Global Food Safety Testing Market Size, Share, Trends & Growth Forecast Report - Segmented By Contaminant (Microbial, GMOS, Metal Contaminants, Pesticide And Residues, Toxins, Food Allergen, And Others), Food Type (Poultry, Meat, Seafood, Dairy Products, Processed Foods, Fruits & Vegetables, Others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Food Safety Testing Market Size

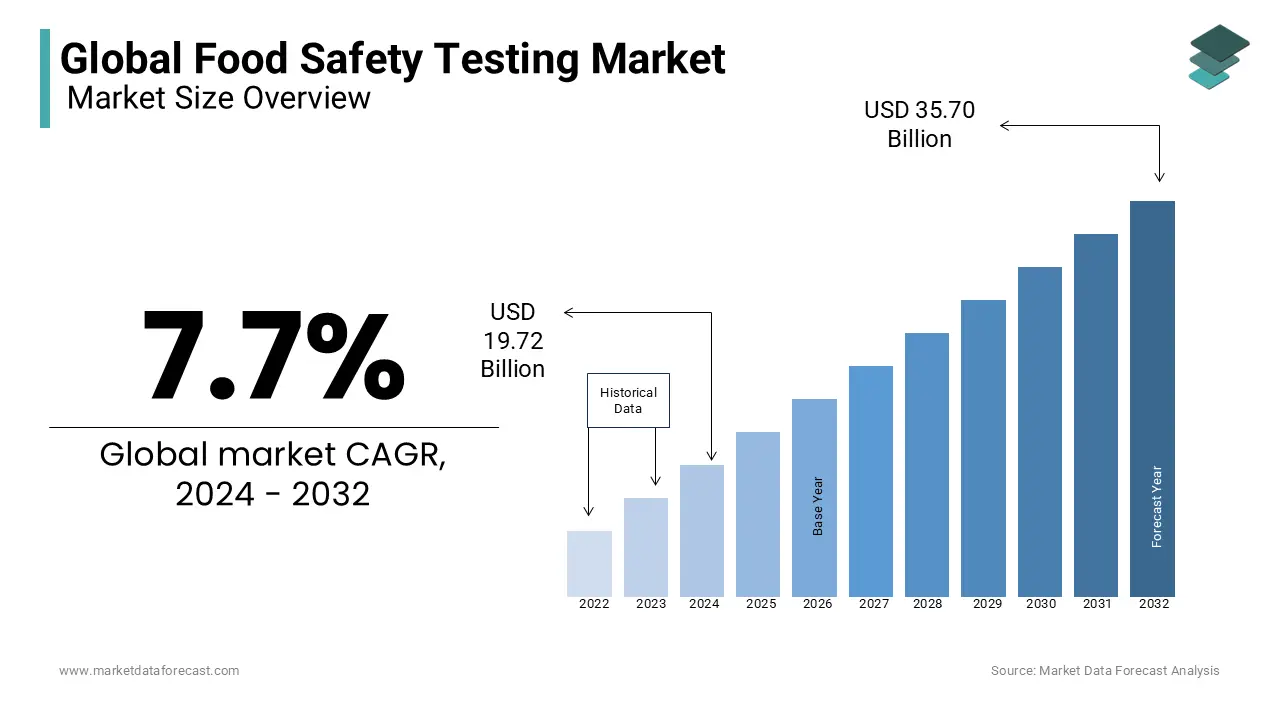

The size of the global food safety testing market size was assessed to be USD 19.72 billion in 2024. The global market is further expected to grow at a CAGR of 7.70% from 2025 to 2033 and be valued at USD 38.45 billion by 2033 from USD 21.24 billion in 2025.

Food safety testing refers to the validation of food products to identify disease-causing organisms, chemicals, and other harmful substances. It generally helps identify contaminants like pathogens, chemicals, and genetically modified organisms (GMOs). This testing ensures the safety of foodborne illness and reduces the risk of contamination. Food testing is crucial for maintaining food quality based on taste, ingredients, and visual appearance. Food analysis technology involves chemical analysis and microbial contamination, which are the reasons for safe production, delivery of food, and processing to consumers. Food testing helps to regulate allergens and pathogens by offering consumers healthy products.

MARKET DRIVERS

The rising demand for packaged foods, increased incidence of chemical contamination in the food processing industry and increased consumer awareness of food safety are primarily driving the growth of the global food safety testing market.

The global outbreak of food poisoning disease is increasing, and the globalization of the food trade is driving demand for food safety testing services. The global food safety testing market is growing as safety issues increase due to the increased incidence of foodborne illness. During the forecast period, the growth of the global market is anticipated to be favored by increased consumer awareness of food safety, increased chemical contamination, and rapid inspection. Additionally, product quality is improving by modifying regulations to reduce the number of people affected by foodborne illnesses such as nausea, food poisoning, and diarrhea. The food and beverage industry has grown significantly due to factors such as urbanization, rising disposable income, and economic development. As imports and exports increase, the levels of pollutants increase due to incorrect control and monitoring, which supports the global market growth.

