge traction over the share of the market. Collaborations between the top companies and the online dealers will enhance the sales of the products in either way, which is set to elevate the growth opportunities for the tablet PC market during the forecast period. The offline segment is set to have the potential market share in the coming period, with the rising number of consumers buying a product by directly going to the store to explore the device before purchasing it.

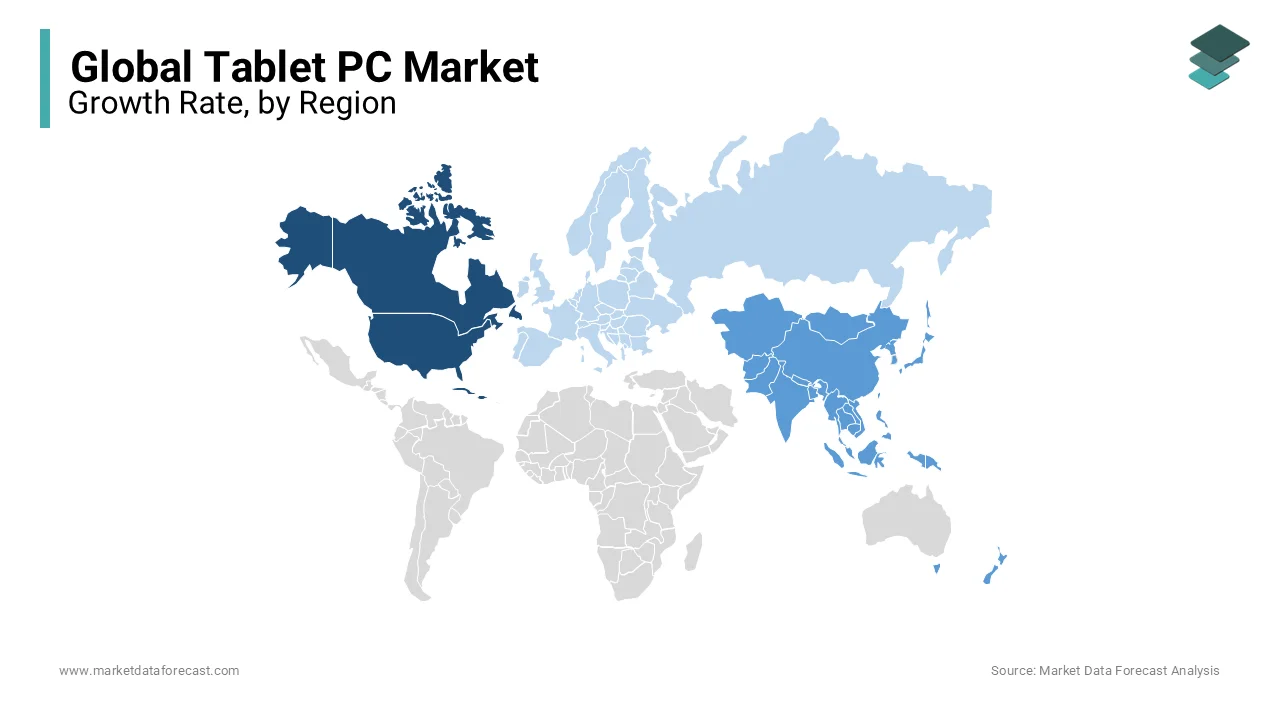

REGIONAL ANALYSIS

The North American tablet PC market is leading with the dominant share of the market from past years and is expected to continue the same growth rate throughout the forecast period.

The presence of the topmost companies in the most developed countries like the US is certainly a major factor in the market's growth at a higher rate in this region. The launch of various technological features in tablet PCs is ascribed to bolstering the growth rate of the market. Feasibility in online stores, especially in expanding their portfolio for start-up companies, is elevating the demand for tablets and PCs. E-commerce is making a huge difference in raising the sales of electronic devices. Online stores also offer discounted prices to attract customers, which is lucrative for soaring the growth rate of the tablet PC market in the North American region.

Asia Pacific region is attributed to gaining huge traction over the growth rate of the tablet PC market during the forecast period. China is a well-known country for launching various electronic devices with a huge scale of industries. The mass production of tablets PC for many years in China has certainly leveled up the new opportunities for tablet PCs with new features and is likely to showcase wonderful opportunities for the market to grow eventually during the forecast period. The Chinese government is emphasizing its support for the expansion of manufacturing units by hugely investing in extracting economic benefits, which is likely to accelerate the market’s growth rate in China.

Europe is attributed to having the prominent share of the tablet PC market during the forecast period 2024-2032. The usage of tablet PCs is the most common thing in European countries due to the prominence of the launch of better products at affordable prices. The huge competition between the key players is one of the major factors in companies launching prominent products at reasonable prices, which is quietly elevating the growth rate of the market in the European region.

KEY PLAYERS IN THE GLOBAL TABLET PC MARKET

Companies playing a prominent role in the global tablet PC market include Samsung (South Korea), LG (South Korea), Asus (Taiwan), Lenovo (China), Huawei (China), Amazon (US), Microsoft (US), HP (US), Nokia (Finland) and Toshiba (Japan), and Others.

RECENT HAPPENINGS IN THE GLOBAL TABLET PC MARKET

- In 2024, Asus and Lenovo teamed up together to launch three tablets. Lenovo unveiled both a Windows laptop and an Android tablet named Tab M11 and the Thinkbook Plus Gen 5 Hybrid, whereas Asus announced the exciting news of launching a new Chromebook Tablet by the end of 2024. The companies are expecting that these three tablets will stand out this year with the advanced features integrated into all of these three tablets.

DETAILED SEGMENTATION OF THE GLOBAL TABLET PC MARKET INCLUDED IN THIS REPORT

This research report on the global tablet PC market has been segmented and sub-segmented based on operating system, screen size, application, distribution channel, and region.

By Operating System

- Android

- iOS

- Windows

By Screen Size

- 7 Inch

- 7 Inch & Above

By Application

- Education

- Work

- Entertainment

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the projected growth rate of the Global Tablet PC Market?

The Global Tablet PC Market is expected to grow from $111.12 billion in 2024 to $382.27 billion by 2032, with a CAGR of 16.7% during the forecast period from 2023 to 2032.

What are the primary drivers of the Tablet PC Market?

The Tablet PC Market is driven by factors such as the paradigm shift in customer demand towards tablet devices, advancements in tablet design and features, increased adoption in various industries including education, corporate, personal, and commercial, and the introduction of new upgraded models with lucrative features.

What are the major challenges facing the Tablet PC Market?

Challenges in the Tablet PC Market include consumer preference for hybrid devices like 'phablets' and hybrid PCs, competition from smartphones with tablet-like features, and the pressure from emerging players in the industry focused on drastically cutting the cost of tablet computers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]