Global Sugar Substitutes Market Size, Share, Trends, & Growth Forecast Report - Segmented By Origin (Natural And Synthetic), Composition (Stevia, Aspartame, Cyclamate, Sucrose, Acek, Saccharin, D-Tagarose, Sorbitol, Maltitol, Xylitol), Application (Beverages, Food, Health & Personal Care, Pharmaceuticals, And Others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Sugar Substitutes Market Size

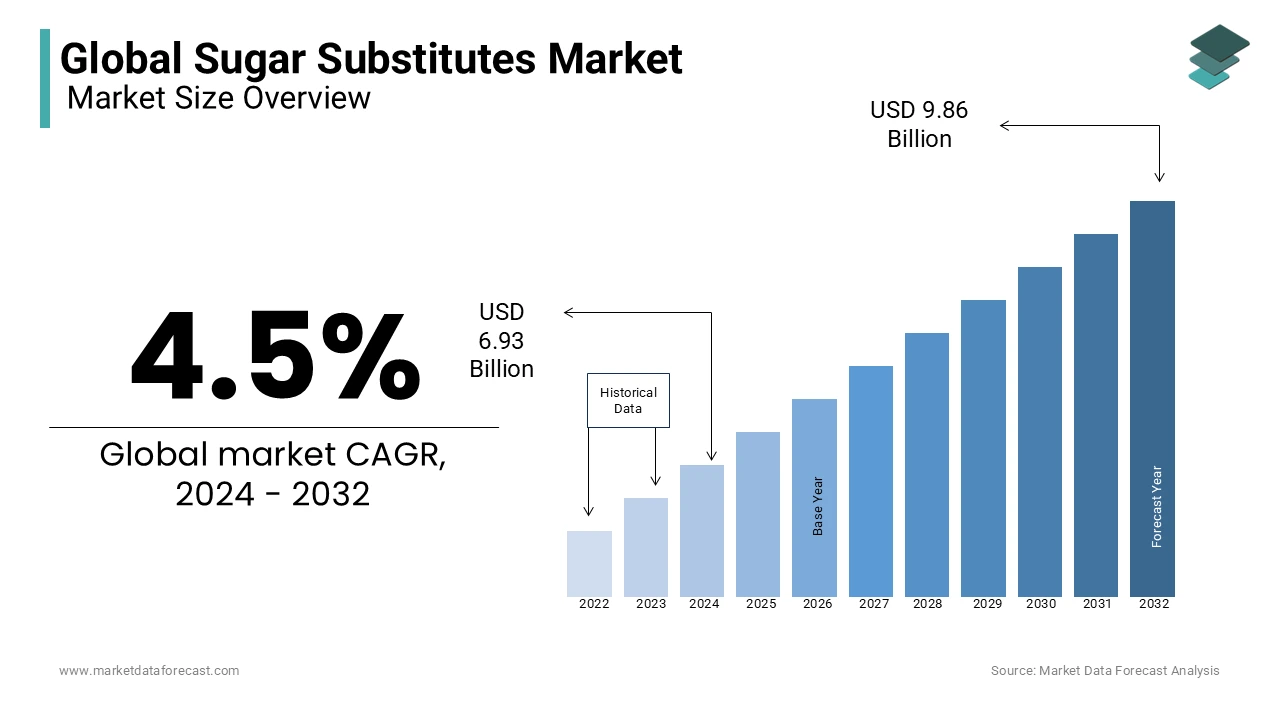

The global sugar substitutes market size was calculated to be USD 6.93 billion in 2024, and is anticipated to be worth USD 10.30 billion by 2033 from USD 7.24 billion In 2025, growing at a CAGR of 4.50% during the forecast period. The growing demand for sugar substitutes in the food and beverage industry is expected to help the market gain enormous traction in the coming years.