The growing food consumption worldwide with the rapidly growing population is supporting the expansion of the food safety testing market.

As the demand for pesticide residues and other contaminants for fruits and vegetables increases along with the increase in global fruit and vegetable trades, the market for food safety testing is likely to improve. The increasing level of adultery to increase the shelf life of the product is one of the key aspects of adjusting testing needs on import. Meats, poultry and seafood, fruits and vegetables, and processed products are among the top contributors to the global food safety testing market. Emerging economic trends for processed foods and convenience foods will drive product development along with government initiatives to reduce foodborne illness and business expansion. Intensified competition among service providers has resulted in patent applications for new contaminant detection technologies.

Technological advancements for the development of reliable and rapid testing technology are driving the growth of the food safety testing market.

Technological innovations and new technological developments have been made in spectroscopy and chromatography, with a focus on reducing delivery times, sample utilization, testing costs, and deficiencies associated with multiple technologies. The wide adoption of these technologies is an opportunity to expand the provision of services in small and medium laboratories and compete with large market players in the industry. These technologies also have other advantages, including high sensitivity, the accuracy of results, reliability, non-target detection with multiple contaminants, and short processing times.

MARKET RESTRAINTS

High costs associated with food safety testing are primarily impeding the global market growth.

The industry said the innovation focused on reducing the time it takes to get test results and improving accuracy. Globally, food supply and quality are constantly at risk, increasing the demand for effective test products that certify safety. This is because food processors are obstructing industrial growth by skipping routine food inspections to reduce operational food. Also, generous food contamination laws and penalties in developing countries can limit industrial growth. However, as consumer concerns increase, the government has urged actions such as increasing the level of evidence to reduce food contamination and disease outbreaks. Furthermore, the high costs of technology may affect adoption rates in the coming years.

The lack of food management infrastructure is further hindering the global food safety testing market growth. The complexity of testing technology and the lack of regulation are expected to hamper business growth in food safety testing.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.7% |

|

Segments Covered |

By Contaminant, Food Type, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

IDDEX Laboratories INC, Douglas Scientific, Agilent Technologies Incorporated, Biocontrol Systems Incorporated, Bio-Rad Laboratories Incorporated, Roka Bioscience, 3M Company, Ecolab Incorporated |

SEGMENTAL ANALYSIS

Global Food Safety Testing Market Analysis By Contaminant

By contamination, the microbial testing sector emerged as a major segment in 2023, accounting for 28.0% of the market revenue share. This segment helps detect microorganisms in edible products using chemical, biological, molecular, and biochemical methods, so it expects a boost as it provides very accurate results with respect to the components. Microbial tests are performed to confirm the presence of indicator microorganisms in edible products, including acid-resistant microorganisms, heat-resistant microorganisms, and fecal contamination.

Global Food Safety Testing Market Analysis By Food Type

According to the food type, the meat, poultry, and seafood sectors have a dominant share of food safety testing revenue of over 29.6% in 2023, and the trend is expected to continue over the prognosis period. As the consumption of meat and seafood products increases worldwide, it is expected to lead to the growth of the segment during the forecast period. Processed foods have become the second-largest sales segment in 2018, and they are expected to post notable gains as demand for packaged goods such as frozen foods, snacks, ready-to-eat convenience products, and blends for cakes. In addition, the high shelf life of processed products imposes strict regulations regarding such products.

