Global Camel Meat Market Size, Share, Trends & Growth Forecast Report - Segmented By Volume (imports, Exports), and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2025 to 2033)

Global Camel Meat Market Size

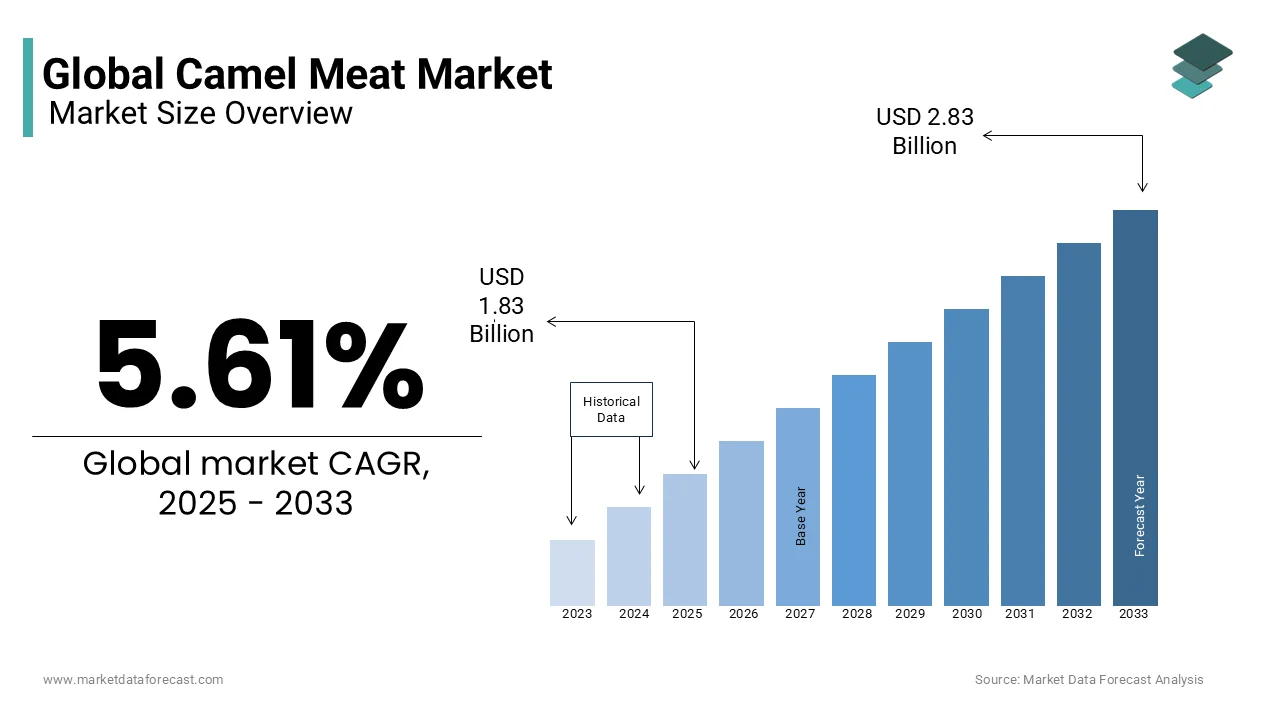

The global camel meat market size was valued at USD 1.73 billion in 2024 and is anticipated to be worth USD 2.83 billion by 2033 from USD 1.83 billion in 2025, growing at a CAGR of 5.61% during the forecast period

MARKET OVERVIEW

Compared to cow, wild ox, and meat fat, camel meat fat contains less short-affixed unsaturated fats. However, the equivalent since quite a while ago fastened unsaturated fats can be found. Camel meat has fatter protein than dairy animals' meat. Cholesterol in camel meat is lower than in dairy animals or goat meat. Camel's meat has bolstered Bedouins, travelers, and peaceful societies since the taming of camels centuries back. Herders may for periods endure exclusively on the meat when taking the camels on long separations to brush in desert and bone-dry situations. The income of the camel meat market in the Middle East added up to $1.1B in 2018, flooding by 23% against the earlier year. This figure mirrors all out incomes of makers and shippers (barring coordination costs, retail showcasing expenses, and retailers' edges, which will be remembered for the last shopper cost).