Sugar, a carbohydrate used in many foods for a sweet taste, is extracted from various sources, such as sugar cane. Monosaccharides (simple sugar), galactose, and fructose are among the most common types of sugar. The sugar consumed by humans is known as sucrose and, when ingested, it hydrolyzes to glucose and fructose. Sugar is mainly used in bakery products and commercial beverages and sweeteners. Sugar was possibly a commodity with a wide range of commercial products worldwide. People are looking for alternatives because of concerns about obesity and a host of serious health problems caused by sugar consumption. A variety of sugar substitutes has become popular as consumer tastes and preferences increase, especially health problems. The artificial sweetener industry is at the forefront of making big profits by investing in the alternative sugar market. These can be obtained from plants or manufactured synthetically. Advances in processing technology have allowed us to expand and mass-produce raw materials to produce sugar substitutes.

Regular consumption of sugar can lead to weight gain and an increased risk of heart disease, an increased risk of acne, diabetes, cancer, depression, accelerated skin aging, and fatty liver, which is boosting the market business for sugar substitutes.

MARKET DRIVERS

With the increasing trend to move to a low-calorie diet, it has become a major factor driving product development in the alternatives to the sugar market.

Food companies are also looking for attractive income potential as a substitute for sugar. Several brands containing sugar substitutes have attracted the attention of the population of developed countries. Stevia-based functional food is one example. This is one of the important trends for the growth of the market for sugar substitutes. The family of artificial sweeteners is considered "generally recognized as safe" and is accumulating steam. Therefore, scientific support is driving their needs in more and more regions of developing countries. The market potential is being strengthened as its role in nutritional interventions to control the risk of type 2 diabetes and heart disease increases. Additionally, many of the functional sweeteners in food companies are on the rise as they promise consumers that these sugar substitutes will have a beneficial effect in preventing tooth decay. As the number of FDA approved products increases, you are helping to expand the profitable path in the sugar substitute market. Along with growing consumer awareness of sugar substitutes, the growing demand for low calorie or low-calorie products is a major contributor to the growth of the sugar substitute market. Sugar substitutes are mainly used in drinks, ice creams, powdered drink mixes, processed foods like puddings, jams, jellies, sweets, dairy products, etc.

Today, consumers are more health-conscious and follow a healthy diet. In the food and beverage industry, table calories, which are high in calories, are rapidly being replaced by a variety of sugar substitutes. Diet foods, sodas, sugar-free desserts, and grains are some of the common foods that contain sugar substitutes. Sometimes sugar substitute mixtures are used. USA and Europe, the use of stevia as a sweetener has been approved and the demand for stevia leaves has soared. Compared to other countries, the import rate of sugar substitutes in countries such as Indonesia and India are low due to a lack of consumer awareness of sugar substitutes. Sugar substitutes are used in a variety of applications including bakery, confectionery, dairy, frozen foods, beverages, pharmaceuticals, and personal care. Increasing awareness of population health and continued technological development are among the key factors expected to drive market growth. Increased prevalence of diabetes and weight-related problems are among the main factors in the adoption of sugar substitutes. The Asia-Pacific region is believed to be a promising region for manufacturers of sugar substitutes, which improves the living standards of the middle-class population and increases consumer energy consumption. In addition to this, the growing concern of the health-conscious population is expected to be one of the main factors driving the growth of the market.

MARKET RESTRAINTS

A strict regulatory framework for the concept among the general public that the production of sugar substitutes and the consumption of sugar substitutes is assumed to cause health problems will prevent the market from realizing its full potential during the forecast period.

Product labelling, claims issues and ambiguity related to health problems stemming from the consumption of sugar substitutes are deterrents to the sugar substitute market. The health problems associated with consuming sugar substitutes prevent consumers from using sugar substitutes extensively.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.5% |

|

Segments Covered |

By Origin, Composition, Application, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill Incorporated, Tate & Lyle PLC, E. I. du Pont de Nemours and Company, Roquette Freres S.A., Pure Circle Ltd, Ajinomoto Co. Inc, Archer Daniels Midland Company, MacAndrews & Forbes Incorporated, Ingredion Incorporation, and JK Sucralose Incorporation |

SEGMENTAL ANALYSIS

By Origin Insights

The natural sugar substitute segment is leading with the dominant share of the market, whereas the synthetic segment is expected to have the highest CAGR by the end of the forecast period. Naturally, origin sugar substitutes have immense health benefits, due to which the demand is growing very high these days. Many people are majorly shifting towards healthy diet options, especially replacing sugar with other products. Therefore, the demand for naturally abstracted sugar substitutes will play a prominent role in the future.

