Europe Frozen Food Market Research Report – Segmented By Product (Frozen Ready Meals, Meat & Poultry, Seafood, Vegetables & Fruits, Potatoes, And Soup), User (Retail And Foodservice Industry), And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe) - Industry Analysis On Size, Share, Trends & Growth Forecast (2025 To 2033)

Europe Frozen Food Market Size

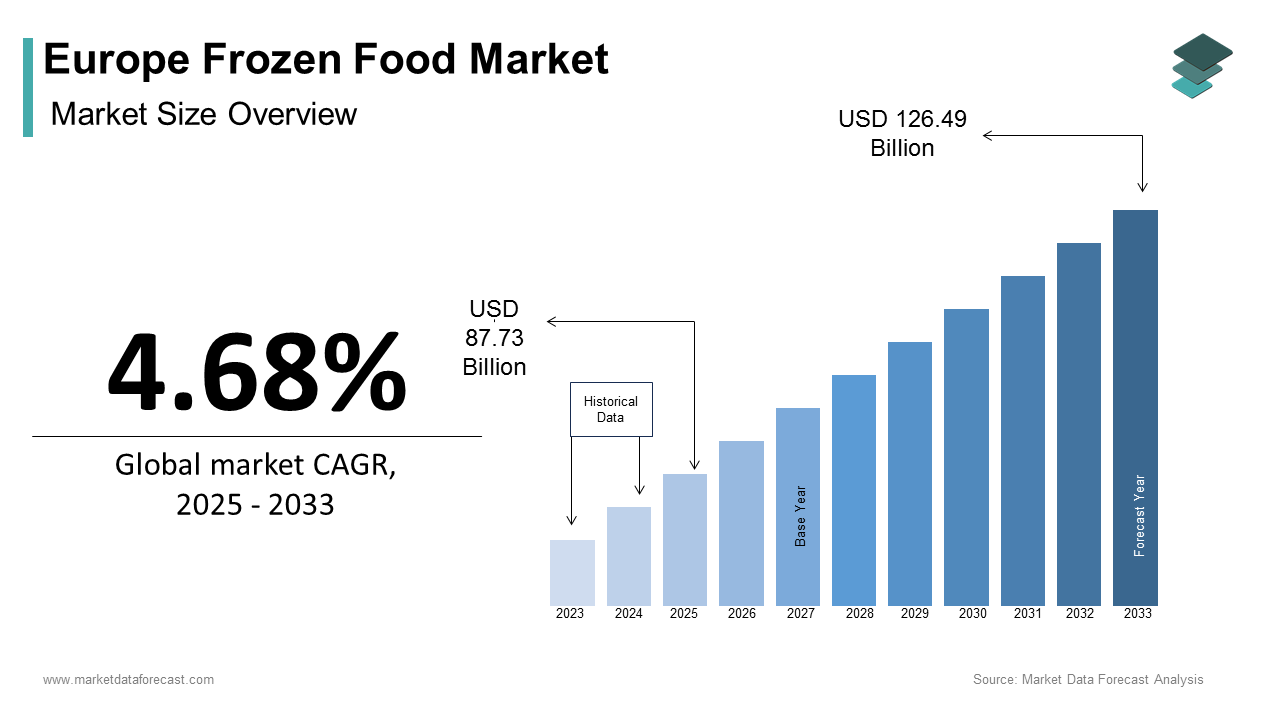

The Europe Frozen Food Market Size was expected to be worth USD 83.81 billion in 2024, and is anticipated to be worth USD 126.49 billion by 2033 from USD 87.73 billion In 2025, growing at a CAGR of 4.68% during the forecast period.

The Europe frozen food market has emerged as a cornerstone of the region’s food industry, driven by changing consumer lifestyles and the growing demand for convenience-based solutions. A significant factor shaping the market is the growing preference for ready-to-eat meals. As per the European Food Information Council (EUFIC), over 60% of European consumers cited time constraints as a primary reason for purchasing frozen foods by creating a critical need for high-quality and nutritious options. Additionally, advancements in freezing technologies have amplified adoption by positioning frozen foods as a convenient yet healthy alternative to fresh produce.

MARKET DRIVERS

Urbanization and Changing Lifestyles

Urbanization and changing lifestyles are cornerstone drivers of the Europe frozen food market. According to Eurostat, over 75% of Europe’s population resides in urban areas, where fast-paced lifestyles necessitate convenient meal solutions. Frozen foods, particularly ready meals and vegetables, have gained significant traction due to their extended shelf life and ease of preparation.

A pivotal factor amplifying this growth is the emphasis on nutritional value. As per a report by Statista, over 50% of frozen food manufacturers introduced nutrient-rich products in 2023, catering to health-conscious consumers. For instance, frozen vegetable sales grew by 25% in urban centers like London and Berlin, driven by campaigns promoting their vitamin retention compared to fresh alternatives. These innovations not only enhance accessibility but also align with EU goals for sustainable food systems.