MARKET DRIVERS

The development of the worldwide Camel meat market is driven by the rising dispensable wages and the essential intrigue of the medical advantages of camel meat. Nonetheless, the market is compelled by episodes of corruption. Camel meat is a significant food segment in the staple weight control plans over the MEA area. It contains a substantial wellspring of protein and is plentiful in fat, nutrients A and B, iron, zinc, and amino acids, which are required to look after, form, and fix body tissues. Camel meat comprises a decent wellspring of supplements for individuals dwelling in bone-dry regions. As far as arrangements just as medical advantages, camel meat is exceptional from other red meats. Camel meat has advantages, for example, low cholesterol levels; high convergence of minerals, including sodium, iron, zinc, potassium, copper, and magnesium; and a high nutrient C content when contrasted and other red meats. Camel meat additionally contains different unsaturated fats, chemicals, and defensive proteins. Camel meat is slowly gaining prominence in several developed countries due to its numerous health benefits compared to other meat products. The Middle Eastern nations are at the forefront of this business growth and are supposed to create immense growth potential for the stakeholders in the foreseen years. The changing food patterns of consumers around the world, coupled with the increasing disposable income, are further promoting the consumption of camel meat in different parts of the planet. One challenge that is influencing the market is health dangers related to the utilization of prepared meat.

MARKET RESTRAINTS

Camel meat has numerous advantages as a meat item. It has a low-fat substance is exceptionally nutritious, and can possibly be utilized to battle hyperacidity, hypertension, pneumonia, and respiratory infection. A nearly little segment of worldwide meat utilization, camel meat can experience a blast of creation around the world, and as of now cultivating for camel meat in Asia, Africa, Latin America and Australia are experiencing noteworthy extension. The capability of camel meat in assisting with meeting anticipated world food deficiencies, and being reasonably cultivated, is additionally investigated by the editors. Of the two significant items, the prepared camel meat section held the biggest piece of the overall industry in 2019, representing almost 79% offer. The portion of the pie for this item is relied upon to diminish by 2022. The quickest developing thing is crisp camel meat, which will represent almost 22% of the complete piece of the pie by 2022. The growth of the global vital Camel meat market is driven by the rising disposable incomes and the primary appeal of the health benefits of camel meat. However, the market is constrained by incidents of adulteration.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.61% |

|

Segments Covered |

By Volume And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

FettaylehSmallgoods, Samex Australian Meat Company, Windy Hills Australian Game Meats, Exoticmeatmarkets, Walgreens, MS Global food, Golden Camel Foods, Fettayleh, Windy Hills |

