Global Black Pepper Market Size, Share, Trends & Growth Forecast Report - Segmented By Product (Brazilian Black Pepper, Lampang Black Pepper, Malabar Black Pepper, Sarawak Black Pepper, Talamanca Black Pepper, Vietnamese Black Pepper, India Black Pepper, Tellicherry Black Pepper), Source (Organic, Inorganic), End-Use (Food & Beverages, Pharmaceuticals, Cosmetics), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Global Industry Analysis, Size, Share, Growth, Trends And Forecast 2025 To 2033

Global Black Pepper Market Size

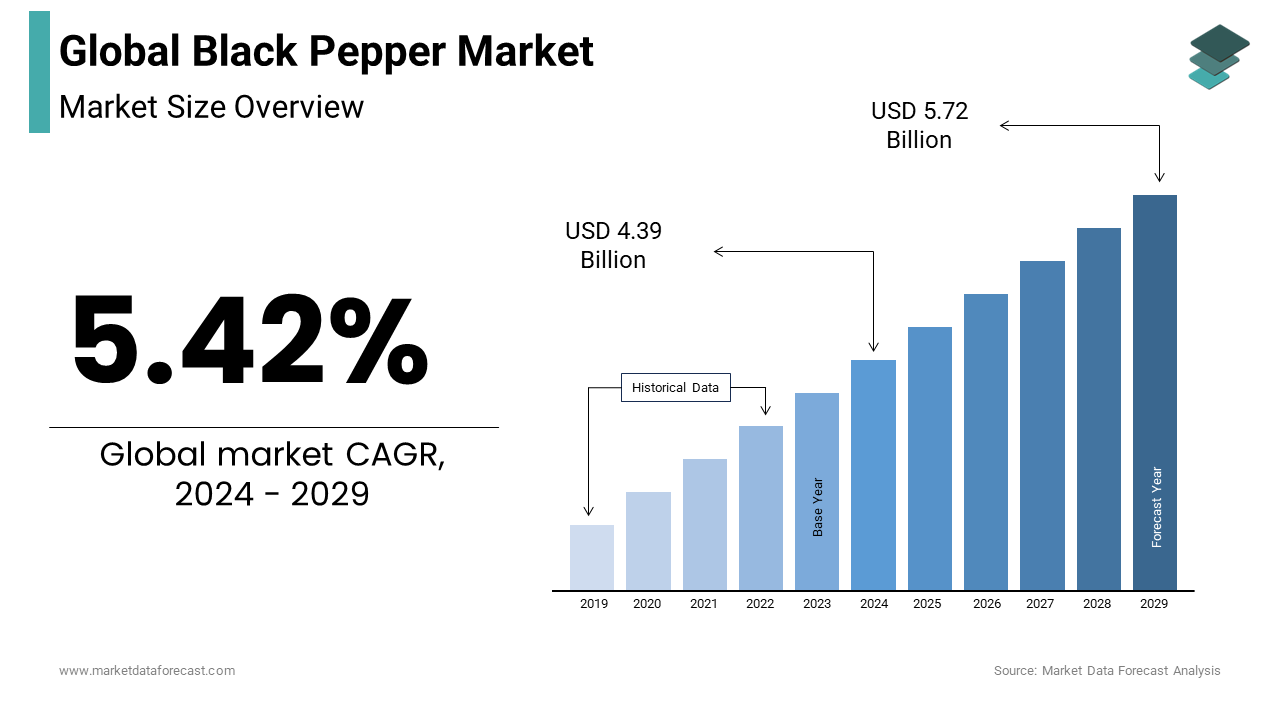

The size of the black pepper market was expected to be worth USD 4.39 billion in 2024 and is anticipated to be worth USD 7.06 billion by 2033 from USD 4.63 billion In 2025, growing at a CAGR of 5.42% during the forecast period.

Black pepper is a species of flowering plant in the Piperaceae family that is grown for its peppercorn-shaped fruit, which is used as a spice and condiment and is typically dried. The fruit is a drupe that has a stone within that carries a single pepper seed. It is dark red, about 5 mm in diameter. Black pepper, green pepper, and white pepper are the more specific terms for peppercorns, and ground pepper is made from them. The Malabar pepper, which is native to the Malabar Coast of India, is widely grown there as well as in other tropical areas.

MARKET DRIVERS

The market for prepared meals is actively influencing the demand for black pepper and the consumers are becoming more health conscious and aware of the advantages of black pepper, which has resulted in its inclusion in everyday meals.

Moreover, the international black pepper market has been driven in large part by growing demand from Far Eastern countries that have started using more pepper in cuisine. The pepper market is benefiting from growth in the beautifier and healthcare industry. In addition, increasing the production of perfumes, black pepper sprays, and essential oils is also anticipated to fuel market expansion. The demand for spice is being driven by the rise in consumption of prepared and fried foods, confectionery items, and bakery goods in industrialized economies.