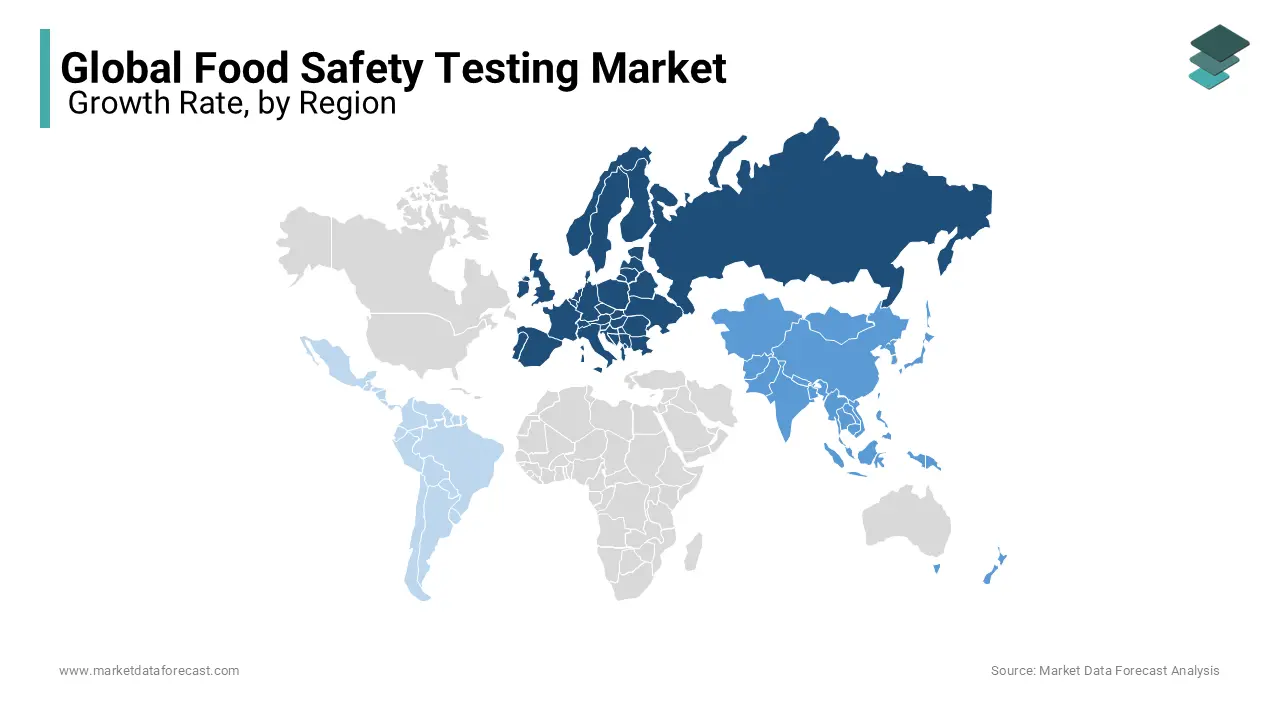

REGIONAL ANALYSIS

Europe has become the dominant region of the food safety testing industry and accounted for 35.3% of the market revenue share in 2023. The increasing cases of food allergies among local consumers are foreseen to increase the call for safety testing procedures in this area. North America has a significant share of the global food safety testing market. A key factor driving the growth of the North American food safety testing market is strict regulation by regulatory agencies. The market is also driven by increased production in the North American food sector. The large market in North America is also due to the outbreak of foodborne illness. Food safety testing is essential at all stages of production and processing, ensuring consumers’ food safety and market supply. Microbial testing and GMO testing are the main types of tests conducted in North America. In the North American food safety market, there are various companies like NSF International, Intertek, Eurofins Scientific, etc.

Industries in the Asia-Pacific region are expected to record notable benefits from related agency efforts regarding the safety of edible products. The Latin American market continues to grow in demand for these tests due to the increased consumption of packaged and processed foods. The region was seriously affected by JBS's meat scandals in Brazil, which are expected to reinforce market growth further by implementing strict regulations.

KEY PLAYERS IN THE GLOBAL FOOD SAFETY TESTING MARKET

Companies playing a significant role in the global food safety testing market are IDDEX Laboratories INC, Douglas Scientific, Agilent Technologies Incorporated, Biocontrol Systems Incorporated, Bio-Rad Laboratories Incorporated, Roka Bioscience, 3M Company, and Ecolab Incorporated.

RECENT HAPPENINGS IN THE MARKET

- In October 2018, Eurofins, which is a group of EnvironeXInc, began providing some testing services to the agricultural, healthcare, environmental, food, and pharmaceutical sectors with three laboratories in Canada.

- In April 2018, Eurofins signed a contract with LabCorp to acquire Covance Food Solutions, a food testing and consulting company, for $ 670 million.

DETAILED SEGMENTATION OF GLOBAL FOOD SAFETY TESTING MARKET INCLUDED IN THIS REPORT

This research report on the global food safety testing market has been segmented and sub-segmented based on contaminant, food type, & region.

By Contaminant

- Microbial

- GMOs

- Metal Contaminants

- Pesticide and Residues

- Toxins

- Food Allergen

- Others

By Food Type

- Poultry

- Meat

- Seafood

- Dairy Products

- Processed Foods

- Fruits & Vegetables

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the opportunities for innovation in the food safety testing market?

Opportunities for innovation in the food safety testing market include the development of portable and user-friendly testing devices for on-site testing, advancements in molecular diagnostics and biosensors for rapid and sensitive detection of contaminants, application of artificial intelligence (AI) and machine learning for data analysis and predictive modeling, and collaboration between industry stakeholders to address emerging challenges and improve food safety practices.

2. What are the challenges facing the food safety testing industry?

Challenges facing the food safety testing industry include the complexity of food supply chains, the need for harmonized global standards and regulations, limitations of existing testing methods in detecting emerging contaminants, cost constraints for small and medium-sized enterprises (SMEs), and the shortage of skilled personnel trained in food safety testing techniques.

3. What are the emerging trends in the food safety testing market?

Emerging trends in the food safety testing market include the adoption of rapid testing methods for real-time monitoring and on-site testing, increased use of automation and robotics to improve efficiency and accuracy, demand for multiplex testing capabilities to detect multiple contaminants simultaneously, and the integration of block chain and other digital technologies for traceability and transparency in the supply chain.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]