REGIONAL ANALYSIS

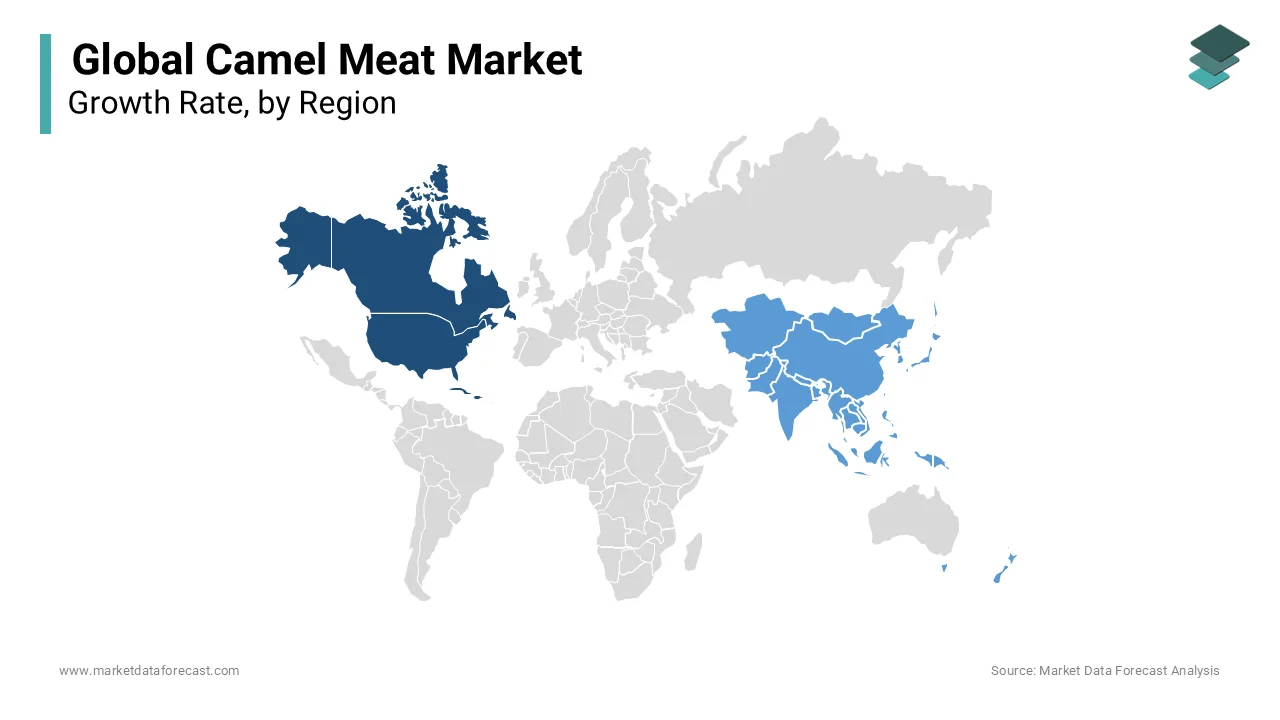

North America drove the worldwide Camel meat showcase as far as a piece of the pie. The market interest for this Camel meat in the Asia-Pacific zone is enhancing on the grounds that a more considerable amount of utilization. The Asia-Pacific and other rising countries are predicted to create at a speedy pace in the Camel meat market in the next years when contrasted and the prepared markets of established areas.

EMEA was the central locale for the global camel meat market in 2023, representing a piece of the pie of almost 45%. By 2022, EMEA is likely to keep ruling the market, despite the fact that the part of the pie will see a slight decay. APAC is foreseen to enlist the most noteworthy development rate, with about 2% expansion in share during the estimated time frame.

The nation with the most significant volume of camel meat utilization was Saudi Arabia (113K tons), involving approx. 61% of the whole amount. In addition, camel meat utilization in Saudi Arabia surpassed the figures recorded continuously by the biggest buyer, the United Arab Emirates (35K tons), by almost three times. Oman (16K tons) positioned third regarding total utilization with an 8.6% offer.

In Saudi Arabia, camel meat utilization expanded at an average yearly pace of +9.6% over the period from 2024 to 2032. The remaining devouring nations recorded the accompanying average annual speeds of utilization development: the United Arab Emirates (+3.4% every year) and Oman (+8.0% every year).

KEY MARKET PLAYERS

Key players in the camel meat market FettaylehSmallgoods, Samex Australian Meat Company, Windy Hills Australian Game Meats, Exoticmeatmarkets, Walgreens, MS Global food, Golden Camel Foods, Fettayleh, Windy Hills

MARKET SEGMENTATION

This research report on the global camel meat market has been segmented and sub-segmented based on volume, & region.

By Volume

- Imports

- Exports

By Region

- North America

- Europe

- Latin America

- Asia Pacific

- Middle East and Africa

Frequently Asked Questions

1.What is camel meat?

Camel meat refers to the flesh obtained from camels, large mammals known for their ability to survive in harsh desert environments. Camel meat is consumed in various parts of the world and is considered a delicacy in some cultures.

2.How is camel meat different from other types of meat?

Camel meat is leaner and lower in fat compared to beef, pork, and lamb. It has a distinct flavor that is often described as slightly sweet and gamey. Camel meat is also rich in protein, iron, and other nutrients.

3.Where is camel meat consumed?

Camel meat is consumed in regions where camels are raised, including parts of the Middle East, North Africa, Central Asia, and Australia. It is a staple food in some cultures and is used in traditional dishes such as camel kebabs, camel stew, and camel burgers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com