Global Laboratory Equipment Market Size, Share, Trends & Growth Forecast Report By Product (Sonicators and Homogenizers, Incubators, Laminar Flow Hood, Centrifuges, Scopes, Autoclaves, Sterilizers, Calorimeters, Spectro Photometers and Others), Disposables, Equipment Type, Services, End-Users, Application, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Laboratory Equipment Market Size

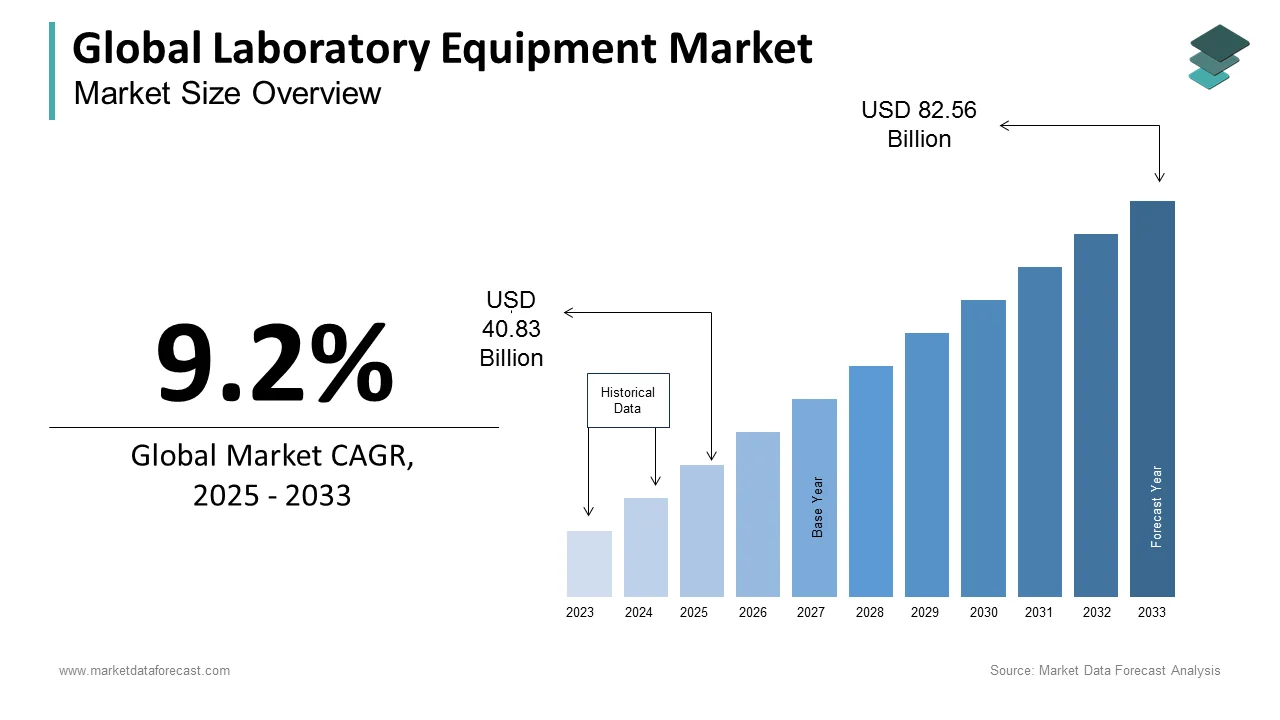

The size of the global laboratory equipment market was worth USD 37.39 billion in 2024. The global market is anticipated to grow at a CAGR of 9.2% from 2025 to 2033 and be worth USD 82.56 billion by 2033 from USD 40.83 billion in 2025.

MARKET DRIVERS

The growing number of clinical laboratory tests and increasing R&D activities propel the laboratory equipment market growth.

The rising volume and complexity of clinical laboratory tests are driving the demand for laboratory tests. The requirement for diagnostic tests, screening procedures and monitoring methods has also increased due to the growing healthcare needs and increasing number of advancements in the healthcare industry. The growing prevalence of chronic diseases, the aging population, and the need for early disease detection are fuelling the demand for clinical laboratory tests and contributing to the growth of the laboratory equipment market. On the other hand, the growing number of R&D activities in pharmaceutical and biotechnological industries is propelling the demand for laboratory equipment.

