Global Gluten Free Prepared Food Market Size, Share, Trends & Growth Forecast Report - Segmented By Distribution Channel (Grocery Store, Supermarkets And Hypermarkets, Health Or Natural Food Store, Drug Store), Product Type (Bakery Products, Pasta, Ready To Eat Products, Bread And Rolls), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Industry Analysis On Size, Share, Growth, Trends And Forecast 2025 To 2033

Global Gluten Free Prepared Food Market Size

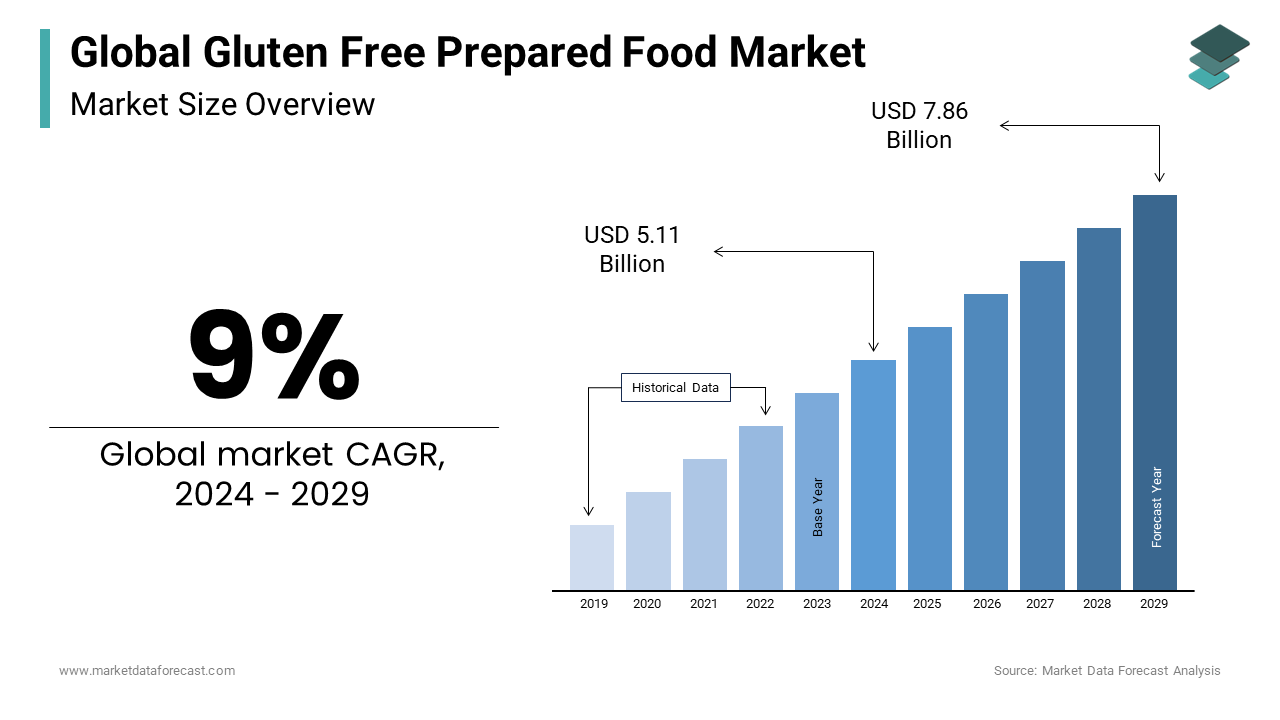

The size of the global gluten free prepared food market was expected to be worth USD 5.11 billion in 2024 and is anticipated to be worth USD 11.10 billion by 2033 from USD 5.57 billion In 2025, growing at a CAGR of 9% during the forecast period.The market is leading with increased awareness of celiac disease and the adoption of a special dietary lifestyle.