The synthetic segment is likely to have huge growth opportunities in the coming years. The necessity to fulfill the ongoing demand for various healthy food products is quietly not possible with naturally sourced ingredients, which is why the demand to use synthetic products is becoming a major aspect of the F&B industry.

By Composition Insights

Stevia segment is estimated to have the largest share of the market. It is made from the leaves of the stevia plant, which is highly famous in South America. These leaves have natural sweeteners that can act easily as a sugar substitute with eventually lower risk for people who are suffering from diabetes, obesity, and others. Stevia doesn’t affect insulin levels and adds great taste to sweet-tasting foods. Government support through investment in the expansion of the food and beverage industry is also meant to boost the growth rate of the market. In addition, the aspartame segment is next in holding the prominent share of the market, whereas the sucralose segment is likely to have the prominent growth rate of the market.

Sucralose is completely different when compared to sugar, which is calorie-free and 600 times sweeter than sugar. Many research studies show that it can be completely replaced with sugar and any other artificial sweeteners, which may even help in losing lower body weight.

By Application Insights

The food segment is gaining huge traction over the share of the market. Expanding the scale of industries, especially in developed and developing countries, are showcasing different opportunities for various cuisines with low-calorie options to meet the expectations of customers. This is more likely to elevate the growth rate of this segment.

The pharmaceuticals segment is anticipated to have the highest CAGR by the end of 2032. Sugar substitutes can be used both in solid and liquid formulations in the industry, which makes it ideal to manufacture high-quality drugs according to government rules and regulations and is generally accounted for in enhancing the growth rate of the market.