The main factor that is anticipated to impede the market's growth is the overconsumption of spices to create gastrointestinal problems. In addition, it is anticipated that pepper's high price may impede market expansion. Furthermore, the market is seeing a significant rise in black pepper demand year over year. Unfortunately, there is not enough supply to meet this demand, which has proven to be a major drawback in this market.

Increasing the Awareness of Health Concerns

More than food enhancers, Piperine offers health benefits owing to its bioactive compounds, which are of utmost importance. Piperine is a natural alkaloid that gives black pepper a stimulating flavor. It is also the main ingredient that gives black pepper a health-promoting effect. Moreover, piperine is considered a type of antioxidant that helps reduce the risk of chronic diseases such as atherosclerosis, cardiovascular disease, and neuropathy. In addition, this compound also has a positive effect on the bioavailability of nutrients. Adding black pepper to your diet increases the number of nutrients absorbed into your bloodstream.

Black Pepper stimulates hydrochloric acid in the stomach to help digest and absorb the food you eat better. It also has digestive properties that help reduce intestinal discomfort and gas buildup. And also, a strong immune system is important to prevent illness, and black pepper can also help here. Its active ingredients serve to strengthen the white blood cells that your body uses to fight off invading bacteria and viruses. This hot spice contains a variety of active compounds, especially alkaloids such as oleoresin, piperine, and chavicine. It also contains antioxidants, flavonoids, essential oils, and other phenolic compounds that protect cells and promote digestive health.

Rising Demand for Baked and Meat Products

Increased consumption of bakery and confectionery products, as well as fried and ready-to-eat dishes, has greatly increased demand for smoked black pepper. Black pepper is commonly used to enhance flavor to foods such as garlic bread, pastries, and chocolates. As a result, its global demand is being supported by a thriving food and beverage industry. With the addition of smoked black pepper, meat and poultry receive a smoky flavor and taste. Black pepper is an excellent finishing pepper and an excellent complement to grilled meats as well as seasoning blends. As a result, these variables will contribute to an increase in demand in the next years.

Market Restraints

Overconsumption of Spices to Create Gastrointestinal Problems

Too much black pepper can cause health problems in addition to stomach irritation and gastrointestinal problems. It is safe to take black pepper in small amounts rather than daily. Ingesting large amounts of this spice can have many health side effects. Moreover, the Ingestion of large amounts of black pepper can accidentally enter the lungs. There are also reports of death from this accidental use. It is especially common in children. For example, the Absolute mortality by spicy food consumption category is less than once a week, 1 or 2 days a week, 3 to 5 days, and 6 or 7 days per 1000 participants per year 6.1, 4.4, 4.3, and 5.8 deaths respectively. After adjusting for other known or potential risk factors, spicy food consumption showed a very consistent inverse correlation with all-cause mortality in both men and women.

High Prices due to Low Supply

As an internationally traded commodity, black pepper has always been associated with price fluctuations affected by a variety of factors, including production and consumption in India and around the world, international prices, import and export policies, exchange rates and trade agreements. increase. The annual price volatility index of nominal and real prices of black pepper in the domestic and international markets was calculated and used to compare price volatility before and after the liberalization of India's agricultural trade. Studies show that black pepper price volatility in the Indian market increased significantly during the post-liberalization period, but decreased in the international market. The destabilizing effect of trade liberalization on black pepper prices is relatively greater in the Indian market than in the international market. This could be due to the transfer of volatility from the international and domestic markets after liberalization, reducing international price volatility and at the same time increasing domestic market volatility. Therefore, in order to protect Indian black pepper producers from price fluctuations caused by the liberalization of international trade in agricultural products, it is necessary to implement appropriate price stabilization policies.

For instance, the Brazilian black pepper wholesale prices rose +14.89% year-on-year. The Jan-22 price was $5.01/kg, +8.7% year-on-year. Brazilian black pepper price rose to US$5.35/kg on 2021-02-22 from US$4.66/kg over the same period. Black pepper production in Brazil was interrupted by extreme weather, reducing supply. Meanwhile, in order to strengthen trade ties with the Middle East, Brazil's economy minister will boost exports of black pepper from Brazil to the UAE in 2021, rising 279.6% year-on-year from $10.3 to $39 in 2021. became. led million in 2020. A combination of limited supply and rising imports of black pepper from the United Arab Emirates has pushed up the price of black pepper in Brazil.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.42% |

|

Segments Covered |

By Product, Source, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Gupta Trading, Akar Indo, Vietnam Spice Company, Visimex, Olam International Limited, Brazil Trade Business, DM AGRO, Baria Pepper, Silk Road Spices, Webb James, British Pepper and Spice, Everest Spices, Catch, PT AF, The Spice House and Others |

SEGMENTAL ANALYSIS

Global Black Pepper Market Analysis By Product

Among the products, the Brazilian Black Pepper segment is registered major market share in the black pepper market. For instance, the export volume exceeded 51,600 tonnes in 2021, and sustained value growth has also been noted. Outside of Asia, Brazil is a major grower and supplier of black peppercorn. Brazilian ASTA and B1 Black Peppercorns Grade are among the greatest in the world in terms of flavor and quality. Their Black Peppercorn is sourced directly from farms and local producers in Brazil, and they offer global shipping and competitive pricing.