Technological advancements further fuel the growth rate of the laboratory equipment market. The manufacturers of laboratory equipment have leveraged technological developments to develop innovative instruments and equipment with improved accuracy, efficiency, and automation capabilities. This trend is likely to continue in the coming years and boost the market’s growth rate. The growing need for laboratory equipment such as diagnostic instruments, molecular biology tools, and imaging systems supports the market growth. The growing patient population of chronic diseases, advancements in personalized medicine, and the demand for accurate diagnostic solutions is fuelling the demand for laboratory equipment in the healthcare industry.

The growing number of initiatives and funding from the governments of various countries for scientific research and development programs contribute to market growth. The growing awareness about environmental testing, rising demand for point-of-care testing, expansion of academic and industrial research institutes and growing investments by key market players further propel the laboratory equipment market growth.

MARKET RESTRAINTS

The high cost of laboratory equipment is one of the major factors hampering the market growth. Budget constraints in research and healthcare sectors, stringent regulatory requirements and compliance challenges and limited access to advanced technology in certain regions further hinder the market growth. Lack of skilled professionals to operate and maintain complex equipment, long equipment replacement cycles, impact of economic downturns on research and healthcare funding and competition from refurbished or second-hand equipment inhibit the market’s growth rate. Concerns regarding equipment reliability and accuracy and limited adoption of automation and digitalization in some laboratories impede the laboratory equipment market growth.

MARKET OPPORTUNITIES

The laboratory equipment market is evolving, and witnessing potential prospects. The trend of artificial intelligence and automation is highly certain to dominate in the coming years. For the second year in a row, these are the major trends, propelled by their part in managing enhanced patient care and higher lab workloads. According to industry experts, COVID-19 is one of the key drivers of greater application of automation in health services laboratories. These systems are widely accepted during the pandemic to administer the extraordinary cases of SARS-CoV-2 examination that coursed through various labs. Apart from better quality metrics, the latest technologies are decreasing the duration of pre-cessing and considerably encouraging test response time. For instance, many companies have come to light with technologies to reduce the time and expenditure of nucleic acid extraction.

- According to a survey by Siemens Healthineers, about 400 laboratory experts with 89 per cent of them consenting that automation is important for keeping pace with demand. On the other hand, more interesting, is that 95 per cent of surveyed participants see automation as the key to enhancing patient care.

Portability and miniaturization present potential opportunities for market expansions. The shift towards compact and portable design is raising the adaptability and accessibility of laboratory equipment. Researchers are capable of executing analyses and tests outside of the laboratories because of the increasing popularity of mobile equipment. These energy-saving and small devices are appropriate for environmental monitoring and on-site diagnostics among other applications.

Sustainable solutions for laboratory testing tools have now become an obligation and are likely to take the market forward. In the coming years, these devices and systems will be green, with zero wastage, power friendly, and only ecologically favourable materials.

MARKET CHALLENGES

The landscape of healthcare is constantly evolving. Several factors are derailing the growth trajectory of the laboratory equipment market. Direct-to-consumer (DTC) testing is one of the emerging issues companies face in this field. DTC tests attract customers desiring more checks over their medical decisions. Generally, Vendors of this test provide promotional prices to increase sales. This business model functions by ignoring the cost and complications of third-party insurance providers, coupled with evading expenditures related to submissions of claim forms, awaiting payments, and handling prior or denial authorizations. The increasing interest of people in DTC testing services poses detrimental impacts to an integrated healthcare delivery model because of the loss of revenue of community establishments, patients’ local EMRs are not being incorporated with test records and results, absence of quality/regulation can produce false outcomes, etc.

Another problem for the market players is the third-party specialty lab services. These specialty laboratories that operate directly with the consumer’s providers to give forte referral testing also present a risk to these labs. Additionally, acquisition and commoditization affect the development of this market because lab operators compete at a significantly reduced cost. Therefore, all these factors are major challenges for the laboratory equipment market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Disposables, Equipment Type, Services, End-Users, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Agilent Technologies, BD, Beckman Coulter, Inc., Bio-Rad Laboratories, Inc., Bruker, Eppendorf AG, F. Hoffmann LA-Roche AG, PerkinElmer Inc., Shimadzu Corporation, Thermo Fisher Scientific Inc |

SEGMENTAL ANALYSIS

By Product Type Insights

Based on the product, the incubators segment held the major global market share in 2024 and is anticipated to grow at a healthy CAGR during the forecast period. The expansion of the stem cell research field and regenerative medicine applications, rising emphasis on in vitro fertilization (IVF) procedures and assisted reproductive technologies that require controlled incubation conditions, the growing utilization of incubators in the microbiology and bioprocessing industries for microbial culture and fermentation processes and increasing demand for tissue engineering and 3D cell culture techniques drive the growth of the instruments segment.