REGIONAL ANALYSIS

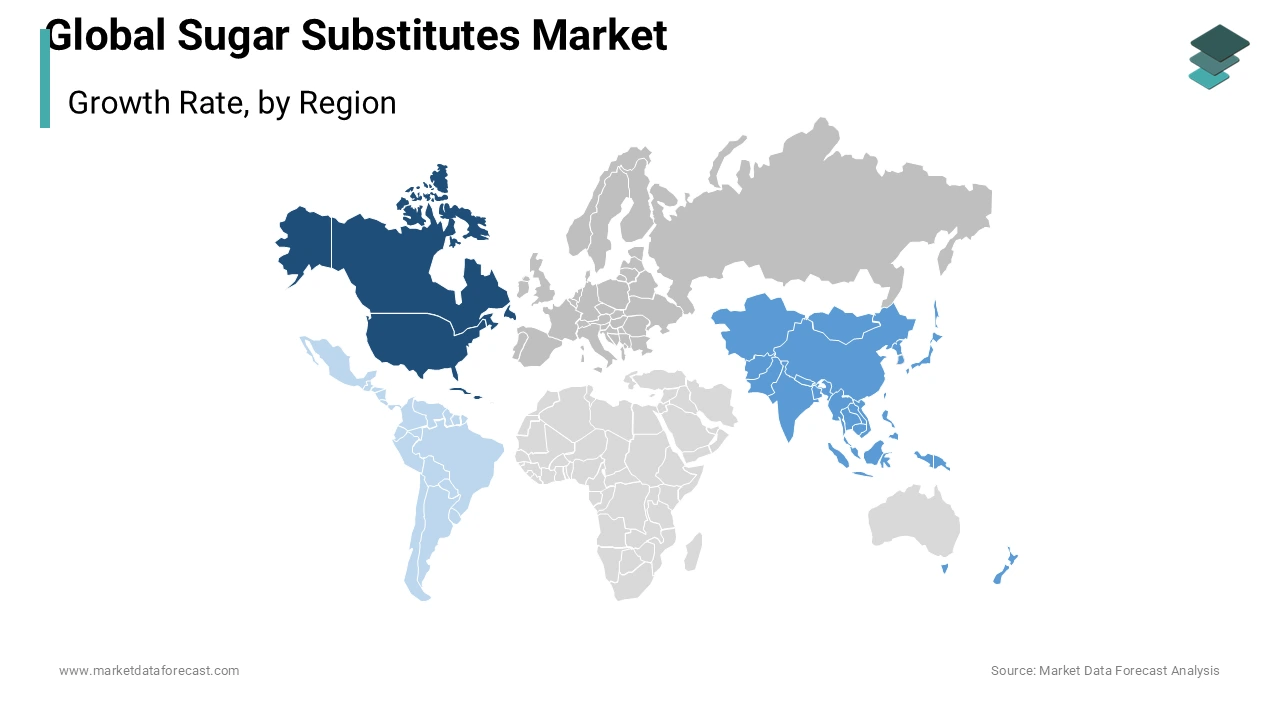

As demand for sweeteners increases in North America, the region will likely dominate the world market for sugar substitutes. The growing demand for sugar substitutes for industrial and non-industrial uses and changing consumer preferences are driving market demand for sugar substitutes for the time being. Additionally, North America is one of the leading manufacturers in the sweetener market as demand for prepared foods, alternative sources of sugar, and functional foods increases. Europe is assumed to grow at an average annual rate of 3.2% from 2018 to 2025. Sugar substitutes are contributing to the growth of the local market. The Asia Pacific region is estimated to have averaged an average annual growth rate of 7.0% during the prediction period. Health problems associated with sugar consumption, the presence of emerging economies that provide profit margins to key market participants, and rising disposable incomes are driving regional markets. The Latin American market is foreseen to reach US $ 11.7 billion by 2024, with an average annual growth rate of 5.1% during the outlook period. Growth in this region may be due to rich natural resources and the presence of sorbitol manufacturers.

KEY PLAYERS IN THE GLOBAL SUGAR SUBSTITUTES MARKET

Major Key Players in the global sugar substitutes market are Cargill Incorporated, Tate & Lyle PLC, E. I. du Pont de Nemours and Company, Roquette Freres S.A., Pure Circle Ltd, Ajinomoto Co. Inc, Archer Daniels Midland Company, MacAndrews & Forbes Incorporated, Ingredion Incorporation, and JK Sucralose Incorporation

RECENT HAPPENINGS IN THE MARKET

- In 2016, PepsiCo began adding aspartame to a new Calorie-free Pepsi or Diet Pepsi.

- In 2018 GLG Life Tech Corp. launched a line of Reb M sweetener products consisting of stevia leaves.

- In May 2018, Cargill released a new calorie-free sweetener containing substances extracted from Stevia. As demand for healthier alternatives to synthetic sweeteners increased, the product name 'EverSweet' was introduced.

DETAILED SEGMENTATION OF GLOBAL SUGAR SUBSTITUTES MARKET INCLUDED IN THIS REPORT

This research report on the global sugar substitutes market has been segmented and sub-segmented based on origin, composition, application, & region.

By Origin

- Natural

- Synthetic

By Composition

- Stevia

- Aspartame

- Cyclamate

- Sucralose

- Saccharine

- AceK

- D-Tagarose

- Sorbitol

- Maltitol

- Xylitol

By Application

- Heath & Personal Care

- Beverages

- Food

- Pharmaceuticals

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the key drivers of growth in the sugar substitutes market?

Key growth drivers include rising health consciousness among consumers, the increasing prevalence of diabetes and obesity globally, government initiatives to reduce sugar consumption, and advancements in food and beverage formulations using sugar substitutes.

2. What are the challenges faced by the sugar substitutes market?

Challenges include regulatory scrutiny and safety concerns regarding certain artificial sweeteners, formulation difficulties in achieving taste parity with sugar, consumer skepticism about the taste of some sugar substitutes, and price sensitivity compared to traditional sugar.

3. What are the key applications of sugar substitutes?

Sugar substitutes are used in various applications, including beverages, confectionery, bakery products, dairy products, pharmaceuticals, and personal care items.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com