Global Black Pepper Market Analysis By Source

The source segment in the black pepper market is divided into organic and inorganic. Among these, organic segment is expected to grow with the highest CAGR during the foreseen period. One of the key factors influencing the growth is the "adopt organic" trend. The inherent advantages of organic products, such as their superior, quicker healing abilities and lack of chemicals, are fostering global market expansion.

Organic products are more effective at healing and contain natural nutrients rather than antibacterial chemicals. Additionally, millennials are choosing organic items because they improve the absorption of nutritional supplements, particularly those like turmeric which may have significant cholesterol-lowering effects. As a result, consumers accept black pepper which is acquired organically in a variety of ways, including as a food ingredient and nutrition in the food and beverage sector.

Global Black Pepper Market Analysis By End Use

The end-user segment in the black pepper market is categorized into food & beverages, pharmaceuticals, and cosmetics. Among these, cosmetics segment is likely to occupy the highest market share by 2027 due to increasing awareness of beauty products among both men & women driving the market. The demand for cosmetics could be further fueled by consumers' increased purchasing power, which would increase the size of the black pepper market during the anticipated period. Furthermore, the food & beverages segment is expected to grow with a high CAGR owing to rising awareness of food safety and health policies.

REGIONAL ANALYSIS

The regions covered in the global black pepper market are North America, Latin America, Europe, Asia Pacific, Middle East & Africa. Among these, the North American region is accounted highest market share during the forecast period. Moreover, the APAC region is expected to grow at a high CAGR during the forecast period due to an increase in population and aged populace with getting awareness of healthcare.

In North America, the United States accounted for 28% of the global import market share followed by Canada. The growth is due to rising demand for bakery and confectionery products and increasing usage of pepper in beauty products.

In APAC, Vietnam is a world leader in black pepper production, producing 163,000 tons, which is about 34% of the world's production. This plant is a traditional cash crop in the country, and 95% of the black pepper produced is mainly exported to the United States, India, the Netherlands and Germany. Indonesia is the second largest producer with 89,000 tonnes, and India produces 53,000 tonnes. The main growing areas of black pepper in India are Kerala, Karnataka, Konkan and Tamil Nadu. Additionally, As of July 2020, China accounted for 16% of the worldwide import market share, making it the second-largest importer behind the United States.

In Europe, the amount of pepper shipped by Germany in 2020 was 13,068 tons. The most common form of black pepper used in food is ground pepper, although most peppers are imported whole. Almost 90% of imported black pepper is whole pepper and the remaining 10% is ground pepper. Also, properly dried peppercorns can retain their flavor after being crushed for a long time. Moreover, the intense urbanization of the European region has brought about rapid changes in the lives and diets of many people. Due to busy lifestyles, consumers prefer nutritious, spicy and tasty processed foods that are primarily derived from pepper.

In MEA, the market potential for black pepper as spice companies in Saudi Arabia, the United Arab Emirates, and other Middle Eastern countries remains strong during the forecast period. Additionally, South Africa, Egypt, and other African countries are analyzed in the report to

KEY PLAYERS IN THE GLOBAL BLACK PEPPER MARKET

Major Key Players in the global black pepper market are Gupta Trading, Akar Indo, Vietnam Spice Company, Visimex, Olam International Limited, Brazil Trade Business, DM AGRO, Baria Pepper, Silk Road Spices, Webb James, British Pepper and Spice, Everest Spices, Catch, PT AF, The Spice House and Others

DETAILED SEGMENTATION OF THE GLOBAL BLACK PEPPER MARKET INCLUDED IN THIS REPORT

This research report on the global black pepper market has been segmented and sub-segmented based on product, source, end user, and region.

By Product

- Brazilian Black Pepper

- Lampang Black Pepper

- Malabar Black Pepper

- Sarawak Black Pepper

- Talamanca Black Pepper

- Vietnamese Black Pepper

- India Black Pepper

- Tellicherry Black Pepper

- Others

By Source

- Organic

- Inorganic

By End Use

- Food & Beverages

- Pharmaceuticals

- Cosmetics

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What factors are driving the growth of the black pepper market?

Key factors include growing consumer preference for natural and organic spices, increasing global culinary trends that use black pepper, health benefits associated with black pepper, and rising disposable incomes in developing regions.

2. What is the future outlook for the black pepper market?

The future outlook for the black pepper market is positive, with continued growth expected due to rising global demand for spices and natural products. Innovations in sustainable farming practices, enhanced processing technologies, and expanding applications in various industries will drive the market.

3. How is black pepper used in the health and wellness industry?

In the health and wellness industry, black pepper is used for its potential benefits in improving digestion, boosting metabolism, and enhancing the absorption of nutrients like curcumin from turmeric. It is also included in supplements and natural remedies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]