Gluten is a kind of protein that is found in barley, wheat, rye and its derivatives or hybrid varieties. It is also used as a binder to prevent crushing in baked goods. Foods containing gluten are a major cause of food intolerance for consumers with celiac disease, which are autoimmune and genetic disorders. In these cases, eating gluten-rich foods damages the small intestine and is life-threatening. The only solution for these consumers is to follow a strict diet of foods made without gluten. Another group of users who prefer gluten-free foods are those who suffer from wheat allergies and autism disorders. In addition to medical reasons, some users adopt prepared gluten-free foods as part of their health and fitness routine. These are widely used in the preparation of various products in the food and beverage industry, such as pasta, bread, chocolate and croissants. This gluten-free product helps control medical conditions related to a gluten allergy and digestive disorders. The use of a gluten-free alternative to bakery preparations improves blood cholesterol and lipid profiles by reducing the fat content in preparations such as cakes and strudels, speeding up metabolism that promotes healthy digestion and improves market growth.

MARKET DRIVERS

Gluten-free prepared foods should be adopted globally due to the rapid rise in demand as a result of rising prices due to a lack of general awareness about health maintenance.

Growing concern about food allergies and consumer intolerance is driving the global gluten-free prepared food market. Prepared food manufacturers are investing in products designed to meet specific dietary requirements. Consumer preferences have shifted from regular products to gluten-free foods, such as baked goods, confectionery, and dairy products. Market growth is also accelerating as demand for gluten-free foods increases among non-celiac consumers. Having products available in almost every grocery store is also supposed to have a significant impact on market growth. The increased incidence of irritable bowel syndrome (IBS) and celiac disease is assumed to increase the demand for gluten-free foods in developed and developing countries. People with the syndrome are gluten sensitive, and eating gluten exacerbates the problems caused by the syndrome. Celiac disease is an autoimmune disease in which gluten digestion damages the small intestine. In developed countries in North America and Europe, including the United States, Canada, Germany, and France, the spread of these diseases is presumed to drive demand for the products. As the incidence of IBS and celiac disease increases, the demand for gluten-free products is expected to increase in developed and developing countries.

People suffering from IBS syndrome are sensitive to gluten and the consumption of ingredients worsens the disease system. Technology trends include product innovations to improve the taste of gluten-free prepared foods. In addition, technological advances are taking place in the manufacturing process to reduce product prices. The new manufacturing process includes extrusion cooking and annealing to increase product robustness and reduce the loss of cooking. The availability of gluten-free foods through a wide range of distribution channels, such as supermarkets, hypermarkets and health food stores, is likely to accelerate the growth of the global gluten-free prepared food market. Gluten-free food product manufacturers are launching innovative products to improve taste and nutritional value. The availability of these various products is expected to spur the growth of the global market.

MARKET RESTRAINTS

The price of gluten-free prepared food is a major barrier to adoption among non-users, which is deemed to hinder the growth of this market worldwide.

The concept of gluten-free prepared food worldwide is relatively new and is limited due to the absence of existing companies. Another limitation is that logistics problems related to material storage are a serious lack of consumer awareness in developing countries. The relatively high cost of gluten-free products compared to conventional gluten products is due to the additional production cost by the manufacturer, along with the requirements for additional ingredients such as xanthan gum, guar gum, chicory, inulin, and others. That is, the additional preparation steps necessary to produce an equivalent product increase the cost of producing a gluten-free product. This leads to the high cost of gluten-free products for consumers, hindering the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9% |

|

Segments Covered |

By Product Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Ener-G Foods, Inc, General Mills Inc, Enjoy Life Foods, Udi's Healthy Foods, B&G Foods, Dr. Schär AG / SPA , Mrs Crimble's, Hain Celestial, Genius Foods and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The bakery products segment dominated the market by holding 38.8% of the global market share in 2024. The domination of the bakery products segment is majorly driven by the high consumer demand for indulgent yet healthy options like cakes, cookies, and muffins. The rise in celiac disease (affecting ~1% globally, per WHO) and gluten sensitivity drives growth. In the U.S., gluten-free product sales reached $5.6 billion in 2021 with bakery items being a key contributor. Their importance lies in offering safe, tasty alternatives to traditional baked goods, catering to health-conscious consumers and those with dietary restrictions.

The ready-to-eat segment is expected to progress at a CAGR of 9.5% during the forecast period owing to the busy lifestyles and demand for convenient, healthy meal options. Ready-to-eat products are vital for providing quick, nutritious solutions, especially in urban areas where time constraints drive consumer preferences. Innovations in flavors and clean-label ingredients further boost their appeal.