The spectrophotometers and homogenizers segment is expected to witness rapid growth during the forecast period due to the growing number of product launches. Technological advancements leading to improved performance and efficiency, the growing adoption of sonicators and homogenizers in the food and beverage industry for quality control and product development, increasing demand for nanotechnology research and increasing focus on environmental testing and research contribute to the segmental growth.

By Disposables Insights

Based on the disposable segment, the cell culture and image consumable segment is anticipated to account for the major share of the global market during the forecast period. Factors such as the rising need for cell-based assays, drug screening, tissue engineering, and regenerative medicine, increasing number of advancements in cell culture techniques, such as the development of three-dimensional (3D) cell culture systems and organoids and rising emphasis on personalized medicine propel the segmental growth. The growing investments in the biopharmaceutical industry and rapid automation of cell culture processes and the use of high-throughput screening methods in drug discovery and development further contribute to the growth rate of the segment.

By Equipment Type Insights

Based on the equipment type, the analytical equipment segment is predicted to lead the market during the forecast period owing to the rising adoption rate of the latest technologies in research and development activities. The growing demand for advanced analytical techniques in research and diagnostics, technological advancements in analytical equipment, enhancing efficiency and accuracy and rising focus on quality control and assurance in various industries drive the growth of the analytical segment.

The general equipment segment is predicted to account for a substantial share of the global market during the forecast period. Wide application of general equipment in basic laboratory operations and procedures, rising demand for general equipment from academic and research institutions and continuous advancements in general laboratory equipment improving functionality and user-friendliness propel the growth of the general equipment segment.

The speciality equipment segment is estimated to register a healthy CAGR during the forecast period.

By End-Users Insights

Based on the end-users, the clinical Labs segment is estimated to occupy a major share of the global market during the forecast period owing to the rising demand for medical testing and diagnostics, the growing prevalence of diseases and the need for accurate analysis and an increasing number of advancements in laboratory automation and information management systems.

The hospital segment is expected to grow at a promising CAGR during the forecast period. Factors such as the growing need for accurate and efficient diagnostic testing, an increasing number of advancements in medical technology and laboratory diagnostics and rising focus on personalized medicine and precision diagnostics.

By Services Insights

Based on the services segment, the original equipment manufacturer (OEMs) segment is anticipated to account for the leading share of the global market and register the fastest CAGR during the forecast period. The growing number of advancements in technology leading to sophisticated and complex laboratory equipment, the expertise of OEMs and in-depth knowledge of their own equipment and the availability of original spare parts and manufacturer-authorized services drive the segmental growth.

By Application Insights

Based on the application, the hematology segment had the largest share of the global market in 2024 and it is expected to continue the trend during the forecast period. The growing prevalence of blood disorders, rising need for hematological testing, increasing number of advancements in hematology analyzers and diagnostic techniques and rising demand for hematology testing in clinical settings primarily drive the growth of the hematology segment.

The biochemistry segment is anticipated to be the fastest-growing segment in the global laboratory equipment market during the forecast period owing to factors such as the growing demand for biochemical analysis and biomarker testing, an increasing number of advancements in automated biochemistry analyzers and reagents and the growing number of applications in drug discovery, clinical research and metabolic profiling.