Rising Demand for Convenience Foods

The rising demand for convenience foods is significantly bolstering market growth. According to Frost & Sullivan, investments in frozen ready meals grew by 30% in 2023 owing to the partnerships between food companies and e-commerce platforms. These products cater to busy professionals and families seeking quick yet nutritious meal options.

According to a study by Accenture, online sales of frozen ready meals increased by 40% in 2023, driven by their cost-effectiveness and scalability. Additionally, collaborations with grocery chains have expanded functionality, enabling features like same-day delivery.

MARKET RESTRAINTS

High Energy Costs and Freezing Technology Expenses

One of the primary barriers impeding the growth of the Europe frozen food market is the high energy costs associated with freezing technologies. According to Deloitte, maintaining frozen supply chains can increase operational expenses by up to 20% that is deterring smaller players from adopting advanced freezing methods. Additionally, maintenance costs remain a concern for small-scale producers. According to a report by PwC, 40% of European enterprises cited budget constraints as a barrier to upgrading their freezing infrastructure in 2023. While larger corporations can absorb these expenses, smaller operators often struggle to justify the investment is creating a fragmented market landscape.

Consumer Perception of Nutritional Value

Consumer perception of frozen foods’ nutritional value poses another significant restraint for the Europe frozen food market. According to Capgemini, over 60% of European consumers expressed concerns about the quality and healthiness of frozen products by raising questions about their suitability as dietary staples.

For instance, a study by KPMG reveals that negative perceptions delayed the adoption of frozen fruits and vegetables by 15% in 2023 among older demographics. Addressing these concerns requires significant investments in marketing and education campaigns, which may not be feasible for all stakeholders.

MARKET OPPORTUNITIES

Expansion into Organic and Plant-Based Products

The expansion into organic and plant-based frozen products presents a transformative opportunity for the Europe frozen food market. These products cater to health-conscious and environmentally aware buyers, ensuring compliance with EU sustainability goals. The organic frozen vegetables captured 35% of the frozen food market share in 2023, driven by their pesticide-free cultivation and extended shelf life. Additionally, government incentives promoting sustainable agriculture have expanded adoption by reinforcing the segment’s rapid expansion.

Growth of Online Distribution Channels

The growth of online distribution channels offers another promising avenue for growth in the Europe frozen food market. These platforms enable direct access to urban consumers by reducing logistical challenges and enhancing scalability. For instance, according to a study by McKinsey, partnerships with e-commerce giants like Amazon and local grocery platforms expanded functionality by enabling features like personalized recommendations. These innovations not only drive revenue but also position frozen foods as a cornerstone of modern retail ecosystems.

MARKET CHALLENGES

Supply Chain Disruptions and Logistical Barriers

Supply chain disruptions and logistical barriers represent a significant challenge for the Europe frozen food market. Frozen food manufacturers faced delays in raw material procurement in 2023 during peak seasons. This limitation is particularly evident in cross-border trade, where temperature-controlled logistics are critical for maintaining product quality. For example, a report by ABB reveals that supply chain inefficiencies led to a 10% increase in spoilage rates in 2023 with persistent gaps in cold chain infrastructure. While innovation in IoT-driven monitoring tools can mitigate this challenge, the rapid pace of technological disruption underscores the need for continuous adaptation and differentiation.

Competition from Fresh and Chilled Alternatives

Intense competition from fresh and chilled alternatives poses another pressing challenge for the Europe frozen food market. According to Nielsen, emerging solutions such as vacuum-sealed fresh produce and refrigerated ready meals are gaining traction, particularly in urbanized regions. These alternatives offer advantages like perceived freshness and shorter preparation times is threatening the dominance of traditional frozen products. According to a study by the European Grocery Retail Association, chilled ready meals captured 25% of the convenience food market share in 2023 owing to their superior taste and texture. While collaboration with academic institutions can address this challenge, the sheer scale of required R&D investments remains a persistent hurdle is slowing market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.68% |

|

Segments Covered |

By Product, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

H.J. Heinz, while Nestlé, Maple Leaf Foods Inc., ConAgra Foods Inc., Tyson Foods Inc., General Mills, BRF SA, Pinnacle Foods Inc., Mother Dairy Fruit & Vegetable Pvt. Ltd., Kraft Foods Group Inc., Ajinomoto Co. Inc., and Unilever PLC. |

SEGMENTAL ANALYSIS

By Product Insights

The ready meals segment was the largest and held 45.3% of the Europe frozen food market share in 2024. This growth is driven by the growing demand for convenience foods among urban professionals and dual-income households. According to Eurostat, over 60% of European consumers cited convenience as the primary reason for purchasing frozen ready meals in 2023 is creating a surge in demand for high-quality and nutritious options. Additionally, advancements in freezing technologies have improved taste and texture that will enhance the growth of the market. Another driving factor is the integration of diverse cuisines.