By Distribution Channel Insights

The supermarkets and hypermarkets segment held the major share of the global market in 2024. This segment offers a wide variety of gluten-free products, including ready-to-eat meals, snacks, and bakery items, under one roof. The convenience of shopping for gluten-free products in these large retail stores, along with the growing demand for gluten-free diets, makes supermarkets and hypermarkets the go-to shopping destination for consumers. They provide easy access to gluten-free options, contributing to the dominance of this distribution channel in the market.

The health or natural food store segment is the fastest-growing distribution channel in the global gluten-free prepared food market and is expected to account for a prominent share of the global market during the forecast period. With an increasing number of consumers seeking organic, natural, and gluten-free food options, health and natural food stores are seeing a rise in foot traffic. These stores specialize in health-conscious products and often offer a wide selection of gluten-free options, attracting individuals with dietary restrictions and those following a gluten-free lifestyle. The segment's growth is driven by the increasing awareness of gluten-related health issues and the rising trend of clean-label, natural foods.

REGIONAL ANALYSIS

The global gluten-free prepared food market can be divided into five regions: North America, Latin America, Europe, Asia Pacific (APAC), and the Middle East and Africa (MEA). North America represents more than half of the world market share for gluten-free foods. In North America, the United States has a significant market share, as the number of consumers with celiac disease and food allergies increases, and consumers are adopting gluten-free food products for health benefits. Europe is determined to register the most substantial growth rate over the outlook period. As the number of children and adults affected by obesity increases and awareness of healthy lifestyles increases, the region's gluten-free cooked food market is foreseen to grow. APAC is estimated to maintain a significant share with a high growth rate over the calculated period. This is due to disposable income, population growth, and rapid growth in the local allergenic food market. With increasing awareness of allergen-friendly foods among Latin American and MEA consumers, moderate CAGRs are considered in these areas during the projection period.

KEY PLAYERS IN THE GLOBAL GLUTEN FREE PREPARED FOOD MARKET

Major key players in the global gluten free prepared food market are Ener-G Foods, Inc, General Mills Inc, Enjoy Life Foods, Udi's Healthy Foods, B&G Foods, Dr. Schär AG / SPA , Mrs Crimble's, Hain Celestial, Genius Foods and Others.

RECENT HAPPENINGS IN THE MARKET

- In 2016, Scottsdale gluten-free food maker Mikey's LLC launched gluten-free pizza dough.

- In January 2016, Boulders Brands partnered with Pizza Hut to launch two gluten-free pizzas in the pepperoni and cheese markets using Udi's flagship crust.

- In October 2019, London Food Corporation completed the acquisition of Big Oz, a UK-based company dedicated to the manufacture of cereals and gluten-free foods. The firm provides numerous gluten-free foods, such as crispy flakes, puff pastry, porridge and granola.

DETAILED SEGMENTATION OF THE GLOBAL GLUTEN FREE PREPARED FOOD MARKET INCLUDED IN THIS REPORT

This research report on the global gluten free prepared food market has been segmented and sub-segmented based on product type, distribution channel, and region.

By Product Type

- Bakery Products

- Pasta

- Ready to Eat Products

- Bread and Rolls

By Distribution Channel

- Grocery Store

- Supermarkets and Hypermarkets

- Health or Natural Food Store

- Drug Store

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What are the current trends in the Gluten-Free Prepared Food Market?

Current trends include the rise of organic and non-GMO gluten-free products, increased availability of gourmet and artisanal gluten-free options, the popularity of plant-based and clean-label products, and the expansion of gluten-free offerings in mainstream supermarkets and restaurants.

2. What is the future outlook for the Gluten-Free Prepared Food Market?

The market is expected to continue growing due to increasing health awareness, better diagnostic rates for celiac disease and gluten sensitivity, ongoing product innovation, and expanding distribution channels.

3. What are the main drivers of the Gluten-Free Prepared Food Market?

Key drivers include increasing awareness and diagnosis of celiac disease and gluten sensitivity, the growing health and wellness trend, consumer demand for diverse and convenient gluten-free options, and advancements in food technology and ingredient sourcing.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]