REGIONAL ANALYSIS

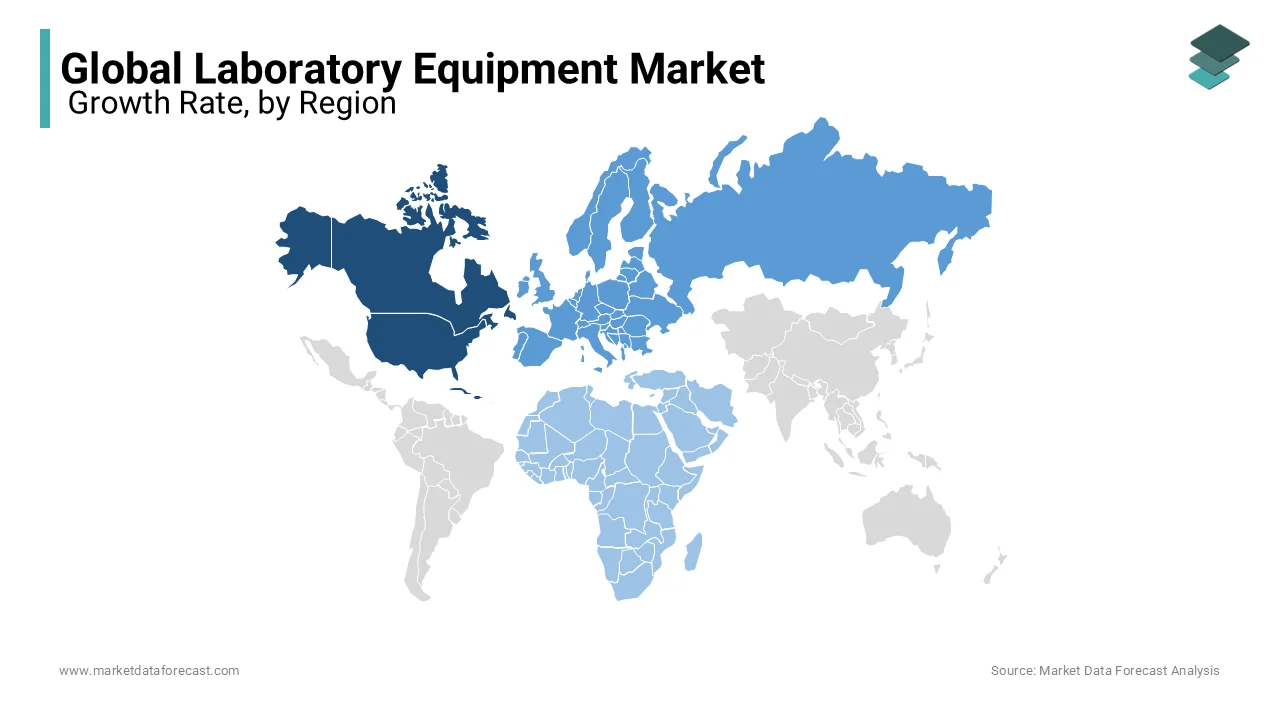

Geographically, North America dominates the global laboratory equipment market and this trend is likely to continue throughout the forecast period.

The presence of a well-established healthcare infrastructure, technological advancements in laboratory equipment and the growing number of R&D activities fuel the demand for laboratory equipment in the North American region and drive the regional market growth. The rising demand for personalized medicine, the presence of several major market participants and increasing emphasis on precision diagnostics in North America further contribute to the growth rate of the North American market. The U.S. accounted for the largest share of the North American market in 2022 and is predicted to grow at a healthy CAGR during the forecast period owing to the growing number of investments in healthcare and life sciences research in the U.S.

Europe secures the second-largest share of the global laboratory equipment market and is anticipated to grow at a healthy CAGR during the forecast period owing to the presence of several research organizations and increasing clinical research activities. Strong support from the governments of European countries for healthcare and research, the rising prevalence of chronic diseases and the rapid adoption of advanced laboratory technologies drive the European market growth. The rising focus on early disease detection, favorable reimbursement policies and increasing number of collaborations between academia and industry further propel the growth of the European laboratory equipment market. Germany captured the leading share of the European market in 2024 and is projected to register a healthy CAGR during the forecast period.

The Asia Pacific region is expected to grow at the fastest CAGR during the forecast period in the worldwide market owing to the growing population and increasing chronic disease prevalence. It led to several clinical activities being performed. Rapid diagnostic test kits are one of the innovations in clinical research. Factors such as the rapidly expanding healthcare sector, growing emphasis on disease prevention and control, increasing investments in healthcare infrastructure and rising demand for advanced diagnostics contribute to the growth of the APAC market. Emerging markets with untapped potential and the growing number of initiatives from the governments of APAC countries promoting healthcare and research further fuel the growth rate of the APAC market. China led the market in APAC in 2024, followed by India.