The Fruits & vegetables segment is anticipated to hit a fastest CAGR of 6.2% during the forecast period. This growth is fueled by the increasing adoption of organic and plant-based diets among health-conscious consumers. The frozen organic vegetables gained significant traction in 2023 owing to their extended shelf life and nutrient retention. These products are particularly valuable for urban areas, enabling efficient meal planning while reducing food waste. Additionally, collaborations with farmers have expanded functionality by enabling seamless integration with sustainable agriculture practices.

By Distribution Channel Insights

The offline distribution segment dominated the Europe frozen food market by capturing 65.2% of the total share in 2024. This growth is driven by the widespread presence of supermarkets, hypermarkets, and specialty stores in rural and suburban areas. A key factor fueling this dominance is the emphasis on product visibility and trial. According to Nielsen, over 70% of European consumers prefer in-store purchases for frozen foods in 2023 owing to the ability to inspect packaging and compare prices. Another driving factor is the integration of sustainable packaging.

The online distribution segment is anticipated to grow with a prominent CAGR of 8.5% during the forecast period. This growth is fueled by the increasing adoption of e-commerce platforms among urban consumers seeking convenience and home delivery options. According to the study by McKinsey, online sales of frozen foods grew by 50% in 2023, driven by partnerships with grocery chains and subscription-based services. These platforms enable direct access to urban consumers, reducing logistical challenges and enhancing scalability. Additionally, collaborations with tech startups have expanded functionality by enabling features like personalized recommendations.

REGIONAL ANALYSIS

Germany was the top performer in the Europe frozen food market by holding 22.2% of share in 2024 owing to its robust retail infrastructure and strong emphasis on convenience foods, supported by initiatives promoting sustainable agriculture.

A pivotal factor fueling this dominance is the growing urban population. According to Eurostat, over 75% of Germans reside in urban areas, where frozen ready meals and vegetables have gained significant traction due to their extended shelf life and ease of preparation. Additionally, partnerships with local farmers have amplified adoption with the Germany’s position as a leader in frozen food innovation.

The UK frozen food market is gaining traction with an esteemed CAGR of 12.3% during the forecast period. London and Manchester have emerged as critical hubs by robust investments in e-commerce platforms and grocery chains. The transition to plant-based diets has significantly bolstered demand. As per the UK Food Standards Agency, frozen plant-based products grew by 35% in 2023 by creating a surge in adoption for organic and nutrient-rich options. Additionally, government funding for sustainable food systems has expanded accessibility is reinforcing the UK’s prominence in frozen food solutions.

France frozen food market is lucratively growing from past few years and likely to have the prominent opportunities in the next coming years. Paris has emerged as a key player by hosting major innovation labs and startups specializing in frozen convenience foods.

A major driver of this growth is the increasing adoption of online grocery shopping. According to the French Retail Federation, online sales of frozen foods increased by 40% in 2023 which was driven by consumer demand for home delivery and subscription services. Additionally, urbanization initiatives have amplified demand for scalable and efficient solutions in metropolitan areas.

Italy frozen food market is likely to gain traction with the Milan and Rome are rapidly emerging as key hubs, supported by a growing emphasis on organic and plant-based diets.

A key factor driving Italy’s growth is the increasing adoption of frozen fruits and vegetables. According to the Italian Ministry of Agriculture, these products accounted for 30% of frozen food sales in 2023, ensuring compliance with EU sustainability goals. Additionally, government incentives supporting local farmers have expanded adoption by ensuring scalability and safety.

Spain frozen food market is likely to grow with a Barcelona and Madrid lead the charge, hosting major frozen food innovation centers and distribution hubs. A pivotal driver of Spain’s growth is the emphasis on Mediterranean-inspired frozen meals. Additionally, collaborations with private sector players have expanded functionality by enabling seamless integration with national retail networks.

LEADING PLAYERS IN THE MARKET

Nestlé S.A.

Nestlé S.A. is a global leader in the frozen food market, playing a pivotal role in shaping the Europe segment. The company offers a comprehensive portfolio of frozen ready meals, vegetables, and plant-based products tailored to diverse consumer preferences. Its focus on innovation and sustainability has positioned it as a trusted partner for retailers and wholesalers.

McCain Foods Limited

McCain Foods specializes in advanced frozen potato products, emphasizing quality and affordability. The company’s frozen fries and hash browns are widely adopted in households and foodservice outlets, enabling efficient meal preparation. McCain’s commitment to sustainability aligns with EU Green Deal objectives, earning it a loyal customer base.

Birds Eye Ltd.

Birds Eye Ltd. is renowned for its cutting-edge frozen vegetable and ready meal solutions, particularly in the UK and Scandinavia. The company’s focus on organic and plant-based options has made it a leader in health-conscious segments. Birds Eye delivers superior performance while reducing environmental impact by integrating AI-driven analytics.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Emphasis on Sustainability

Leading players in the Europe frozen food market have embraced sustainability as a core strategy to enhance their competitive edge. For instance, the development of eco-friendly packaging and carbon-neutral supply chains has resonated with environmentally conscious consumers. These initiatives not only align with EU regulations but also foster brand loyalty among stakeholders prioritizing green solutions.

Investment in R&D

Investments in research and development are a cornerstone strategy for staying ahead in the market. Companies focus on developing innovative freezing technologies and product formulations to address evolving customer needs. This approach allows them to tackle challenges such as taste preservation and nutritional value while maintaining dominance in technological advancements.

Geographic Expansion

Expanding into emerging markets within Europe, such as Eastern Europe and Scandinavia, has become a priority for key players. Companies can better serve regional demands while capitalizing on favorable regulatory frameworks by establishing localized production facilities and distribution networks. This strategy ensures sustained growth amid intensifying competition.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Key Players in the Europe Frozen Food Market are H.J. Heinz, while Nestlé, Maple Leaf Foods Inc., ConAgra Foods Inc., Tyson Foods Inc., General Mills, BRF SA, Pinnacle Foods Inc., Mother Dairy Fruit & Vegetable Pvt. Ltd., Kraft Foods Group Inc., Ajinomoto Co. Inc., and Unilever PLC.

The Europe frozen food market is characterized by intense competition, driven by the presence of global giants and regional innovators vying for market share. Major players like Nestlé S.A., McCain Foods, and Birds Eye Ltd. dominate the landscape, leveraging their extensive expertise in frozen convenience foods and plant-based solutions. However, the market also features niche players specializing in organic and premium products is creating a fragmented yet dynamic ecosystem.

Technological innovation is a key battleground, with companies investing heavily in IoT, AI, and blockchain to differentiate themselves. According to McKinsey, over 60% of European enterprises prioritize secure and scalable frozen food solutions, intensifying competition among providers to offer cutting-edge technologies. Mergers and acquisitions are another hallmark of the competitive landscape. Larger firms acquire smaller innovators to expand their product portfolios and geographic reach. Meanwhile, price wars and aggressive marketing strategies are common in saturated markets like Germany and the UK. Despite these challenges, the market remains ripe for growth, with opportunities in emerging segments such as plant-based frozen foods driving future competition.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Nestlé S.A. partnered with a German agricultural cooperative to launch a line of organic frozen vegetables, enhancing its position in sustainable food solutions. This initiative aims to reduce carbon emissions while improving product quality.

- In June 2023, McCain Foods introduced a new line of plant-based frozen fries in France, designed to cater to health-conscious consumers. This move underscores the company’s commitment to diversifying its product offerings.

- In September 2023, Birds Eye Ltd. acquired a Swedish startup specializing in frozen plant-based ready meals, expanding its portfolio of health-focused products. This acquisition strengthens Birds Eye’s dominance in the Nordic region.

- In January 2024, Dr. Oetker launched an e-commerce platform for frozen desserts in Italy, targeting urban consumers seeking convenience. This launch positions Dr. Oetker as a leader in digital retail solutions.

- In November 2023, Findus unveiled its carbon-neutral frozen seafood line in Spain, addressing environmental concerns while appealing to eco-conscious buyers. This initiative enhances brand loyalty and trust.

DETAILED SEGMENTATION OF EUROPE FROZEN FOOD MARKET INCLUDED IN THIS REPORT

This research report on the Europe frozen food market has been segmented and sub-segmented based on product, distribution channel & region.

By Product

- Frozen Ready Meals

- Frozen Fruits & Vegetables

- Frozen Meat & Poultry

- Frozen Seafood

- Frozen Bakery Products

- Frozen Dairy Products

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Others

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the growth of frozen food in Europe?

Urbanization and busy lifestyles, rising preference for convenience foods, advancements in cold chain logistics, and increased freezer space in households and retail

2. Which countries in Europe have the highest demand for frozen food?

Top markets include Germany, United Kingdom, France, Italy, and Spain these countries have strong retail networks and high consumer awareness.

3. Who are the leading players in the European frozen food industry?

Major companies include Nestlé S.A., Nomad Foods (Birds Eye, Iglo, Findus), McCain Foods, Dr. Oetker, and Unilever (Magnum, Ben & Jerry’s for frozen desserts)

4. How is sustainability impacting the frozen food industry?

Manufacturers are focusing on reducing plastic packaging, improving energy efficiency in logistics, sourcing sustainable ingredients, and sustainability is becoming a competitive advantage.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]