The Latin American region is predicted to witness a notable CAGR during the forecast period. The growing healthcare expenditure, rising awareness about preventive healthcare, growing medical tourism industry and increasing efforts of Latin American governments to improve healthcare infrastructure, expansion of private healthcare sector and rising demand for cost-effective diagnostic solutions drive the growth of the Latin American market. Brazil occupied the leading share of the Latin American market in 2024.

The Middle East and African regions are expected to grow steadily due to a lack of healthcare facilities and infrastructure. Also, these regions like South Africa experience harsh conditions due to a lack of awareness.

KEY MARKET PARTICIPANTS

Companies like Agilent Technologies, BD, Beckman Coulter, Inc., Bio-Rad Laboratories, Inc., Bruker, Eppendorf AG, F. Hoffmann LA-Roche AG, PerkinElmer Inc., Shimadzu Corporation, Thermo Fisher Scientific Inc., and Waters are leading the global laboratory equipment market.

The major market participants focus on R&D, new product launches, and FDA approvals to compete and maximize their share in the global laboratory equipment market.

RECENT HAPPENINGS IN THE MARKET

- In August 2024, Calibre Scientific via press reported the acquisition of ACEFE, S.A.U (ACEFESA), a Spanish supplier of biotechnology equipment and consumables. Moreover, it is the 5th purchase of Calibre Scientific in Spain and is firmly positioned in the veterinary, pharmaceutical, molecular biology and biotechnology industries. In addition, this takeover will solidify the product portfolio and the presence of this worldwide supplier all over the Iberian Peninsula. Moreover, the company emphasises ultrafiltration and micro, the environmental, blotting, molecular biology, and microbiology.

- In November 2024, The Joint Commission, starting on the 1st of January 2025, will enforce the latest requirements for accreditation for laboratories responding to the technological developments and changing practices. These amendments are positioned at par with the revised performance standards and proficiency testing analyses described in the updated Clinical Laboratory Improvement Amendments of 1988 (CLIA). Further, as per the Joint Commission, it will attach a new Appendix E to the Comprehensive Accreditation Manual for Laboratories (CAMLAB) to catch extra information associated with the updated rules and revised requirements.

- In May 2024, the Food and Drugs Administration (FDA) released its final rule on laboratory developed tests (LDTs) in the Federal Register. This final rule is a landmark measure towards the launch by FDA a more engaged or proactive legal proceedings for LDTs.

MARKET SEGMENTATION

This market research report on the global laboratory equipment market has been segmented and sub-segmented based on the product, disposables, equipment type, services, end-users, application, and region.

By Product Type

- Sonicators and Homogenizers

- Incubators

- Laminar Flow Hood

- Centrifuges

- Scopes

- Autoclaves

- Sterilizers

- Calorimeters

- Spectro Photometers

- Others

By Disposables

- Cuvettes

- Dishes

- Masks

- Gloves

- Pipettes

- Cell Culture and Image Consumables

- Tips and Tubes

By Equipment Type

- Analytical Equipment

- General Equipment

- Specialty Equipment

- Support Equipment

By End-Users

- Educational Institutions

- Hospitals

- Clinical Labs

- Diagnostic Centres

By Services

- Third-party Service Providers

- OEMs

By Application

- Hematology

- Endocrinology

- Microbiology

- Biochemistry

- Genetic Testing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- MEA

Frequently Asked Questions

What is the size of the laboratory equipment market?

The worldwide laboratory equipment market size was valued at USD 37.39 billion in 2024.

Who are the major players in the laboratory equipment market?

Thermo Fisher Scientific, Inc., Danaher Corporation, Agilent Technologies, Inc., PerkinElmer, Inc., and Bruker Corporation are some of the notable companies in the laboratory equipment market.

What is driving growth in the laboratory equipment market?

The growth of the laboratory equipment market is being driven by several factors, including the increasing demand for personalized medicine, growing investments in research and development, and the increasing prevalence of chronic diseases.

What are some of the challenges facing the laboratory equipment market?

Some of the challenges facing the laboratory equipment market include the high cost of equipment, the need for specialized training to operate certain types of equipment, and the increasing competition from low-cost manufacturers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com